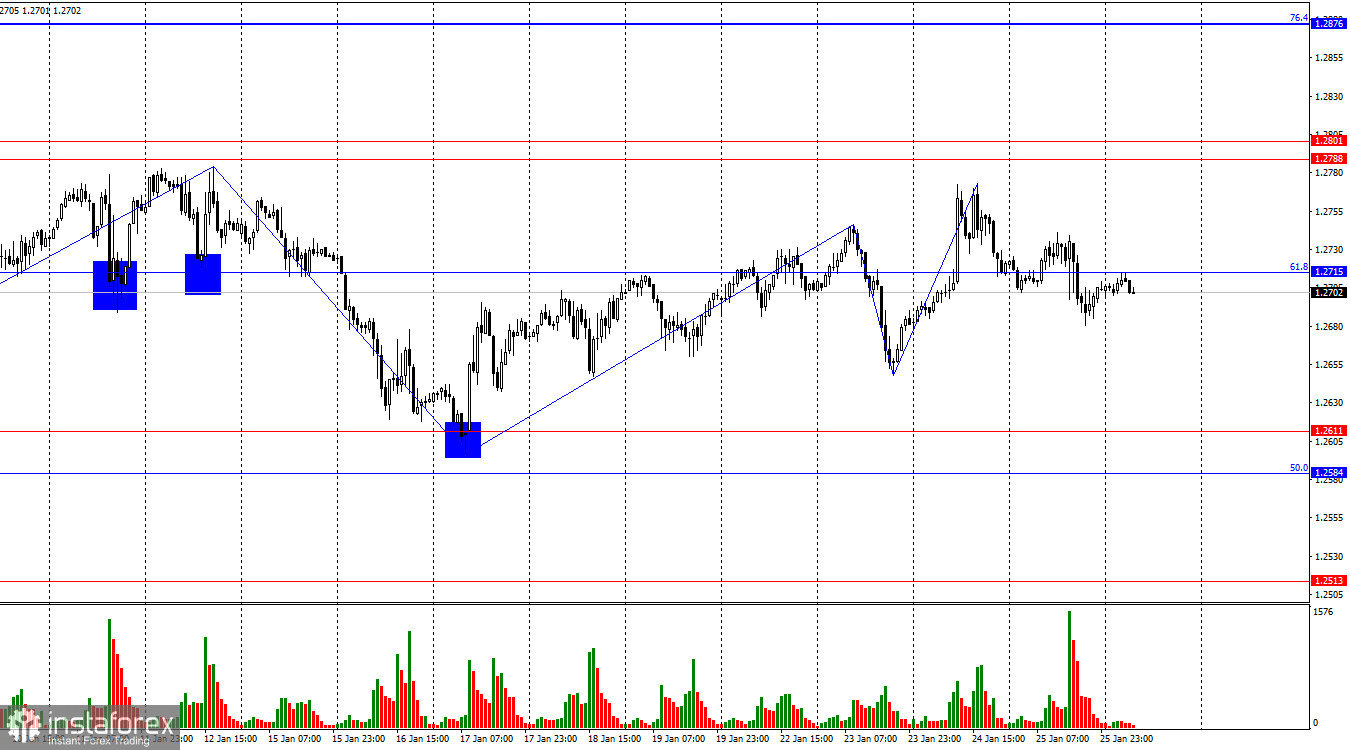

On the hourly chart, the GBP/USD pair continued its downward movement on Thursday and secured itself below the corrective level of 61.8% (1.2715). This level is rather weak, and the price hasn't paid much attention to it recently. Therefore, I wouldn't conclude a highly probable decline of the British currency on Friday. Nonetheless, it's possible in the direction of the support zone at 1.2584–1.2611.

The wave situation remains quite ambiguous. Current trends are relatively short-term, and we often see isolated waves. Bullish sentiment among traders persists due to the absence of the British pound falling below the 1.2584 level. The recent downward wave once again failed to break through the 1.2611 level, around which the lows of all previous waves are located. The new set of upward waves aims for the zone of 1.2788–1.2801, but I have significant doubts that the bulls will be able to surpass it. Thus, the sideways movement persists and will continue within the range of 1.2584–1.2801.

The information background on Thursday favored the US dollar. Traders perceived the results of the ECB meeting and Christine Lagarde's speech as reasons to get rid of euros and pounds. American statistics on GDP and durable goods orders were more positive than negative for the dollar. The US economy grew by 3.3% every quarter in the fourth quarter, which is significantly higher than traders' expectations. I believe that this indicator is one of the key ones and is much more important than a weaker report on durable goods orders.

Therefore, bears received support from the information background yesterday, but their reaction was rather weak. The pair remains within a horizontal channel, and that's the whole story. The situation with the British pound is currently very confusing and ambiguous.

On the 4-hour chart, the pair experienced another rebound from the 1.2745 level in favor of the US currency, allowing it to return to the 1.2620 level. There are no emerging divergences with any indicators today, and the ascending trend corridor has been left behind by the quotes. The trend may continue to shift towards "bearish," but it will take time and require significant efforts from the bears, especially a close below the 1.2620 level. The sideways movement for the pound persists and is evident to the naked eye.

