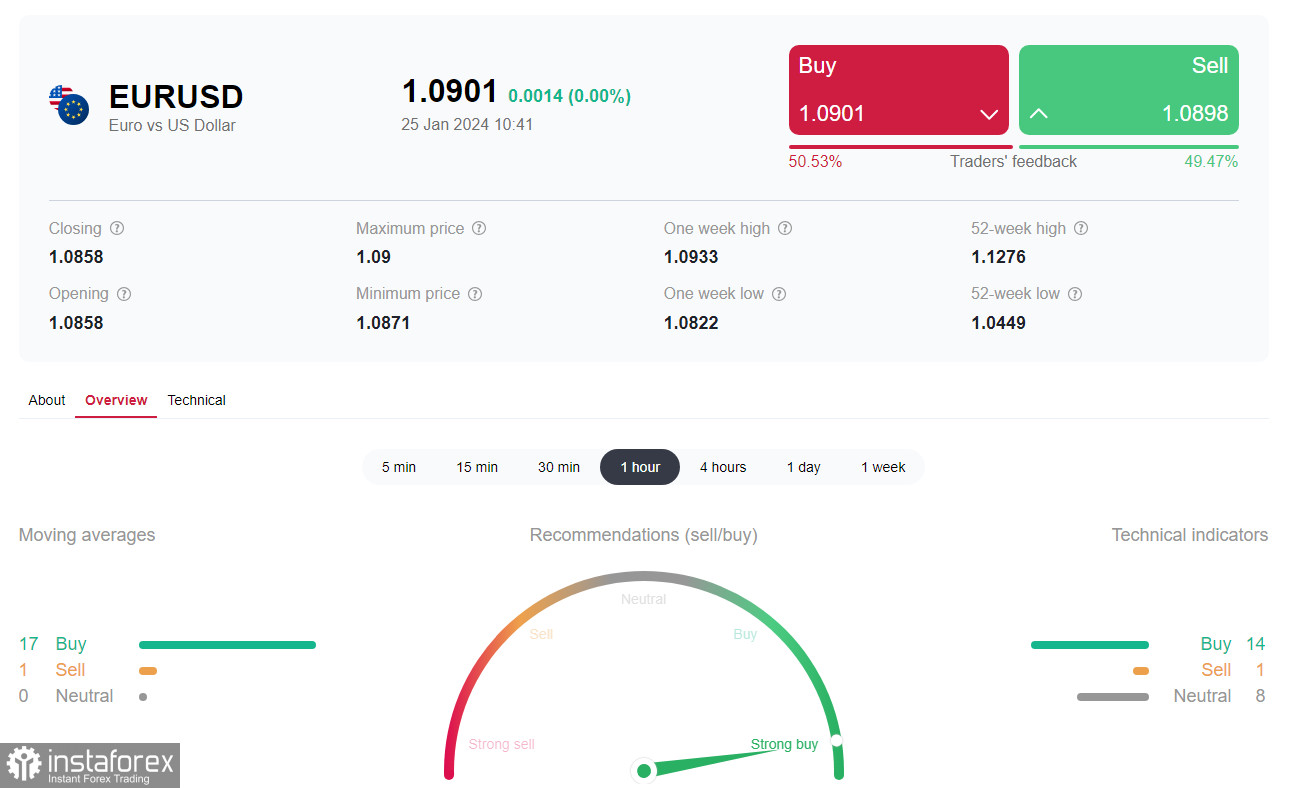

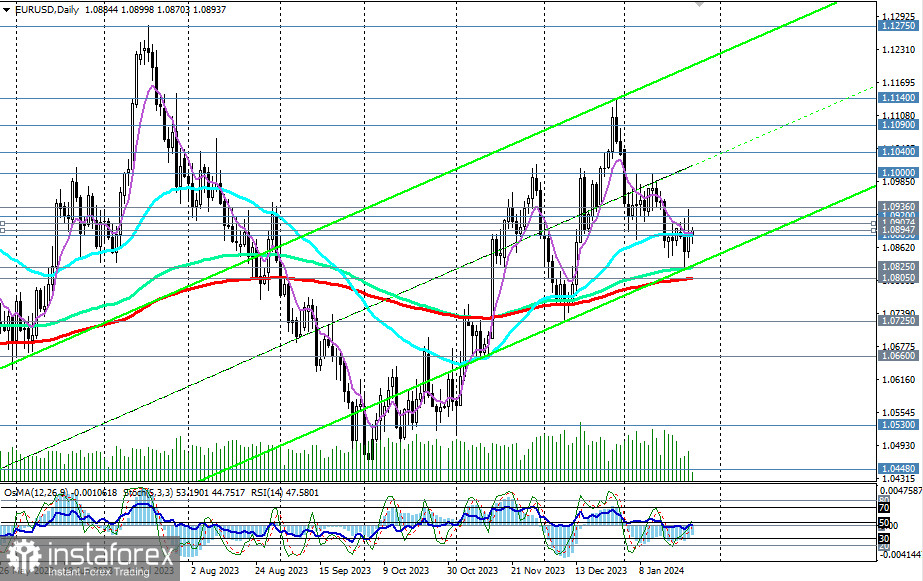

On the eve of the ECB's "fateful" (within a couple of months) decision on interest rates, the dynamics of the EUR/USD pair slowed down near the important short-term support/resistance level of 1.0895 (200 EMA on the 1-hour chart).

It is widely expected that the ECB leaders will not change the parameters of monetary policy, maintaining a cautious position and keeping interest rates at previous levels, and investors are "in waiting mode" ahead of the publication (at 13:15 GMT) of this decision.

If today's decisions and statements by the ECB leaders are perceived by the market as dovish, then we should expect the euro to weaken and the EUR/USD pair to fall.

In this case, breaking today's low of 1.0870 could be the first signal to sell the pair with the nearest targets at the key medium-term support levels of 1.0825 (144 EMA on the daily chart), 1.0805 (200 EMA on the daily chart).

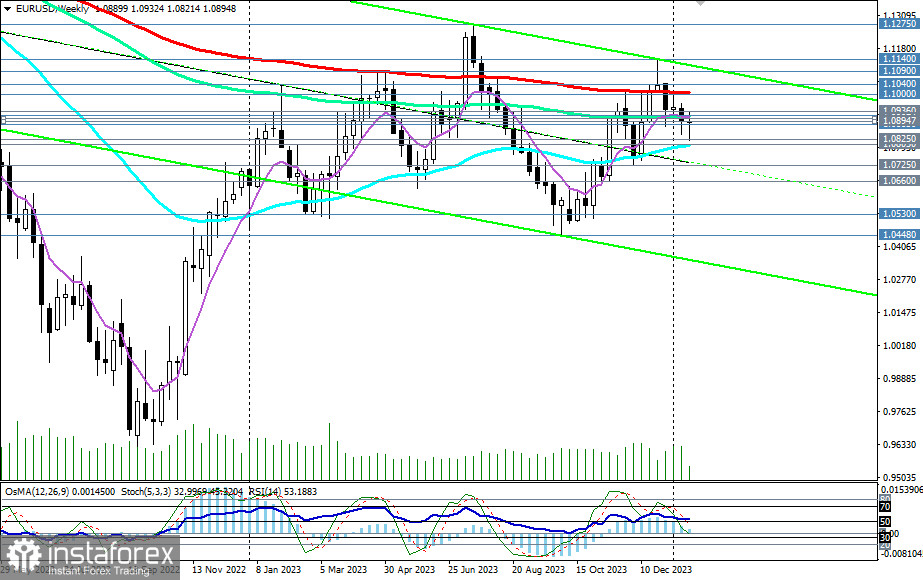

A break below these levels and further decrease will take EUR/USD into the medium-term bear market zone, intensifying the downward dynamics within the long-term bear market.

The targets for the decline in case this scenario materializes are the local support levels of 1.0530, 1.0450, and then the marks of 1.0400, 1.0300, near which the lower boundary of the downward channel on the weekly chart passes.

