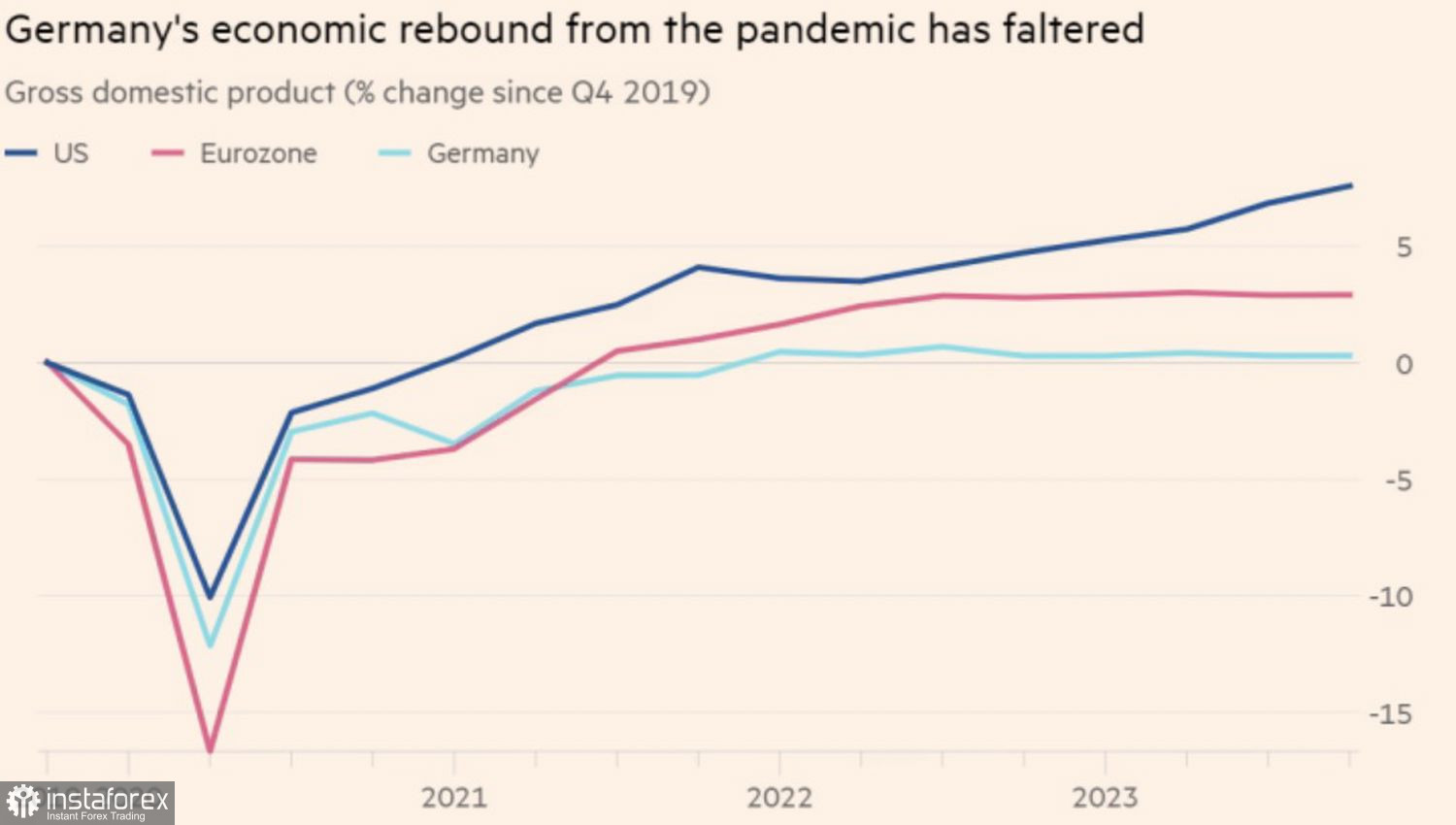

Strength in unity! Thanks to Spain, Portugal, and Italy, the Eurozone managed to avoid a technical recession. The GDP of the currency bloc in the fourth quarter recorded zero growth, which turned out to be better than Bloomberg experts' expectations and allowed EUR/USD bulls to lift their heads. It's good when there are countries like Spain, Portugal, and Italy to fill the gaps in Germany and France! However, against the backdrop of a 3.3% expansion of the gross domestic product in the United States, the achievements of the Eurozone look more than modest.

A decline in construction investments and weakness in the industrial sector, led by the production of machinery and equipment, dragged the German economy into a recession. Its GDP for 2023 decreased by 0.3%, its Italian counterpart grew by 0.7%, French by 0.9%, and Spanish by 2.5%. It is expected that the Eurozone's economy will accelerate in 2024, as a strong labor market and slowing inflation will stimulate consumer activity. However, governments are rolling back pandemic aid programs and facing an energy crisis, which will hinder gross domestic product growth.

