EUR/USD

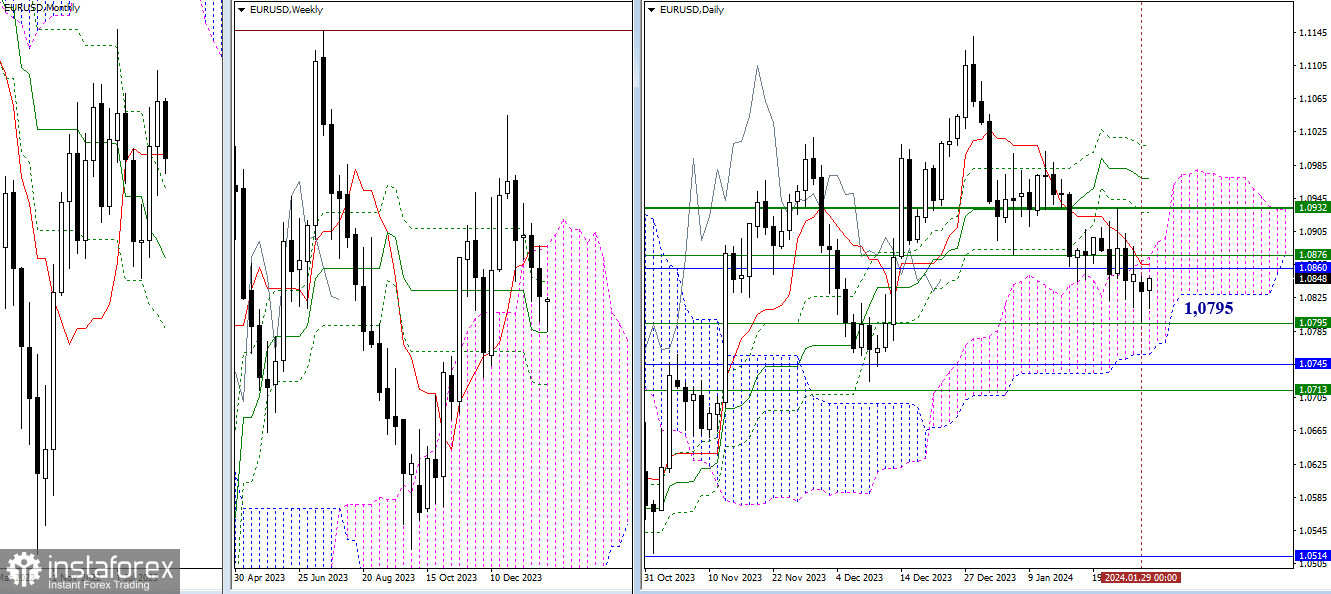

Higher Timeframes

The pair on Monday descended and tested the weekly medium-term trend (1.0795). The daily outcome led to the formation of a long lower shadow. If the bulls continue to unwind their positions now and beyond, the struggle will again be in the area of 1.0860 – 1.0876, where several levels from different timeframes combine their efforts. If the retest of the levels reached on Monday (1.0860-76) ends in favor of the bears, then after breaking 1.0795, the pair will face the lower boundary of the daily cloud and the monthly Fibonacci Kijun (1.0745).

