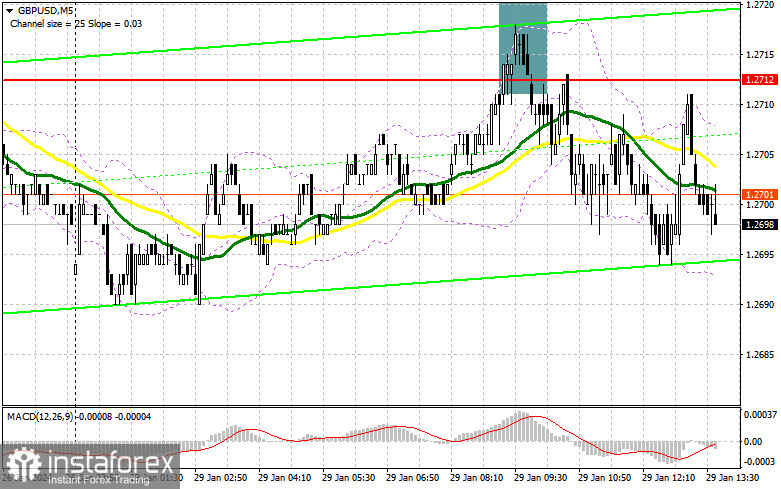

In my morning forecast, I drew attention to the level of 1.2712 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The rise and the formation of a false breakout around 1.2712 resulted in a good entry point for selling the pair. However, the downward movement was only about 15 points when writing the article. In the second half of the day, the technical picture remained unchanged.

To open long positions on GBP/USD:

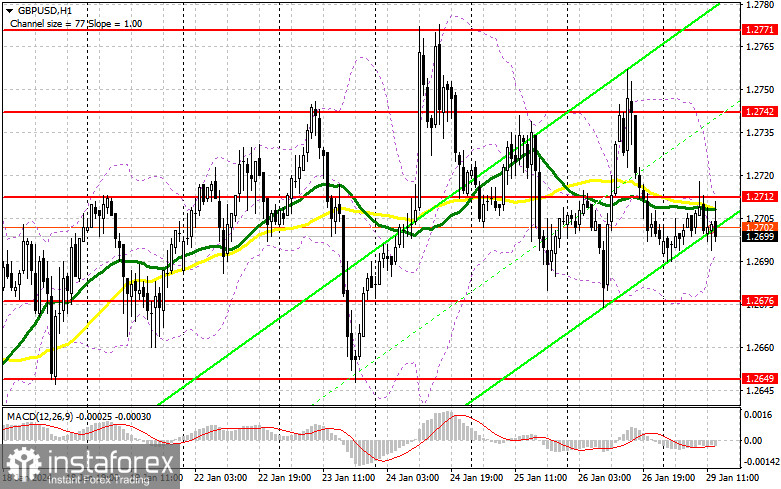

Buyers of the pound tried several times to break above 1.2712, but it didn't go well. The decline in GBP/USD may continue because of the lack of US statistics. If trading is below 1.2712, I am betting on further pound selling. I plan to act on buying only after a decline and the formation of a false breakout around the previous Friday's minimum of 1.2676. This will provide an excellent entry point into long positions in developing the bullish trend to update 1.2712, where the moving averages favor sellers. A breakout and consolidation above this range will strengthen demand for the pound and open the way to 1.2742. The ultimate target will be at 1.2771, where I intend to make a profit. In the scenario of the pair's decline and the absence of bullish activity at 1.2676 in the second half of the day, which could lead to breaking out of the sideways channel, buyers will face difficulties. In this case, I will postpone purchases until testing 1.2649. Only a false breakout there will confirm the correct entry point. I plan to buy GBP/USD immediately on a rebound from the minimum of 1.2623, with a 30-35 point correction target within the day.

To open short positions on GBP/USD:

Sellers have actively made their presence felt, and now I await further development of the bearish scenario. If demand for the pound returns in the second half of the day, I will act only following the European session analogy. The formation of a false breakout at 1.2712 will confirm the presence of major players in the market and lead to another opening of short positions with the target of a decline towards 1.2676. A breakout and a reverse test from the bottom to the top of this range are crucial, as they will strike at bullish positions, leading to the removal of stop orders and opening the way to 1.2649. The ultimate target will be in the area of 1.2623, where profit will be fixed. In the case of GBP/USD growth and the absence of activity at 1.2712 in the second half of the day, and this level has already worked once, buyers will regain the initiative and reclaim the opportunity to develop a new bullish trend – at the very least, maintaining trading within the sideways channel. In this case, I will postpone sales until a false breakout at 1.2742. Without downward movement, I will sell GBP/USD immediately on a rebound from 1.2771, but only counting on a pair correction downwards by 30-35 points within the day.

Indicator Signals:

Moving Averages:

Trading is below the 30 and 50-day moving averages, indicating the likelihood of a pound decline.

Note: The period and prices of moving averages considered by the author are on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator, around 1.2690, will act as support.

Description of Indicators:

- Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

- Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

- MACD Indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.

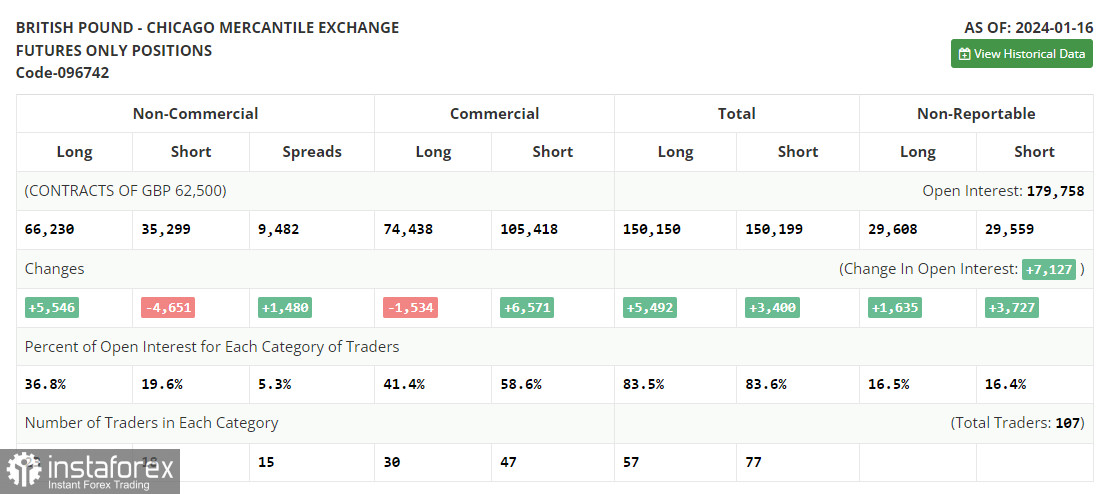

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română