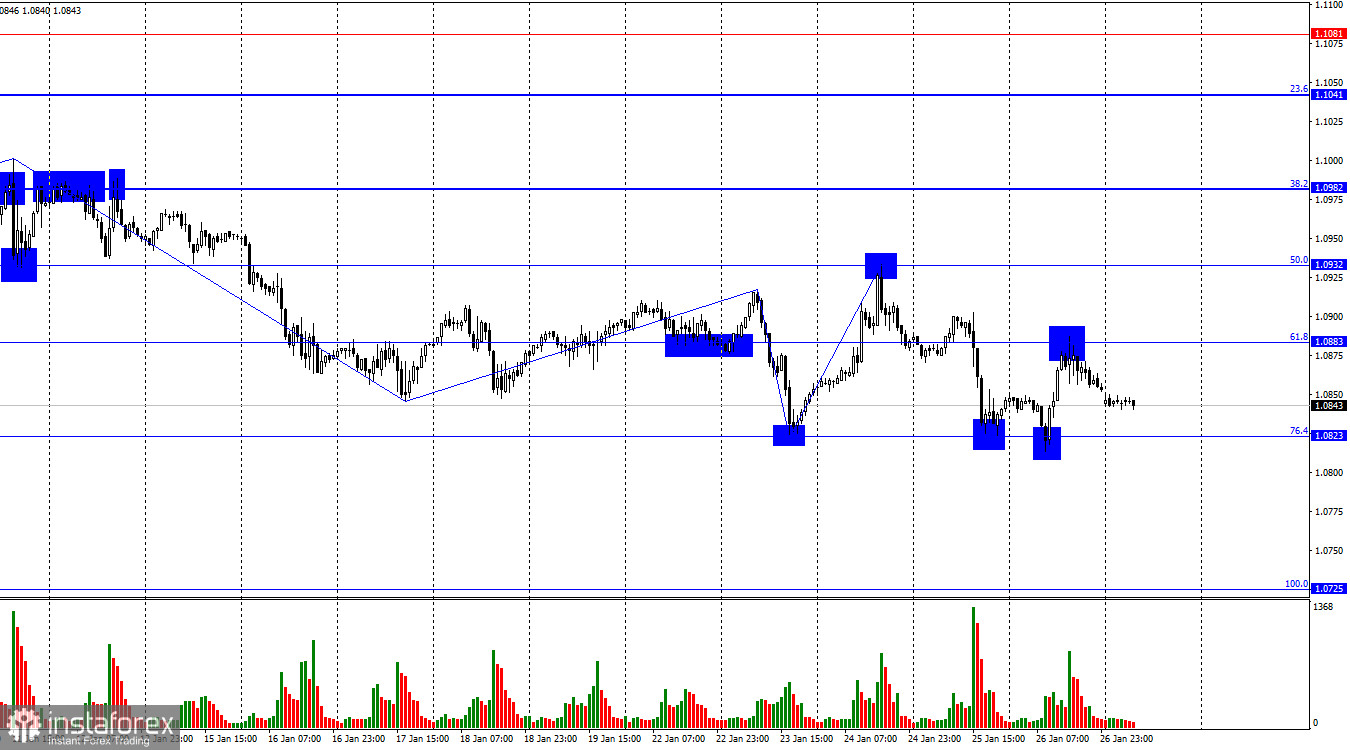

The EUR/USD pair on Friday experienced a rebound from the corrective level of 76.4% (1.0823), rose to the Fibonacci level of 61.8% (1.0883), rebounded from it, and began the process of returning to the level of 1.0823. A new rebound of quotes from the level of 1.0823 will once again work in favor of the European currency and some growth towards the corrective level of 61.8%. If the pair's rate is secured below the level of 1.0823, it will increase the probability of further decline toward the next corrective level of 100.0% (1.0725).

The wave situation over the past week has become more complicated. The last upward wave broke the peak from January 23, the first sign of a trend change from "bearish" to "bullish." However, the next downward wave returned the pair to the previous low and even slightly broke it (by a few pips). Since this low was not confidently and breached, the chances of forming a new "bullish" trend persist. However, if the quotes are anchored below the level of 1.0823, it will either resume the "bearish" trend or further complicate the wave pattern.

