When everyone is buying, a great opportunity to sell emerges. At first glance, the approval of a Bitcoin ETF as a base asset by the Securities and Exchange Commission (SEC) should have attracted new capital to the digital asset market and contributed to price growth. However, this event was already priced into the BTC/USD quotes. Before the SEC's verdict was announced, the markets were showing a 90% or higher probability that it would happen. In 2023, due to the anticipation of the launch of specialized exchange-traded funds, the cryptocurrency sector leader more than doubled. At the beginning of 2024, the principle of "buy the rumor, sell the fact" was played out.

In the first few days of their operation, 10 spot ETFs attracted $4.7 billion—an impressive sum. However, the market dominates the view that there was a capital shift from the Grayscale specialized exchange-traded fund, which was allowed to convert base assets from Bitcoin futures into Bitcoin. This involves an amount of $3.4 billion and higher fees. It's no surprise that money flowed into the new ETFs.

However, according to JP Morgan, much of this reflects the process of profit-taking rather than a capital shift into the newly created specialized exchange-traded funds. Coupled with the sale of assets by the bankrupt exchange FTX and the decline in Coinbase shares after JP Morgan downgraded its rating, this led to capital outflow from the cryptosystem and a fall in BTC/USD quotes. If so, most of the negative impact has already been played out, and Bitcoin may begin to unfold its wings and grow.

Dynamics of Bitcoin and the S&P 500

The implementation of the "buy the rumor, sell the fact" principle and the related nearly 20% peak in the digital asset sector leader led to a divergence in its dynamics with the S&P 500. Both instruments are considered risky assets and, for a long time, moved in tandem, growing and falling simultaneously. However, the approval of spot ETFs by the Securities and Exchange Commission changed everything. Bitcoin took a step back, while the broad stock index rewrote the historical high for the fifth time in a row against the backdrop of the American GDP acceleration to 3.3% in the third quarter and a slowdown in PCE inflation from 2.6% to 1.7%.

The markets have adopted the Goldilocks scenario, where the economy gradually cools but does not enter a recession, and the rate of consumer price growth decreases. In such conditions, the Federal Reserve is more likely to lower the federal funds rate. This situation fuels the global appetite for risk and gives the green light to high-yield assets such as the S&P 500 and Bitcoin. The main thing is for the cryptocurrency sector leader to recover after the events related to the ETF launch.

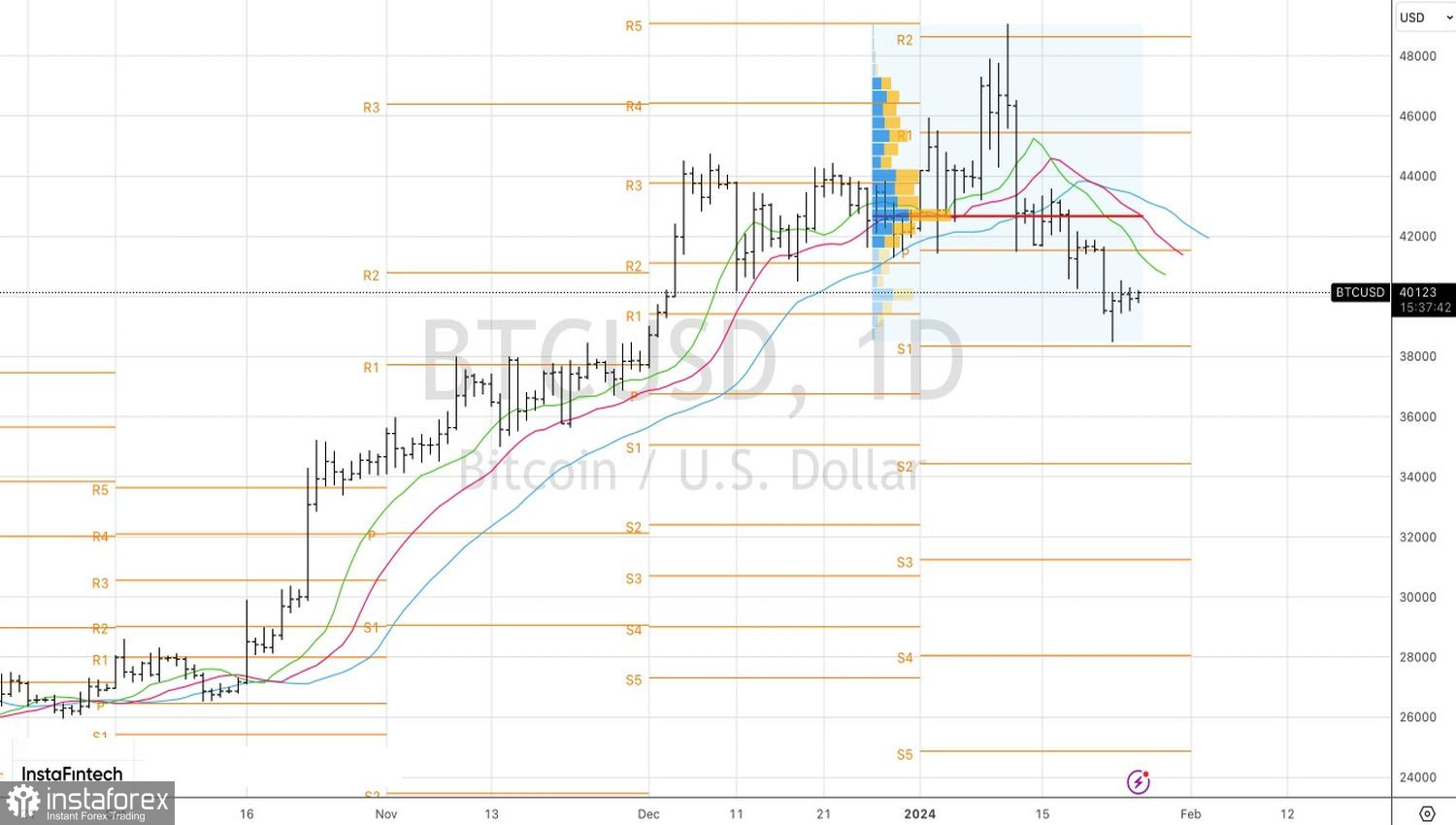

Technically, on the daily chart, BTC/USD is undergoing a correction to the long-term upward trend. As long as the quotes are below the fair value at 40,2630 and the combination of moving averages, bears dominate the market. This enhances the risks of continuation of the pullback and allows selling on the break of support at 39,450 or the rebound from resistances at 40,770, 41,150, and 41,540.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română