EUR/USD

The U.S. stock market showed gains on Monday (the S&P 500 by 0.76%), pulling the currency market along with it (the dollar index -0.08%). The euro, being the most sensitive currency to Federal Reserve meetings, fell by 20 pips, failing to close the gap from the market opening. Today, the pair is showing firm growth, which indicates the price's intention to close this gap as quickly as possible.

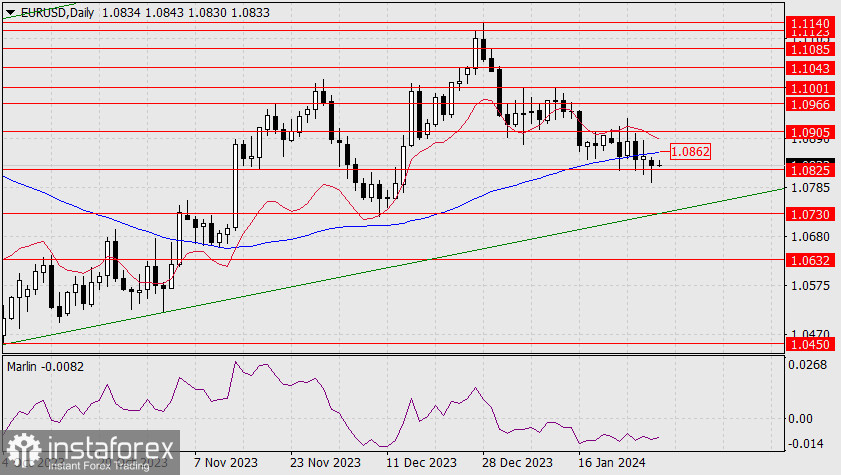

From a technical perspective, we see that the downward correction since December 28 has been extended, lasting long and deep – the price has even dropped below the MACD indicator line. The Marlin oscillator can sense how excessive this correction is and is moving upwards within the downtrend territory for the past two weeks. The main objective for today is to work on the MACD daily line – 1.0862.

On the 4-hour chart, the price has settled above the MACD line, but Marlin is still in the lower half of its field. This is a factor that prevents the price from taking hasty actions before the Fed meeting. The neutral level is 1.0862.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română