The EUR/USD currency pair began the new trading week energetically, with a new test of the level 1.0823, which was as unsuccessful as the previous three. Nevertheless, Monday showed us that market traders prefer selling rather than buying. Yes, these sales are not strong at the moment, but let's remind ourselves that the euro has never been a volatile currency, so expecting a sharp decline from it is unreasonable.

Monday started with several speeches by ECB representatives, although only one was scheduled in the calendar - the speech of Luis de Guindos. However, his colleagues Peter Kazimir and Mario Centeno also spoke. Mr. Kazimir stated that a rate cut in June is more likely than in April. Still, there can be no precision in this matter, as it is important to maintain the downward trajectory of inflation, and the target level of 2% will be reached. Kazimir noted that the next step will undoubtedly be a rate cut, as inflation is consistently slowing down, and additional tightening is not required.

Also, an ECB's monetary committee representative stated that the European regulator is staying caught up; the markets expect too rapid a transition to easing. "We all need to be patient; no one wants to make wrong decisions, and we must ensure that the rate cut occurs on time and does not harm the slowdown in inflation," said Kazimir.

According to Kazimir, deflation still needs to be stable enough, so it is too early to discuss easing monetary policy. At the same time, his colleague Mario Centeno stated that it is better to start lowering rates a little earlier than a little later. Centeno believes there is no need to wait for wage data in May to make a positive decision in June. It is worth noting that the growth rates of wages significantly impact monetary policy. The higher the wage growth rates, the more people earn, the more they spend, and the more they stimulate the rise in prices for goods and services.

In Centeno's opinion, inflation is confidently decreasing, and almost all factors that provoked the price rise have been neutralized. "Rates should start to decrease earlier, but avoiding sharp jumps," Centeno believes.

What conclusions can we draw from all the information provided? First, the ECB will only cut rates at some meetings. Maintaining a cautious approach and closely monitoring inflation and wages is necessary. Second, within the ECB, there still needs to be a unanimous opinion on the timing of the easing cycle of monetary policy. Third, the first easing will likely occur in June, not April. Most ECB representatives are still more cautious than Mario Centeno.

However, even if the first cut happens in June, it is still much earlier than the market expected just a month ago. Therefore, in the market's opinion, the ECB's stance is becoming more "dovish," so the European currency remains under moderate pressure. As before, we expect the decline of the euro. Almost all available factors speak in favor of this.

Also, this week will feature two central bank meetings, and many macroeconomic statistics will be published. Therefore, the rise of the EUR/USD pair cannot be completely ruled out. If the US labor market statistics fail, it will be a sufficient reason to sell the dollar. This week promises to be "hot."

