Despite strong macroeconomic statistics published on Wednesday and Thursday, the dollar and its DXY index are declining in the first half of today's trading day.

According to the data presented, the U.S. GDP grew by +3.3% in the 4th quarter (in a preliminary estimate) after a 4.9% increase in the previous period (with a forecast of +2.0%). Business activity in the U.S. manufacturing sector, as indicated by the S&P Global Purchasing Managers' Index, strengthened to 50.3 in January (from 47.9 previously with a forecast of 47.9), and in the services sector from 51.4 to 52.9 (with a forecast of a decrease to 51.0).

The overall positive was slightly marred by weak weekly statistics from the U.S. labor market, reflecting an increase in the number of initial jobless claims to 214,000 (with a forecast of 200,000 and a previous value of 189,000) and the number of continuing claims (for the week of January 12) to 1.833 million (from 1.806 million the week before with a forecast of 1.828 million).

Nevertheless, the data presented reduce the likelihood of an imminent start of a cycle of easing the Federal Reserve's monetary policy, providing important support for the dollar.

Today, investors are focusing on statistics regarding the dynamics of personal consumption expenditures in the U.S. Economists estimate that the core PCE price index in December may accelerate from +0.1% to +0.2% but slow down annually from +3.2% to +3.0%. This is another important inflation indicator used by the Federal Reserve in assessing inflation and planning monetary policy prospects.

If the data exceed expectations, the dollar will receive the necessary support, allowing the DXY index to close the week in positive territory, above the 103.00 mark.

The beginning of next week will likely be quite "lackluster": no significant publications are scheduled in the economic calendar for Monday. Market dynamics will intensify on Tuesday, with the publication of preliminary data on Germany's and the Eurozone's GDP for the 4th quarter at the start of the European trading session.

GDP is considered an indicator of the overall state of the economy. A rising GDP trend is viewed positively for the EUR; a low result weakens the EUR. In the previous 3rd quarter of 2023, Germany's GDP decreased by -0.1% and fell by -0.8% annually, while the Eurozone's GDP decreased by -0.1% (with 0% annually). The forecast expects a repetition of the 3rd quarter's GDP figures for the Eurozone in the 4th quarter, indicating ongoing recession risks.

If the data turns out to be weaker than the forecast and previous values, the euro may decrease sharply. Data better than forecast could strengthen the euro in the short term, although, as suggested by the macroeconomic statistics presented lately, a full recovery of the European economy—even to pre-crisis levels—is still far off.

On Wednesday (at 19:00 GMT), the Federal Reserve's interest rate decision will be published. However, more on this will be in our upcoming reviews.