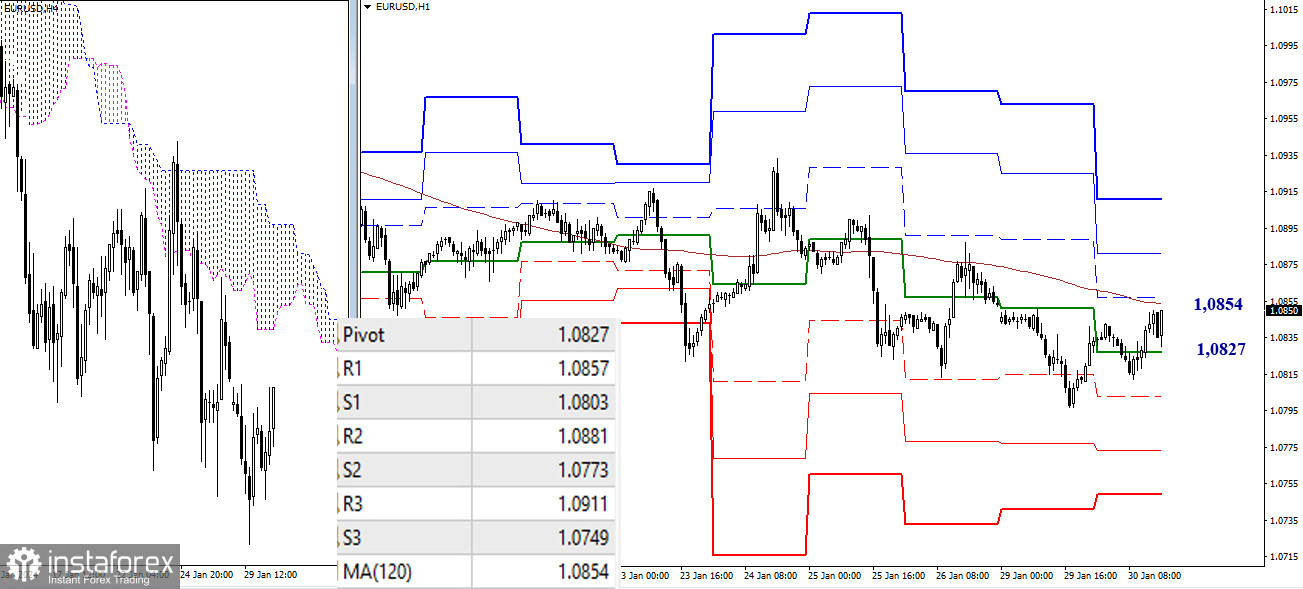

H4 – H1

On the lower timeframes, the advantage is still in favor of the bears; however, the pair has approached the weekly long-term trend (1.0854), which is responsible for the current balance of power. If the bulls can break through and reverse the trend, securely consolidating above, their intraday targets will be the resistances of classic pivot points (1.0857 – 1.0881 – 1.0911). If the trend (1.0854), reinforced by the levels of higher timeframes (1.0860-76), can defend the bears' interests, then to restore the downward trend, the bears must update the low of the current correction (1.0797), with additional targets being the supports of classic pivot points (1.0803 – 1.0773 – 1.0749).

