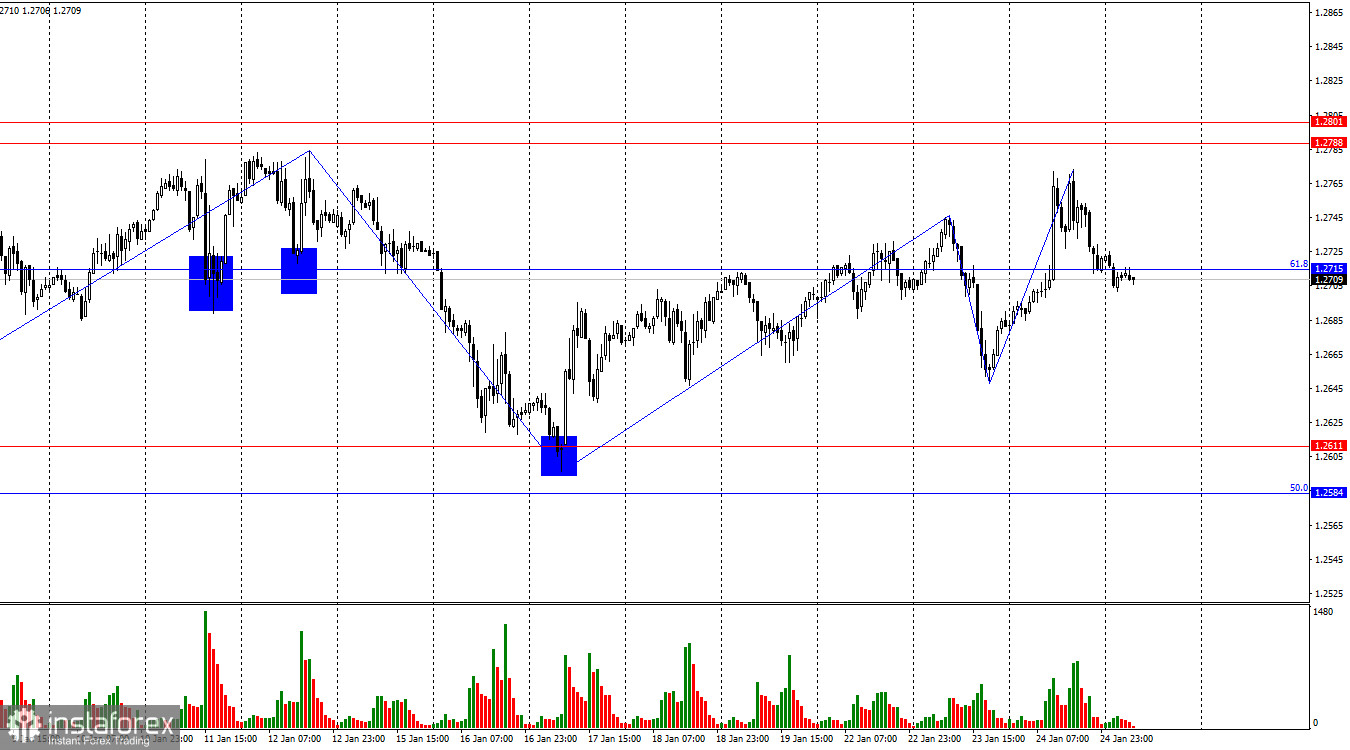

On the hourly chart, the GBP/USD pair reversed in favor of the British pound on Wednesday, rallying to the resistance zone of 1.2788–1.2801. However, in the second half of the day, a reversal occurred in favor of the US currency, bringing it back to the corrective level of 61.8% (1.2715). If the pair's exchange rate remains below this level, we can expect a further decline towards the support zone of 1.2584–1.2611. It's worth noting that we have been witnessing a prolonged period of horizontal movement.

The wave situation remains quite ambiguous. Currently, we have relatively short-term trends, often with single waves. Bullish sentiment among traders persists due to the absence of the pound falling below the 1.2584 level. The recent downward wave failed to break the 1.2611 level, around which the lows of all previous waves are located. The new set of upward waves aims for the zone of 1.2788–1.2801, but I am confident that the bulls can break through it. Thus, the sideways movement continues until the pair breaks out of the 1.2584–1.2801 zone.

On Wednesday, the information background supported both the pound and the dollar. In the morning, the UK released business activity indices for the services and manufacturing sectors, slightly better than traders' expectations. Then, in the second half of the day in the US, similar indices were released, which supported sellers as business activity also increased in the United States. Today, important reports include US GDP and durable goods orders.

However, I will shift my focus to the ECB meeting, as this event has much higher chances of being worked out by traders, even for the pound. I expect significant movements after lunch.