Dynamics of the American and European Economies

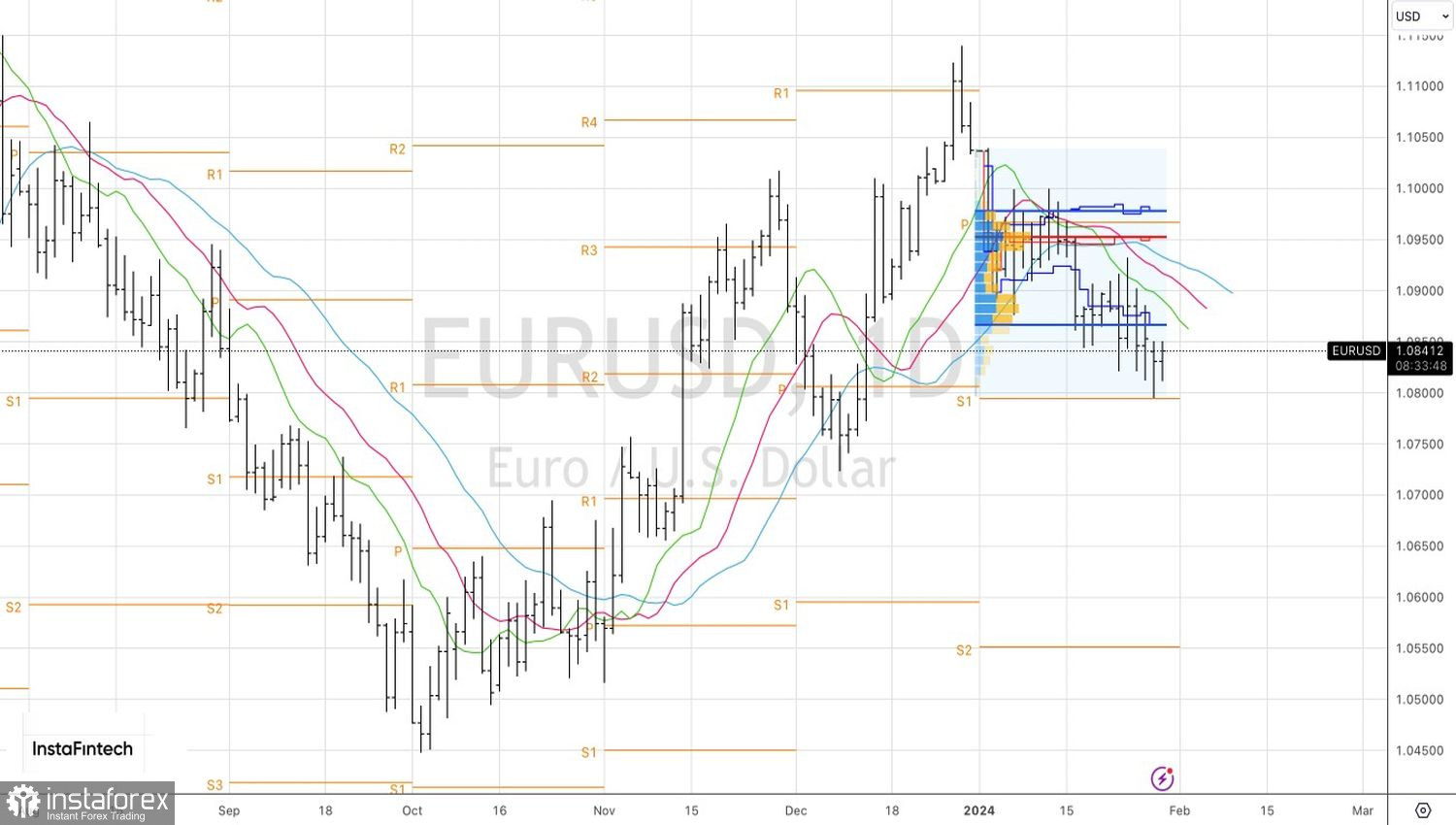

EUR/USD reacted quite calmly to the Eurozone GDP data, playing out the principle of "sell on rumors, buy on facts." Investors are more concerned about the results of the January FOMC meeting and the U.S. labor market report for December, which will clarify the Fed's position. The central bank is unlikely to cut the federal funds rate at the upcoming meeting, but Fed Chairman Jerome Powell is capable of signaling the timing of the start of monetary policy easing.

The January meeting will be fundamentally different from December's. At the end of 2023, the U.S. economy was slowing down, and inflation was quite far from the 2% target. Now, it is obvious that the United States is still firmly in the saddle, and the Personal Consumption Expenditures index on a 6-month basis has fallen below the target. If at the previous meeting the Federal Reserve made a dovish pivot, why not please the stock market bulls and EUR/USD even more at the end of the first month of the year?

For now, the main currency pair is falling against the backdrop of the growth of U.S. stock indices, which looks rather strange. The dollar is a safe-haven currency. It usually strengthens when Fear dominates the market and global risk appetite decreases. Today, the S&P 500 repeatedly rewrites historical highs due to Greed. However, EUR/USD has fallen to the 1.08 mark.

In my opinion, the correlation between the euro and the broad stock index will be restored soon. Their further dynamics will depend on whether Powell can scare the markets or, conversely, decide to present them with a pleasant surprise.

Technically, on the daily chart of EUR/USD, the formation of a pin bar with a long lower shadow creates prerequisites for its play by placing a pending buy order from the level of 1.085. If activated, longs formed on the rebound from support at 1.08 will automatically be increased.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română