Lately, the market has been constantly speculating about future interest rate changes in the U.S., the eurozone, and the United Kingdom. This topic has already bored many people, but interest rates are arguably the key parameter that directly impacts the movement of many currencies. Therefore, there's no choice but to closely monitor all aspects of various economies to understand the potential future decisions of central banks.

Take note that indicators of inflation, economic growth, unemployment, labor markets, and interest rates are closely interconnected. The chains are simple and understandable to everyone. If the economy is not growing or contracting, it means that the pressure of monetary policy is too high, and interest rates need to be lowered. If inflation is decreasing, there's no reason to maintain interest rates at their peak level. If the labor market is shrinking, and unemployment is rising, it means that interest rates are too high or have remained high for too long.

Let's take a look at what's happening in the U.S. right now. The latest GDP report showed that the U.S. grew at a robust 3.3% annual pace in the fourth quarter. The market was expecting +2-2.3%. Therefore, we can arrive at the conclusion that the U.S. economy is in good shape. It has been growing stronger than even the most optimistic forecasts for several quarters now. And it's important to note that forecasts are usually pessimistic. It seems like analysts are deliberately waiting for the U.S. economy to falter. Then they want to claim they were right by predicting a new crisis, stagnation, or recession.

However, economic growth in the United States has been consistently strong from quarter to quarter. Unemployment has increased only slightly during the period of high Fed rates, and the labor market remains robust, with inflation now down to 3%. In my opinion, these numbers indicate that the FOMC should not be in a rush to start lowering rates as quickly as possible. Inflation has shown a very weak slowdown over the last six months and has occasionally even risen. Therefore, I personally don't understand why James Bullard and many economists are expecting a rate cut in March.

According to the CME FedWatch tool, the probability of a rate cut in March is currently at 44%. Just a few weeks ago, it was above 80%. As a result, the market is now backing away from the expectation of a March rate cut. This information, combined with strong economic indicators in the U.S., should boost demand for the U.S. dollar.

The U.S. dollar manages to gain ground against the euro, albeit somewhat slowly, but the British pound continues to remain stagnant, likely awaiting some signals from the Bank of England regarding its future course of actions. The central bank meeting will take place next week, and I still expect the pound to show weakness.