On the 4-hour chart, the pair has made another bounce from the 1.2745 level and a reversal in favor of the US currency, allowing it to return to the 1.2620 level. There are no imminent divergences in any of the indicators, and the ascending trend corridor has been left behind. The trend may continue to shift towards a bearish one, but this will take time and require considerable effort from the bears, particularly a close below the 1.2620 level. The sideways movement in the pound continues and is visible.

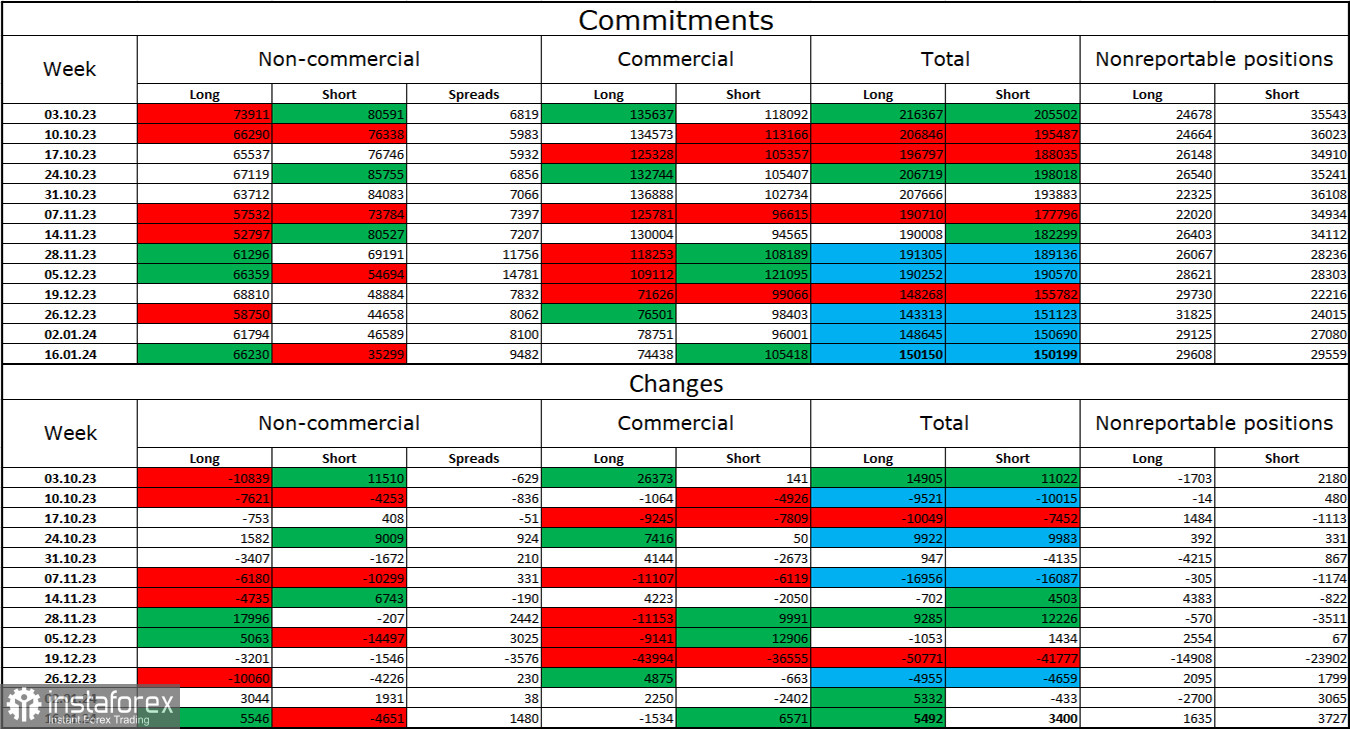

Commitments of Traders (COT) Report:

The sentiment of "non-commercial" traders in the last reporting week shifted in favor of the bulls. The number of long contracts held by speculators increased by 5546 units, while the number of short contracts decreased by 4651. There is almost a two-fold gap between the number of long and short contracts: 66 thousand versus 35 thousand.

The pound still has excellent prospects for a decline. Over time, bulls will continue to unwind their buy positions, as all possible factors for buying the British pound have already been worked out. The growth we have seen over the past three months is corrective. The bulls have been unable to push the pound below the 1.2745 level for over a month. However, the bears are not hurrying to go on the offensive and are struggling with the 1.2584-1.2611 zone.

Economic Calendar for the US and the UK:

US - Durable Goods Orders (13:30 UTC).

US - GDP Change in the Fourth Quarter (13:30 UTC).

US - Initial Jobless Claims (13:30 UTC).

On Thursday, the economic events calendar contains three interesting entries. The impact of the information background on market sentiment today could be significant due to the ECB meeting.

GBP/USD forecast and trader advice:

I will not consider selling the pound today, as the price is stubbornly moving towards 1.2788 while ignoring the 1.2715 level. However, I currently do not see any signals to buy either. It's better to wait a bit for a bounce or a close above the 1.2788-1.2801 zone.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română