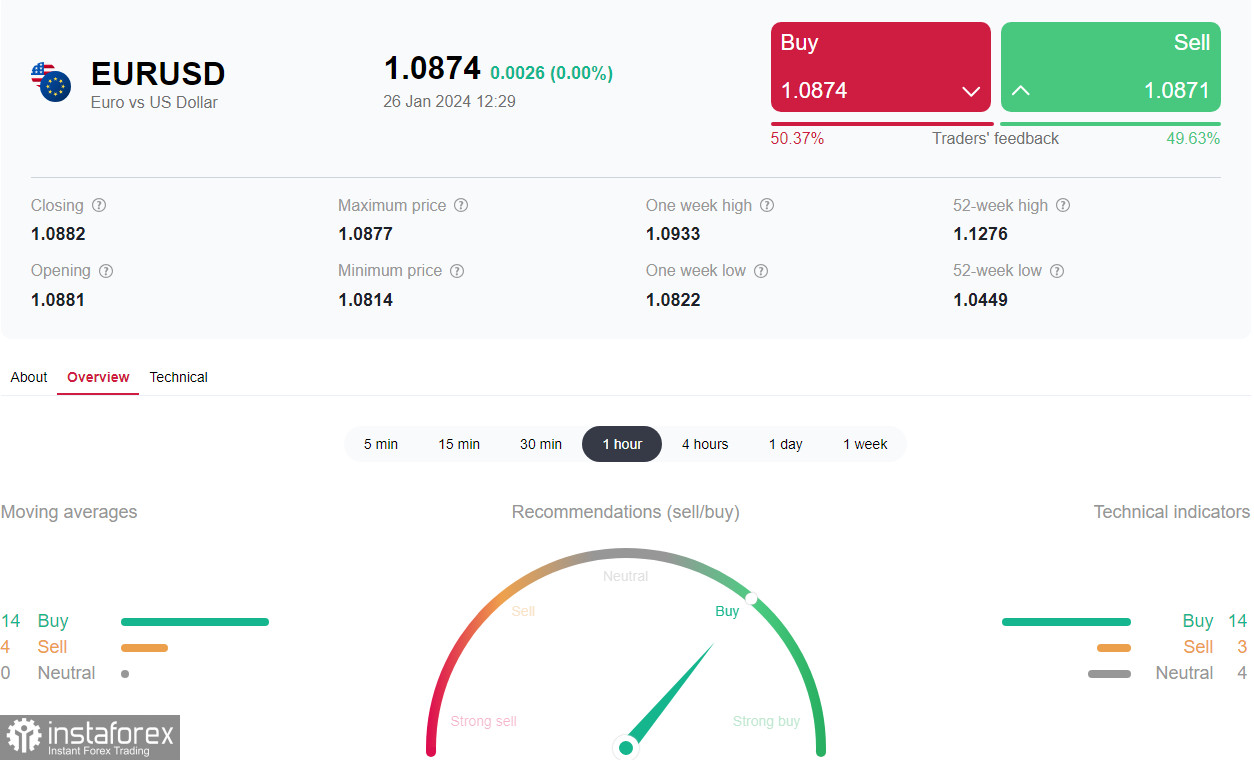

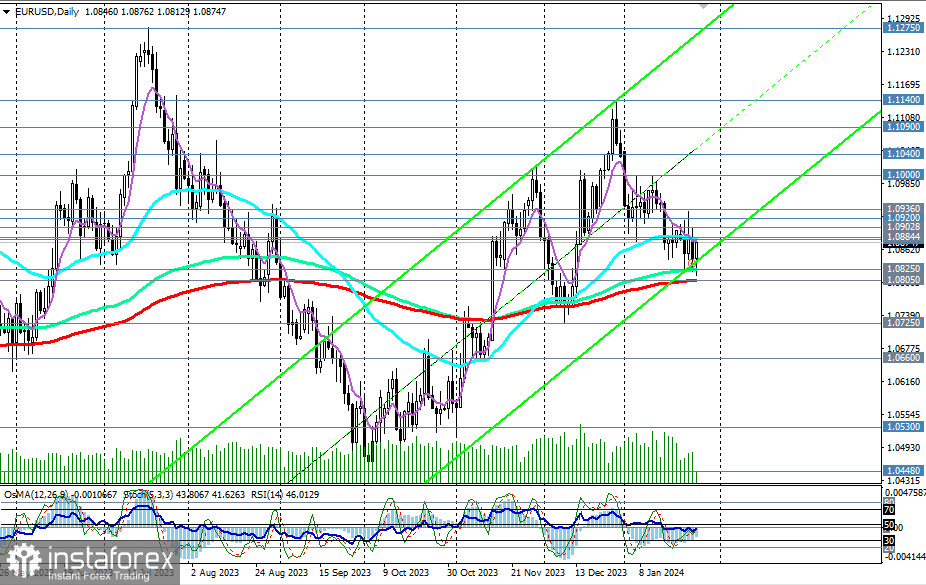

From a technical perspective, EUR/USD remains trading in the medium-term bullish market zone, above the key support level of 1.0805, and in the long-term bearish market zone, below the key resistance level of 1.1000.

The outcome of the ECB meeting that concluded on Thursday was unable to support the euro, although its president, Christine Lagarde, noted that it is premature to discuss easing monetary policy parameters at this time. At the same time, Lagarde said that the decisions of the bank's Governing Council would depend on the data.

Although, in her opinion, geopolitical tensions in the Middle East create upward risks for inflation, it could decrease faster if energy prices also decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română