***

GBP/USD

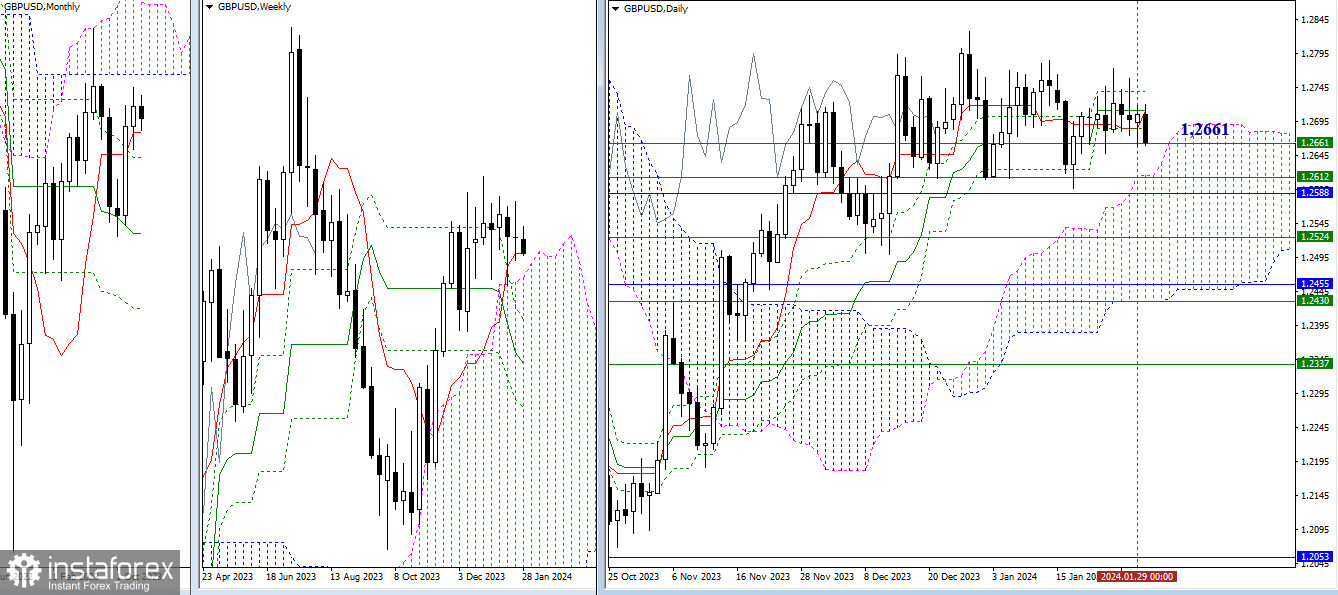

Higher timeframes

Consolidation above the weekly short-term trend (1.2661) is maintained. The pair's movement is still influenced by the levels of the daily Ichimoku cross (1.2684 – 1.2711 – 1.2738). A breakthrough of weekly support (1.2661) will shift attention to the area of 1.2588 – 1.2612, where the current monthly short-term trend and the upper boundaries of the weekly and daily Ichimoku clouds are located. Breaking through these supports can significantly strengthen the bears, opening up new opportunities for them.

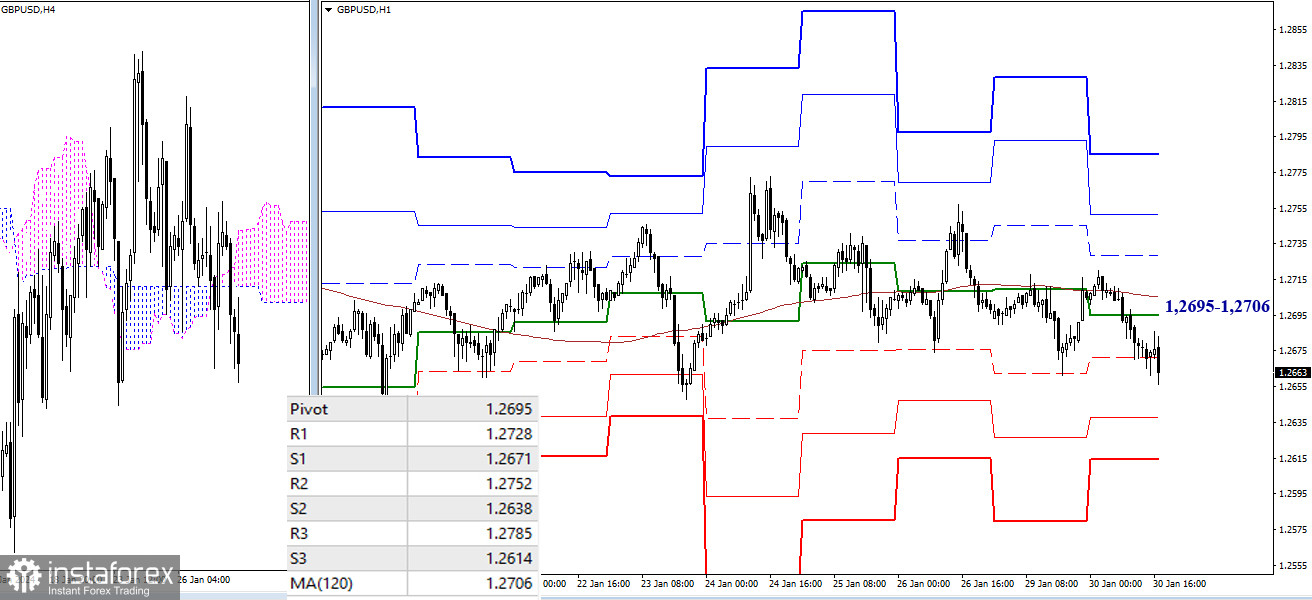

H4 – H1

On the lower timeframes, the bearish players currently maintain an advantage. Since the key levels 1.2695 – 1.2706 (weekly long-term trend + central pivot point) defended the interests of the bears early in the day, an increase in downward sentiment can now be expected. The targets for the development of intraday decline today are the supports of classic pivot points S1 (1.2671), currently being tested, S2 (1.2638), and S3 (1.2614).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română