The information background on Friday could have been stronger. Several insignificant reports in the United States should have allowed traders to define their strategy for the near future clearly. The market received a lot of information on Thursday when the first ECB meeting of 2024 ended, but all this information provided extremely weak support for both bears and bulls. Thus, traders should have concluded the ECB meeting. They prefer to wait for the Fed meeting and important statistics for the European Union and the United States, which will be abundant this week.

From the Fed this week, important decisions are also not expected. Only Jerome Powell can slightly orient traders on the date of a possible first interest rate cut.

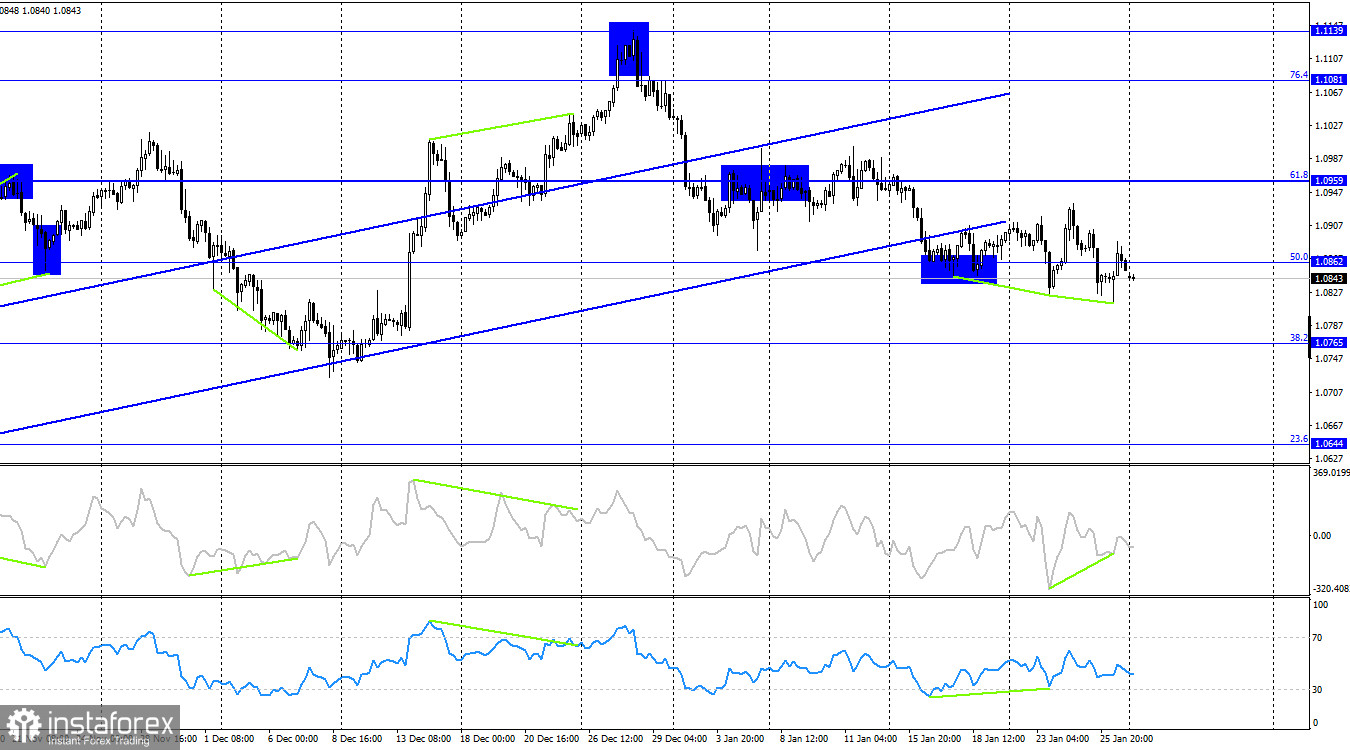

On the 4-hour chart, the pair reversed in favor of the euro after forming a "bullish" divergence on the RSI indicator. At the moment, a "bullish" divergence has also formed on the CCI indicator. The pair's rise may start again, but the consolidation of quotes below the ascending trend corridor indicates a trend change to "bearish," and now we should expect a more significant decline in the euro. The key level on Monday will be 1.0823 on the hourly chart, the closing below, which will open the way for bears further down.

