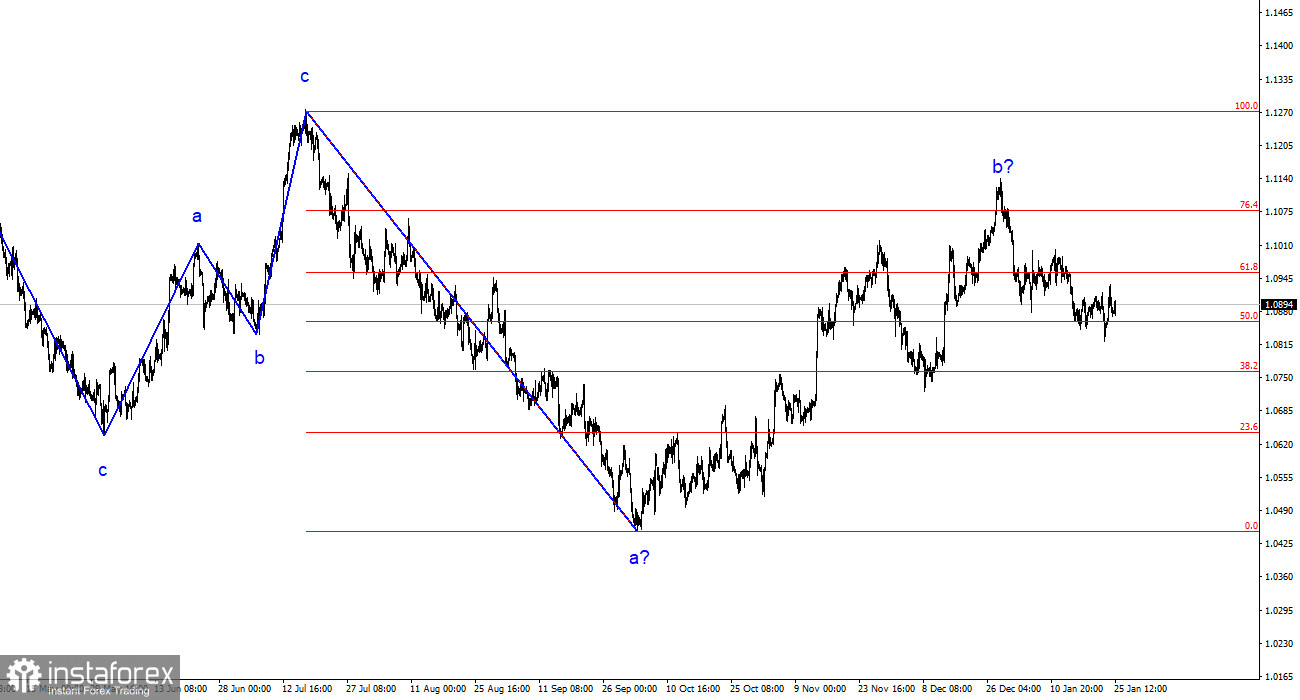

The wave analysis of the 4-hour chart for the euro/dollar currency pair remains unchanged. Over the past year, we have witnessed only three wave structures that constantly alternate with each other. The construction of another three-wave structure, a downtrend, is continuing. The presumed wave 1 is completed, but wave 2 or b has become more complicated three or four times, and there are no guarantees that it will not become more complicated again.

Although the news background cannot be considered "supportive of the European currency," the market always finds new reasons to increase demand for the instrument. This situation is not normal. Even if the upward trend resumes, its internal structure will become unreadable.

The internal wave labeling of the presumed wave 2 or b has changed. Since the last downward wave was disproportionately large, I now interpret it as wave b. If this is the case, wave 3 or c is currently being formed, and the entire wave 2 or b is presumably completed. The current retreat of quotes from the highs looks convincing.

The market reacted calmly to the regulator's decision

The euro/dollar exchange rate increased by 10 basis points during Thursday's trading session. The day is not over yet, and the American session has just begun, so there may still be significant price changes by the end of the day. However, at the moment, the results of the ECB meeting have been summarized, American statistics have been released, and market activity remains at the same level. Most likely, the market will spend several hours digesting the information it has received in the past hour. Therefore, we may see the instrument trading far from its current price level in the evening or tomorrow morning.

What decisions did the ECB make during its first meeting in 2024? In general, none. All three interest rates remained unchanged, and Christine Lagarde's speech will occur later. The market initially pushed the euro down to 1.0875 but quickly returned it to its original position, which was 20 points higher. Consequently, prices and waves are currently the same.

However, I am satisfied with the market's reaction. The market and analysts did not expect any changes in the monetary policy of the ECB, so expectations coincided with reality. The most important event is still ahead, as Christine Lagarde may outline the time frame within which the first easing of the policy can be expected. This information is not just important but painful for the market, so we may see significant pressure from the bulls or bears.

General conclusions.

Based on the analysis conducted, the construction of a bearish wave set continues. Wave 2 or b has taken on a completed form, so in the near future, I expect the continuation of the construction of an impulsive downward wave 3 or c with a significant decline in the instrument. The unsuccessful attempt to break through the level of 1.1125, corresponding to 23.6% according to Fibonacci, indicated the market's readiness for sales a month ago. Currently, I am considering selling with targets around the calculated level of 1.0462, corresponding to 127.2%, according to Fibonacci.

On the higher wave scale, it can be seen that the construction of corrective wave 2 or b is continuing, which in length is already more than 61.8% according to Fibonacci of the first wave. As I have already mentioned, this is not critical, and the scenario with the construction of wave 3 or c and a decline in the instrument below the 4-figure mark still needs to be validated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română