In an alternative scenario, the price will break through the mark of 1.0895, today's high of 1.0900, and the important short-term resistance level of 1.0907 (200 EMA on the 4-hour chart) and resume the upward correction. The nearest growth targets are resistance levels 1.1000 (200 EMA on the weekly chart), 1.1040 (50 EMA on the monthly chart). Their breakout will take EUR/USD into the long-term bull market zone, making long-term long positions preferable with targets at the global resistance level of 1.1630 (200 EMA on the monthly chart).

For now, below the mark of 1.0910, short positions remain preferable.

Support levels: 1.0885, 1.0855, 1.0825, 1.0805, 1.0800, 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Resistance levels: 1.0895, 1.0900, 1.0907, 1.0920, 1.0936, 1.1000, 1.1010, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530, 1.1600, 1.1630

Trading scenarios

Main scenario: Sell Stop 1.0865. Stop-Loss 1.0910. Targets 1.0855, 1.0825, 1.0805, 1.0800, 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Alternative scenario: Buy Stop 1.0910. Stop-Loss 1.0865. Targets 1.0920, 1.0936, 1.1000, 1.1010, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530, 1.1600, 1.1630

"Targets" correspond to support/resistance levels. This does not necessarily mean they will be reached, but they can serve as a guide when planning and placing your trading positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română