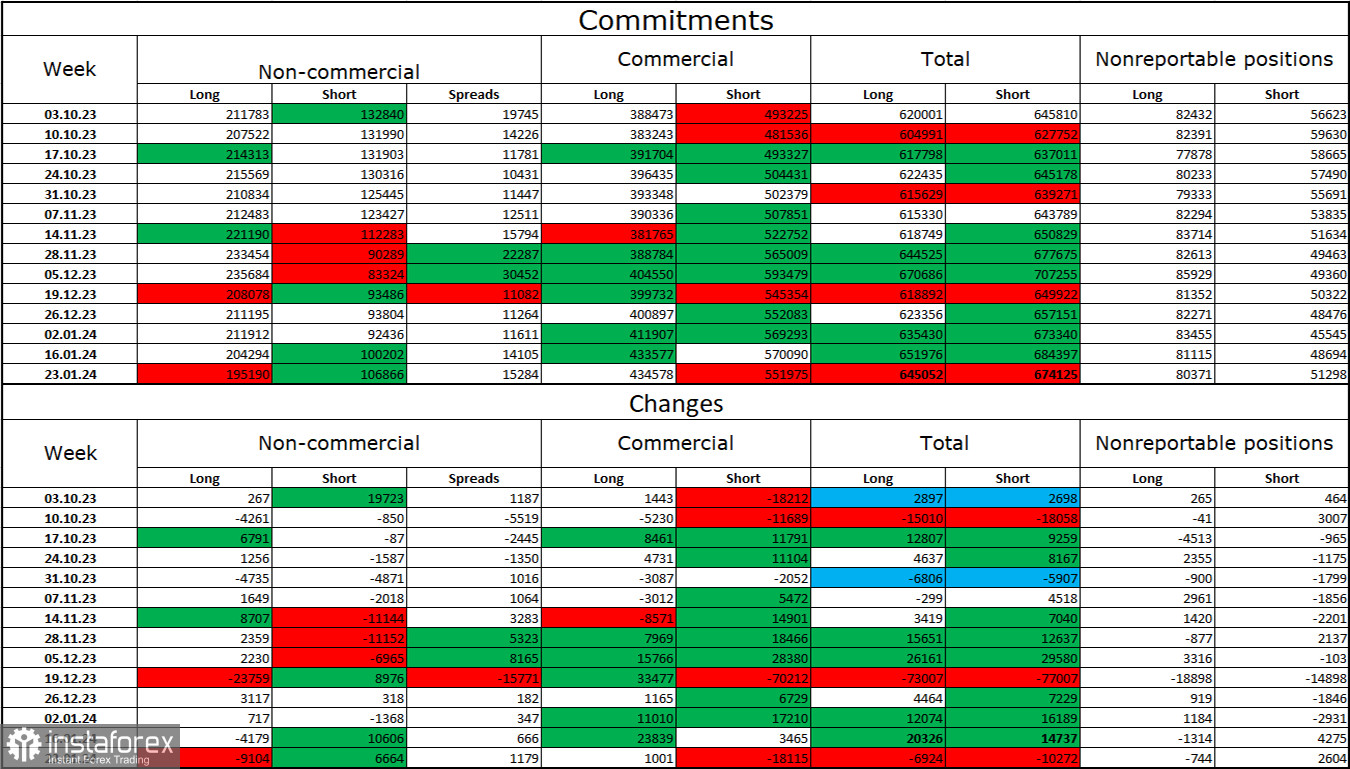

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 9104 long contracts and opened 6664 short contracts. The mood of major traders remains "bullish" but continues to weaken. The total number of long contracts held by speculators now stands at 195 thousand, while short contracts are at 107 thousand. Despite a fairly large gap, the situation will shift toward bears. Bulls have dominated the market for too long, and now they need strong information support to maintain the "bullish" trend. I don't see such a background now. Professional traders may continue to close long positions soon. The current figures allow for a continuation of the decline in the euro in the coming months.

News Calendar for the US and the European Union:

On January 29, the economic events calendar contains no interesting entries. The influence of the information background on traders' sentiment will be absent today.

EUR/USD Forecast and Trader Recommendations:

Selling the pair was possible on a rebound from the level of 1.0883 on the hourly chart with a target of 1.0823. These trades can now be kept open. New sales will be possible when anchored below the level of 1.0823 with a target of 1.0725. Purchases can be considered today on a rebound from 1.0823 on the hourly chart, with targets at 1.0883 and 1.0932.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română