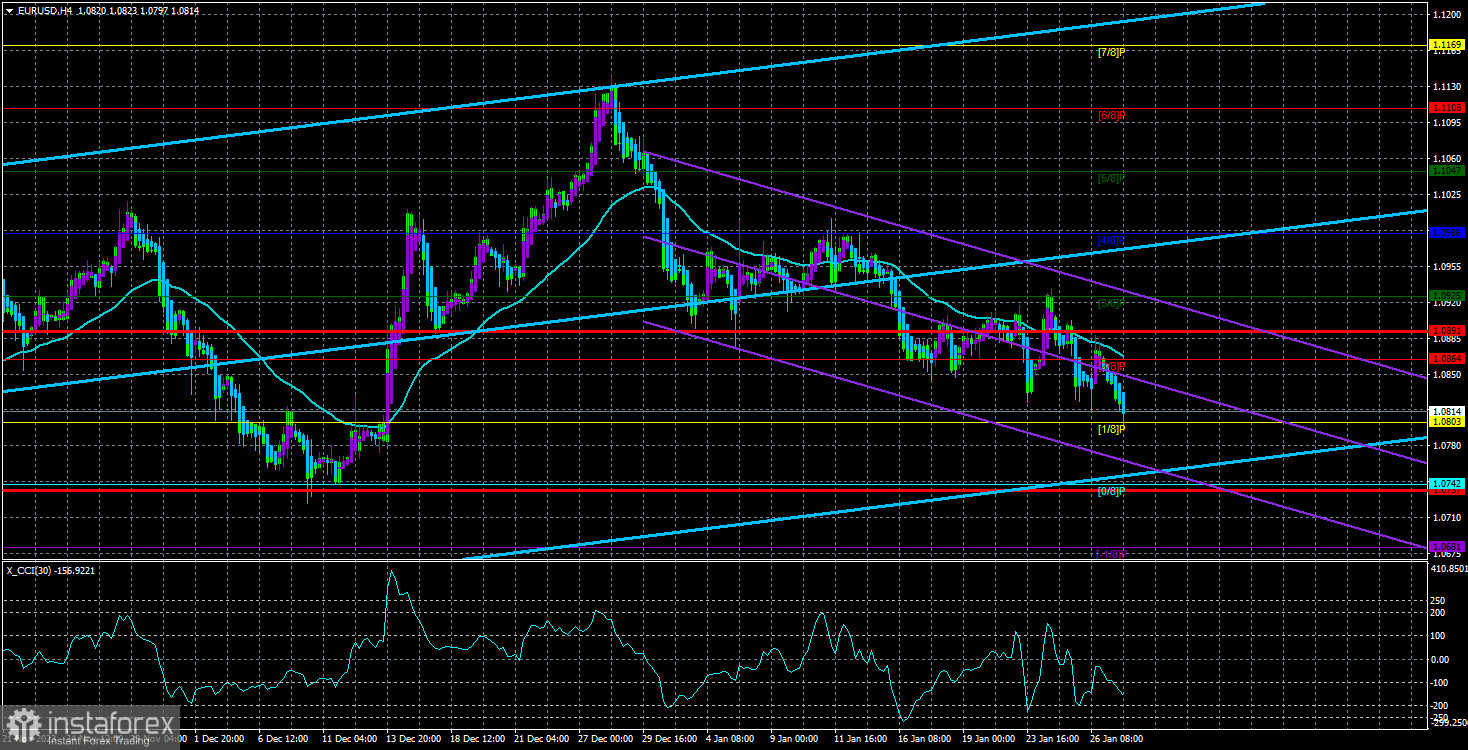

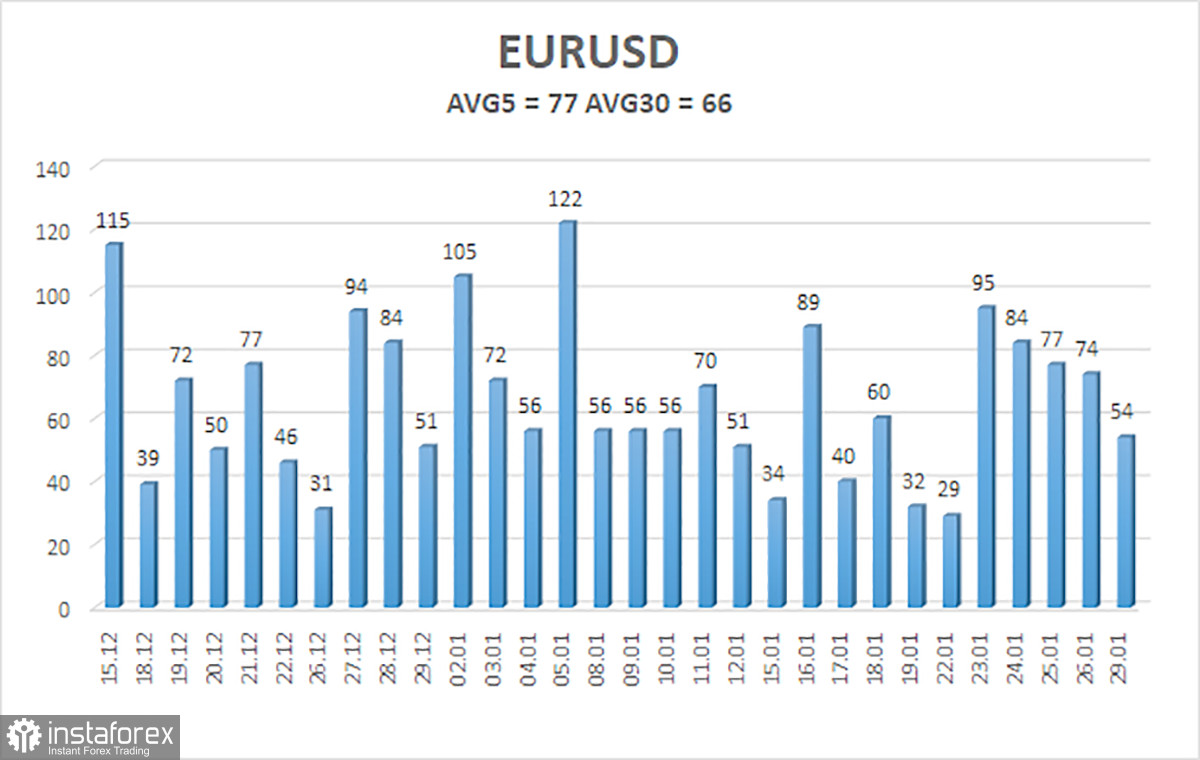

The average volatility of the EUR/USD currency pair for the last five trading days as of January 30th is 77 pips, characterized as "average." Thus, we expect the pair to move between the levels of 1.0737 and 1.0891 on Tuesday. A reversal of the Heiken Ashi indicator upwards will indicate another upward correction.

Nearest support levels:

S1 – 1.0803

S2 – 1.0742

S3 – 1.0681

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0925

R3 – 1.0986

Trading recommendations:

The EUR/USD pair remains below the moving average line. Therefore, we consider short positions with targets at 1.0742 and 1.0737. The downward movement is currently quite weak, and a strong fundamental and macroeconomic background this week may push the pair back up. We plan to consider long positions no earlier than the price consolidates above the moving average with a target of 1.0925.

Explanations for illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română