In the meantime, the Bitcoin price has recovered a bit, clearly before another major sell-off. A lot of experts share the viewpoint that the launch of a spot Bitcoin ETF has attracted only a fairly modest number of large companies willing to take such risks.

For example, the world's investment giant Vanguard said that a spot Bitcoin exchange-traded fund will not be listed on their trading platform for now. The Vanguard top executive stated during the interview that cryptocurrency is "an immature asset class that has little history, no intrinsic economic value, no cash flow, and could create havoc in a portfolio if there is any major disruption in the market."

Vanguard published a blog post titled "No Bitcoin ETFs at Vanguard? Here's why". It explains the firm's position on cryptocurrencies and why it does not allow clients to trade the newly approved Bitcoin-based exchange instrument.

Remarkably, as of December 31, 2023, Vanguard serves more than 50 million investors worldwide. The company manages approximately $8 trillion in assets. The list of financial instruments under management is only increasing every day. Following the approval of 11 spot Bitcoin ETFs by the US Securities and Exchange Commission earlier this month, Vanguard drew attention for not planning to allow its clients to trade newly launched cryptocurrency products. The company also has no plans to launch its own Bitcoin spot ETF.

According to Vanguard, cryptocurrency is more of a speculation than an investment. This was the main reason for refusing to use newly created Bitcoin-based trading instruments. "Although cryptocurrency is classified as a commodity, it is an immature asset class that has no history and no intrinsic economic value," the company noted. "With shares, you own a share of a company that produces goods or services, and many of them also pay dividends. With bonds, you earn interest payments. Commodities are real assets that satisfy consumption needs, have inflation-hedging properties, and can play a role in certain portfolios. But no one knows what Bitcoin is," the statement reads.

However, Vanguard has expressed particular interest in blockchain technology, saying: "We are really very interested in blockchain, the technology behind cryptocurrencies. We believe that its application for a range of purposes other than cryptocurrencies will make capital markets more efficient, and we intend to actively participate in research into the use of blockchain technology."

"Whereas discussions about Bitcoin and cryptocurrencies in general have intensified recently, we do not currently believe they have an appropriate role to play in long-term portfolios," the statement said.

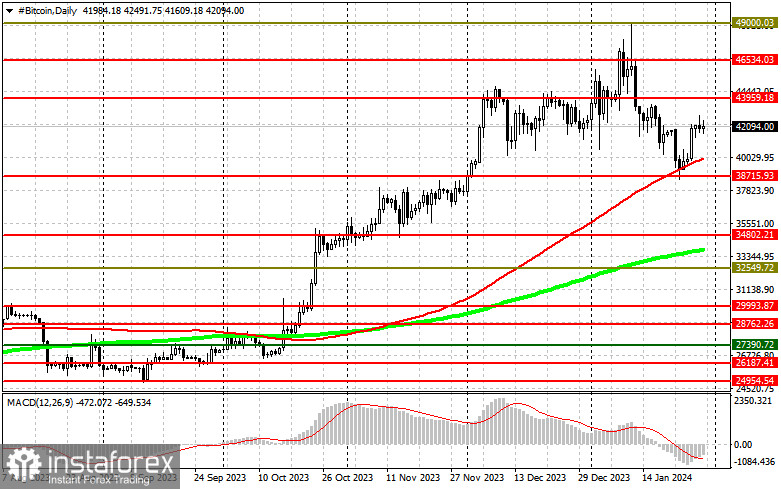

Speaking about the technical picture of Bitcoin, the price rebounded nicely after updating the level of $38,700. If pressure the token comes under selling pressure, the bears' immediate target will be the support of $38,700, where I again expect large buyers to enter the market. To stop massive selling, the bulls need to grab the $44,000 resistance. Its breakout will push BTC to the high of $46,500, where quite large profit-taking and a pullback of Bitcoin downward could occur. The highest target remains the level of $49,000. If pressure on the trading instrument continues and $38,700 is broken, the bears will be focused on protecting $34,800. A breakout of this range would deal a blow to the crypto, opening the door to $32,500.

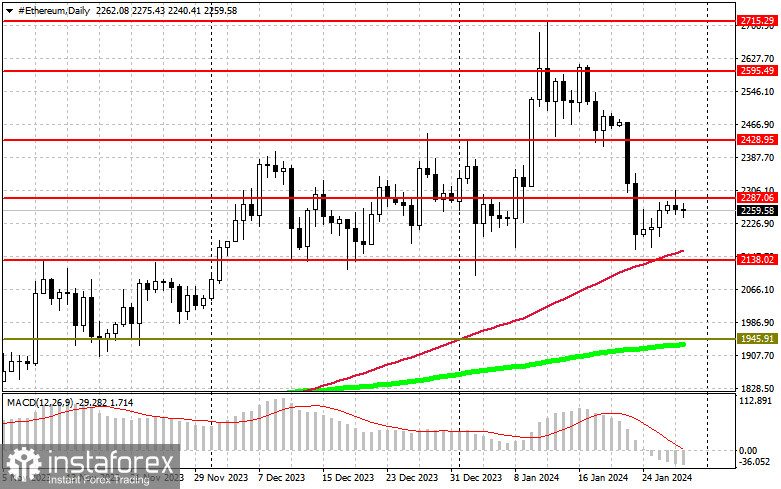

As for Ether's short-term technical picture, there are no significant changes. After last week's big sell-off, the buyers need to get above $2,280 to regain momentum. Only after this, I expect a more powerful movement to the $2,430 area. The highest target will be the next major resistance at $2,595. If it fails and the price consolidates below $2,140, the trading instrument will continue to fall to the $2,020 area. Below is the $1,920 area, where buyers are sure to be even more active.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română