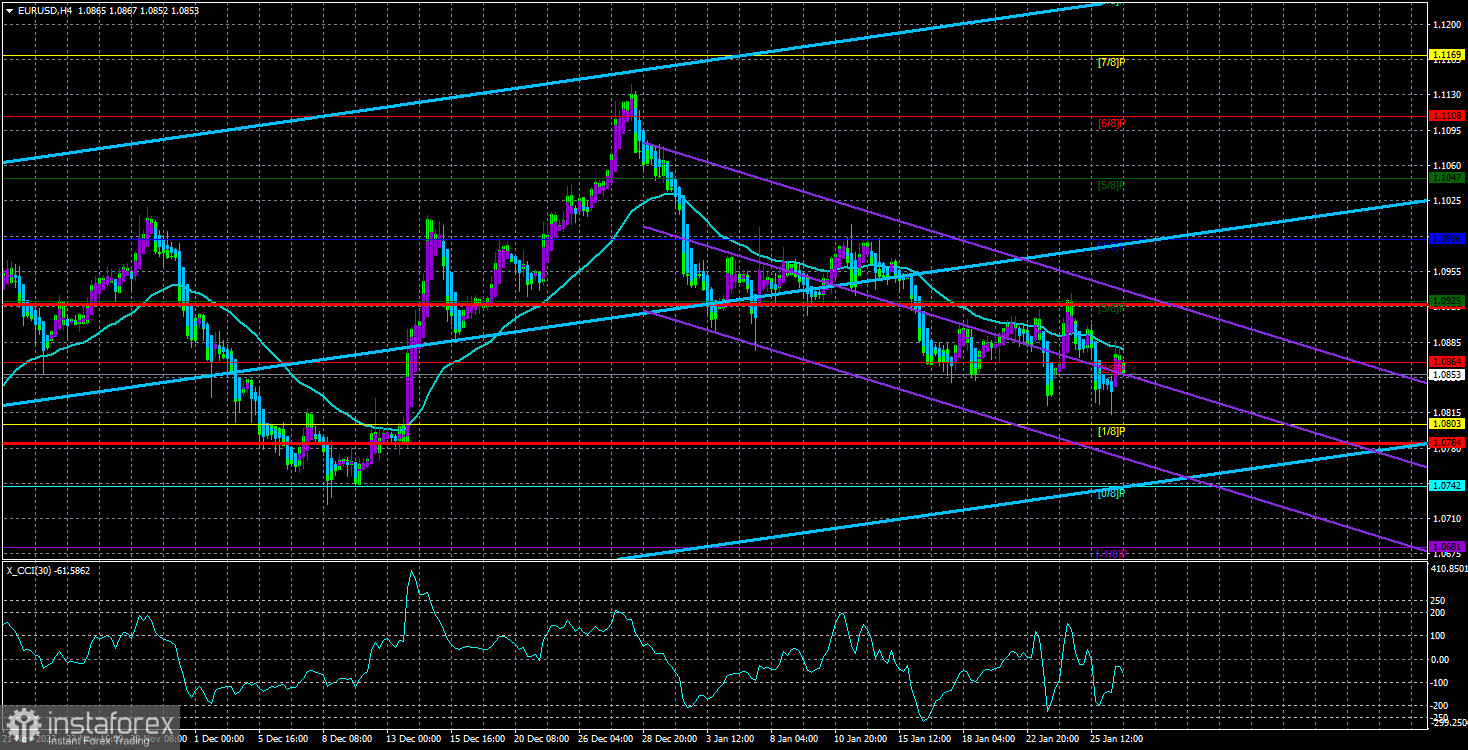

The EUR/USD currency pair traded again quite chaotically on Friday but preserved its descending trend and position below the moving average line. Thus, at the moment, there are no reasons to expect a sharp rise in the European currency. Let's remind ourselves that the euro is only at the very beginning of its downward path, with its final point potentially lying in the range of 1.0000-1.0450. Therefore, the current descending movement is relatively weak, but it still persists, fully aligning with our expectations.

There will be numerous significant events, publications, reports, and speeches in the upcoming week. Among them, there will be crucial ones that could influence the monetary policies of both the ECB and the Fed. Let's break it down.

Monday, as often happens, is "empty." There are no important reports, only one ECB Vice President Luis de Guindos speech. De Guindos frequently speaks candidly, so one can anticipate statements that, if not particularly loud, are at least significant and can provide insight into the regulator's upcoming actions for market participants.

On Tuesday, the Eurozone will release the first GDP estimate for the fourth quarter. According to forecasts, the European economy may contract by 0.1% for the second consecutive quarter. However, the most alarming aspect is that the Eurozone's economy has only grown for part of the year. The fourth quarter could be the fifth consecutive quarter without economic growth and the third with actual contraction. This report will further convince us that selling the euro is right.

In addition to the GDP report, ECB Chief Economist Philip Lane will deliver a speech. He also often makes specific statements and avoids "watering down" information. The market will also expect specifics from him, whether regarding monetary policy plans or at least inflation and economic growth expectations.