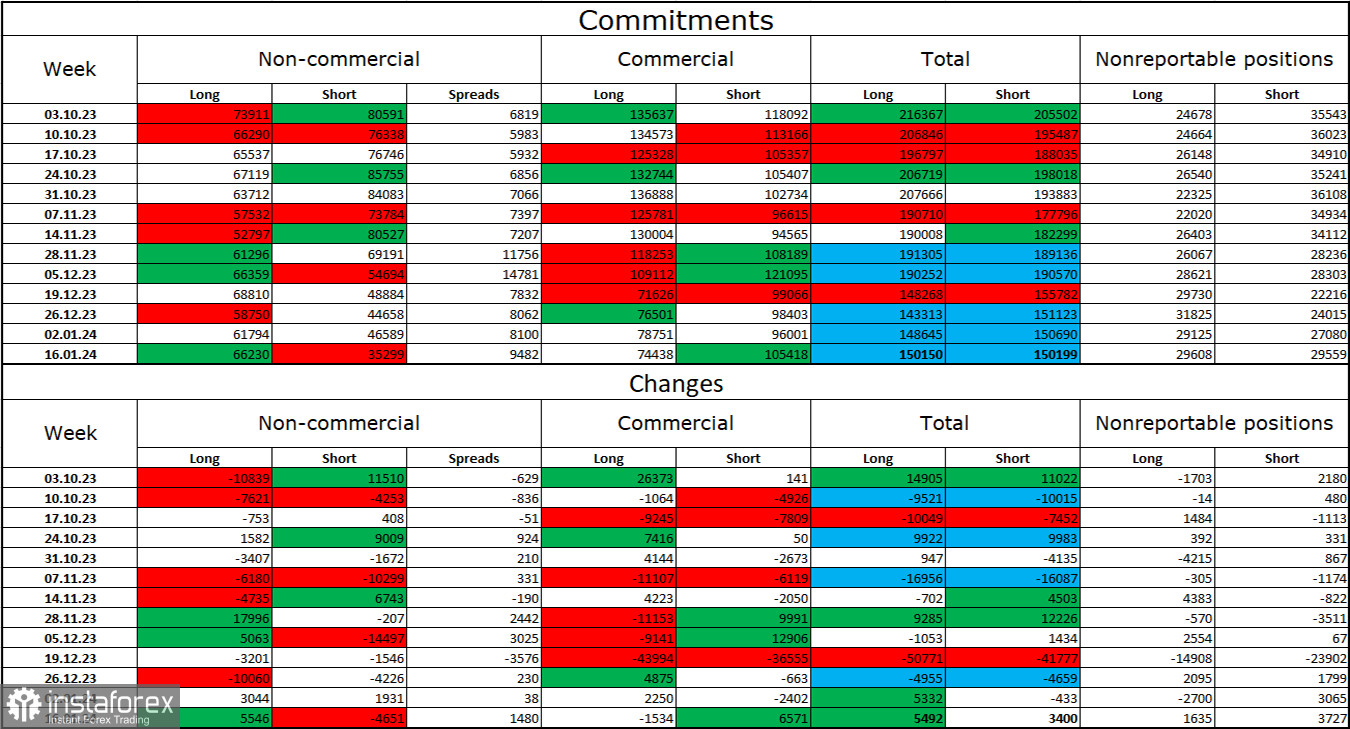

Commitments of Traders (COT) Report:

The sentiment of "Non-commercial" traders over the past reporting week has shifted in favor of the bulls. The number of long contracts held by speculators increased by 5546 units, while the number of short contracts decreased by 4651 units. The overall sentiment of major players turned "bearish" a few months ago, but currently, the bulls have a significant advantage. There is nearly a twofold gap between the number of long and short contracts: 66 thousand versus 35 thousand.

In my opinion, the British pound still has excellent prospects for a decline. I believe that over time, bulls will continue to shed their buy positions, as all possible factors for buying the British pound have already been worked out. The recent growth we've seen over the past three months, in my view, is corrective. The bulls have been unable to push the 1.2745 level for over a month. However, the bears are in no hurry to launch an offensive and are struggling to deal with the 1.2584–1.2611 zone.

News Calendar for the US and the UK:

US - Core Personal Consumption Expenditures (13:30 UTC).

US - Personal Income and Outlays (13:30 UTC).

US - Pending Home Sales Index (13:30 UTC).

On Friday, the economic events calendar contains three interesting entries. The impact of the information background on market sentiment today may be of moderate strength.

Forecasts for GBP/USD and trading recommendations:

I won't consider selling the pound today since the price is stubbornly moving towards 1.2788, ignoring the 1.2715 level. But I currently don't see any signals for buying either. I believe that in the current circumstances, it's better to wait a bit. For example, for a rebound from or a close above the 1.2788–1.2801 zone.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română