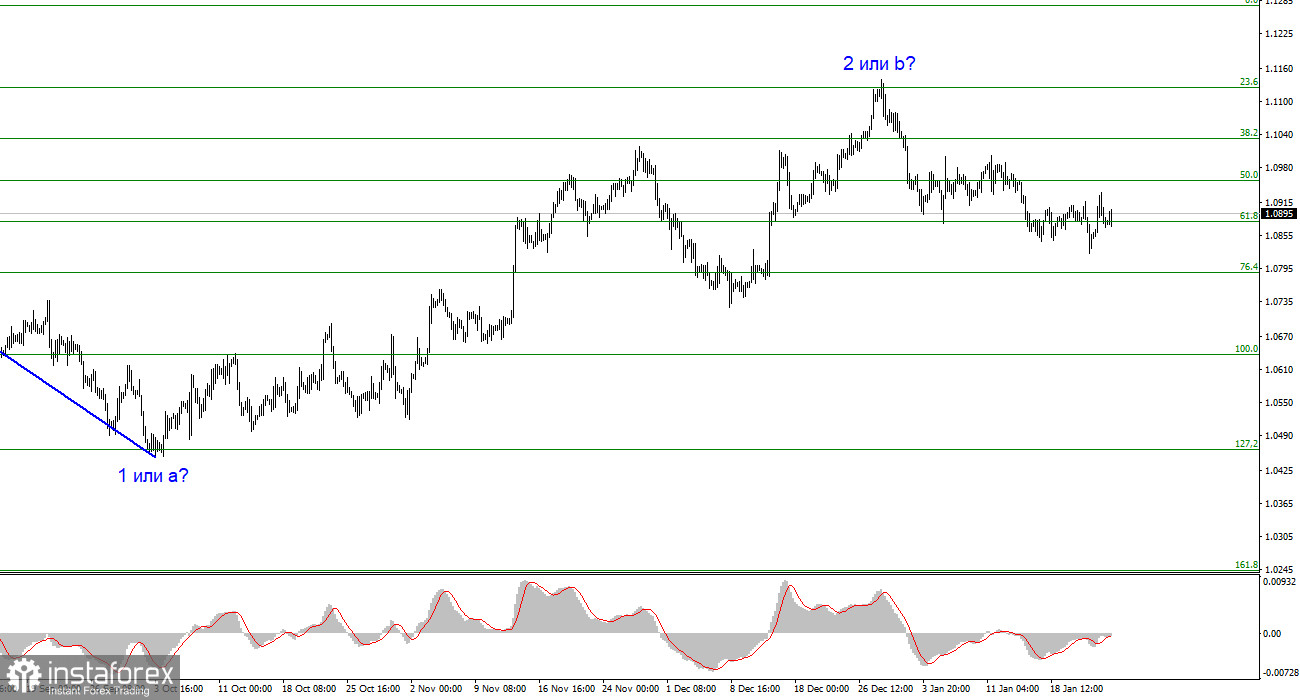

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci retracement, suggests that the market is prepared to sell a month ago. I will only consider short positions with targets near the level of 1.0462, which corresponds to 127.2% Fibonacci.

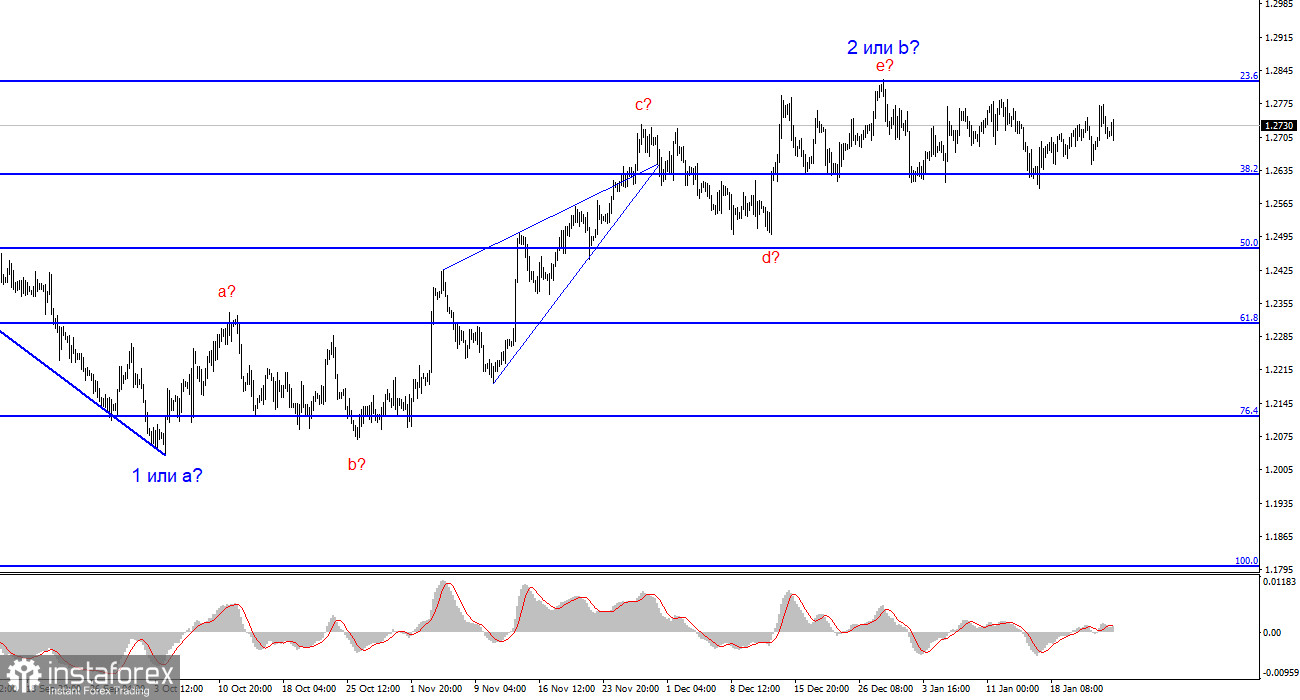

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. However, since we are currently observing a flat pattern, I wouldn't rush to short positions at this time. Since the movement has been horizontal for a month now, I would wait for a successful attempt to break below the 1.2627 level in order to grow more confident in the instrument's decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română