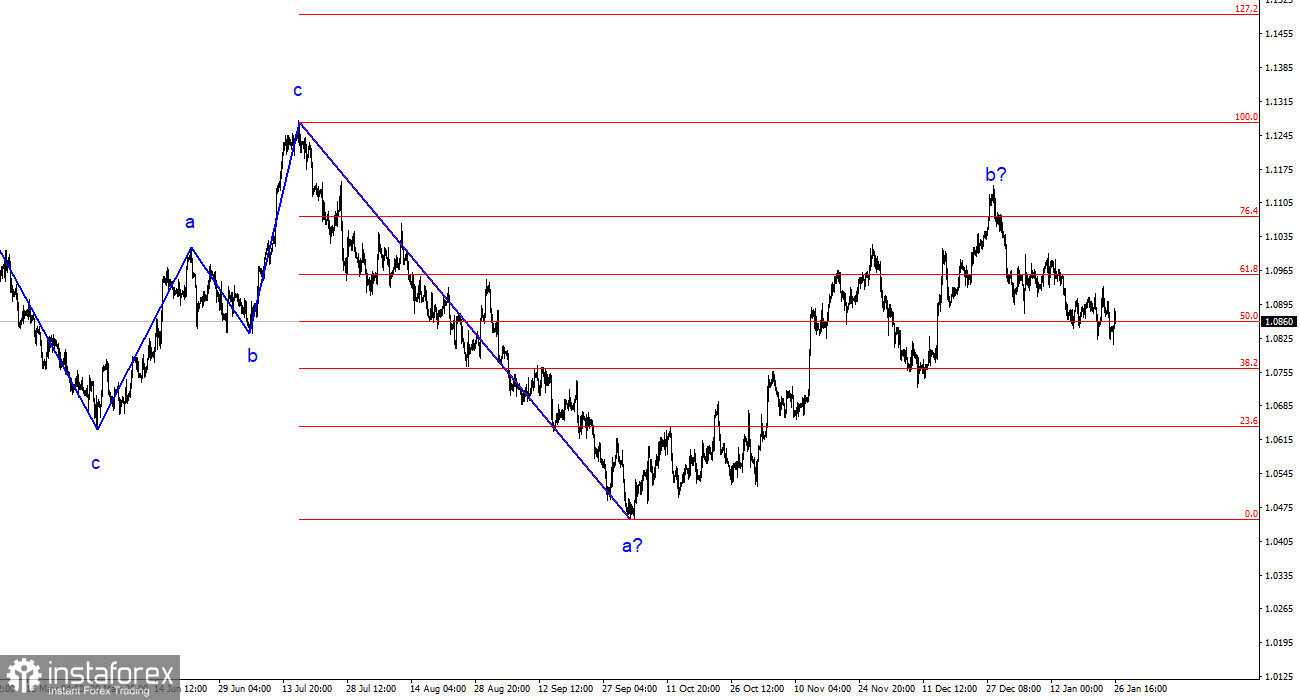

The wave labeling on the 4-hour chart for the euro/dollar pair remains unchanged. Over the past year, we have seen only three-wave structures that constantly alternate with each other. Currently, the construction of another three-wave structure, a downtrend, continues. The presumed wave 1 is completed, but wave 2 or b has complicated three or four times, and there are no guarantees that it will not complicate further.

Although the news background cannot be considered "supportive of the European currency," the market constantly finds new reasons to increase demand for the pair. In my opinion, this situation is not normal. Even if the upward trend resumes, its internal structure will become completely unreadable.

The internal wave analysis of the presumed wave 2 or b has changed. Since the last downtrend wave turned out to be disproportionately large, I now interpret it as wave b. If this is indeed the case, then wave 3 or c is currently being formed, and the entire wave 2 or b is presumably completed. The current retreat from the highs looks convincing.

The market is concerned about the decisions of the ECB and the Fed.

The euro/dollar pair rose by 10 basis points on Friday. The downward movement is very slow. The bears encountered new resistance around the 1.0820 level. Yesterday's decline ended near it, and today as well. The bearish sentiment in the market persists, although the news background has not strongly supported sellers this week. Perhaps this explains the very sluggish market activity this week.

The ECB meeting could have caused a strong market reaction if Christine Lagarde had shared previously unknown information with the market. However, the ECB President repeated everything she had said in Davos, as well as the words of her colleagues on the Governing Council. The market perceived the information received negatively since one statement by Lagarde about a rate cut in the summer could be seen as a slip, but two identical statements indicate specific plans of the regulator.

Lagarde herself stated that the ECB has no plans to cut rates, and everything will depend on incoming economic data. However, the question here was whether the market believed Lagarde or not. So far, it seems that it did not, but at the same time, it is very cautious since it still does not understand what to expect from the European Central Bank.

The same applies to the Fed, whose first meeting in 2024 will take place next week. Since the probability of a rate cut in March has halved, the market now has a more favorable attitude towards the American currency. But the decline is still very weak. However, I expect it to continue with the current wave analysis.

General Conclusions:

Based on the analysis conducted, I conclude that the construction of a bearish wave set is ongoing. Wave 2 or b has taken on a completed form, so I expect the continuation of an impulsive downward wave 3 or c with a significant decrease in the pair. The unsuccessful attempt to break through the 1.1125 level, which corresponds to 23.6% according to Fibonacci, indicated the market's readiness for sales a month ago. Currently, I consider only selling with targets near the calculated level of 1.0462, which corresponds to 127.2% according to Fibonacci.

On a larger wave scale, we can see that the construction of corrective wave 2 or b continues, which is already more than 61.8% in length according to Fibonacci from the first wave. As I mentioned earlier, this is not critical, and the scenario with the construction of wave 3 or c and a decrease in the pair below the 1.04 level remains in force.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română