On Wednesday, in Germany, reports on inflation, unemployment levels, retail sales, and changes in the number of unemployed will be published. The inflation report will be of key importance. And this importance may be resonant. Inflation by the end of January may decrease to 3.2–3.3% year-on-year. If this happens, it may also lead to a decline in overall Eurozone inflation, reducing the probability of the ECB maintaining interest rates at their maximum. In simpler terms, the market may start believing that the European regulator will shift to a more accommodating policy sooner. This is a "bearish" factor for the euro.

On Thursday, the business activity index in the manufacturing sector for January will be released in its final form, and inflation and unemployment in the Eurozone will be released. The business activity index has a secondary character, as does unemployment. However, inflation, which may slow to 2.8%, is an important report that could exert further pressure on the European currency. It's worth noting that the faster and more pronounced the inflation decline, the fewer reasons for the currency to rise. On the same day, ECB President Christine Lagarde will deliver a speech. While she provided all the necessary information after the ECB meeting, her comments on the new inflation report could be crucial.

Nothing interesting is expected in the Eurozone on Friday, but all events and publications on the British pound in the United States will be discussed in a separate article. It remains to be added that the chances of the EUR/USD pair continuing to decline this week are much higher than the chances of it rising. However, we remind you that reports can bring "surprises."

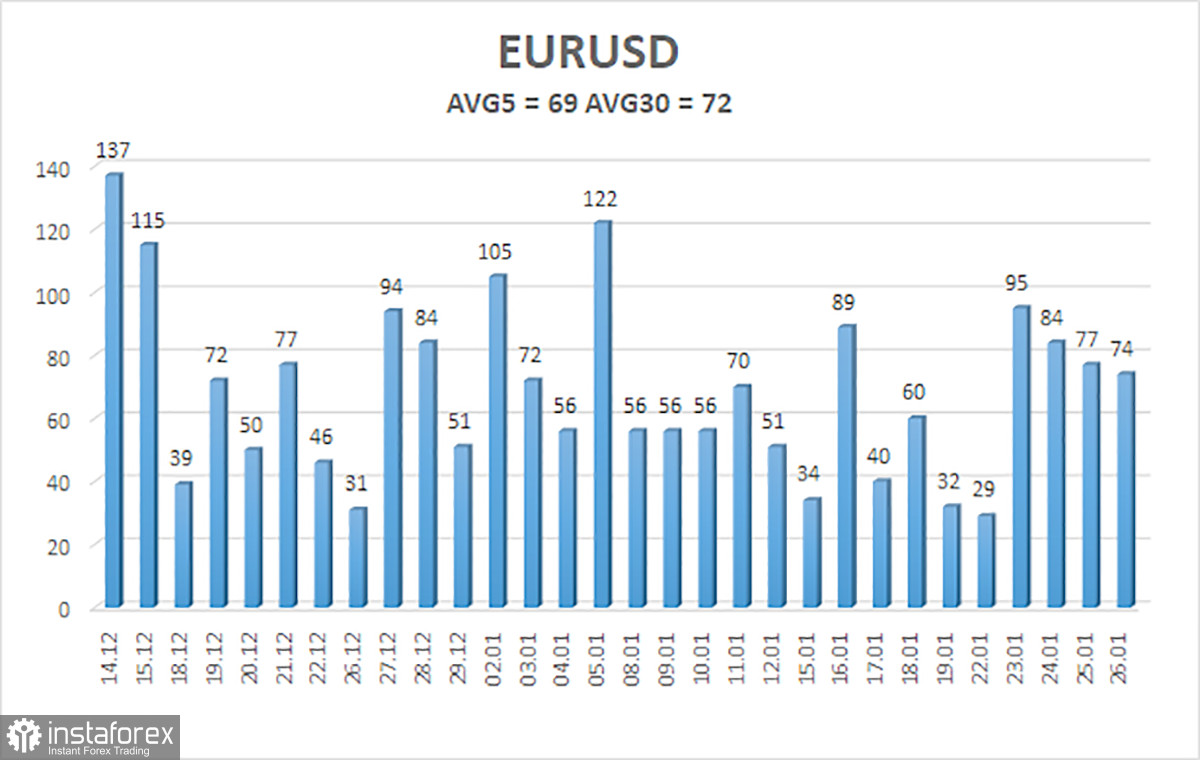

The average volatility of the euro/dollar currency pair for the last five trading days, as of January 28, is 69 points and is characterized as "average." Thus, we expect movement between the levels of 1.0784 and 1.0922 on Monday. A downward reversal of the Heiken Ashi indicator will indicate a resumption of the downward movement.

Nearest support levels:

S1 – 1.0803

S2 – 1.0742

S3 – 1.0681

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0925

R3 – 1.0986

Trading recommendations:

The EUR/USD pair has settled back below the moving average line. Therefore, we are again considering short positions with targets at 1.0803 and 1.0778. However, we remind you that a clear flat pattern on lower timeframes must be at most the level of 1.0823. We plan to reconsider long positions only after the price consolidates above the moving average and the level of 1.0925, targeting 1.0986. However, even in this case, one should be mindful of a possible flat or similar movement.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) determines short-term trend and direction for current trading.

Murray Levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI Indicator - its entry into oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română