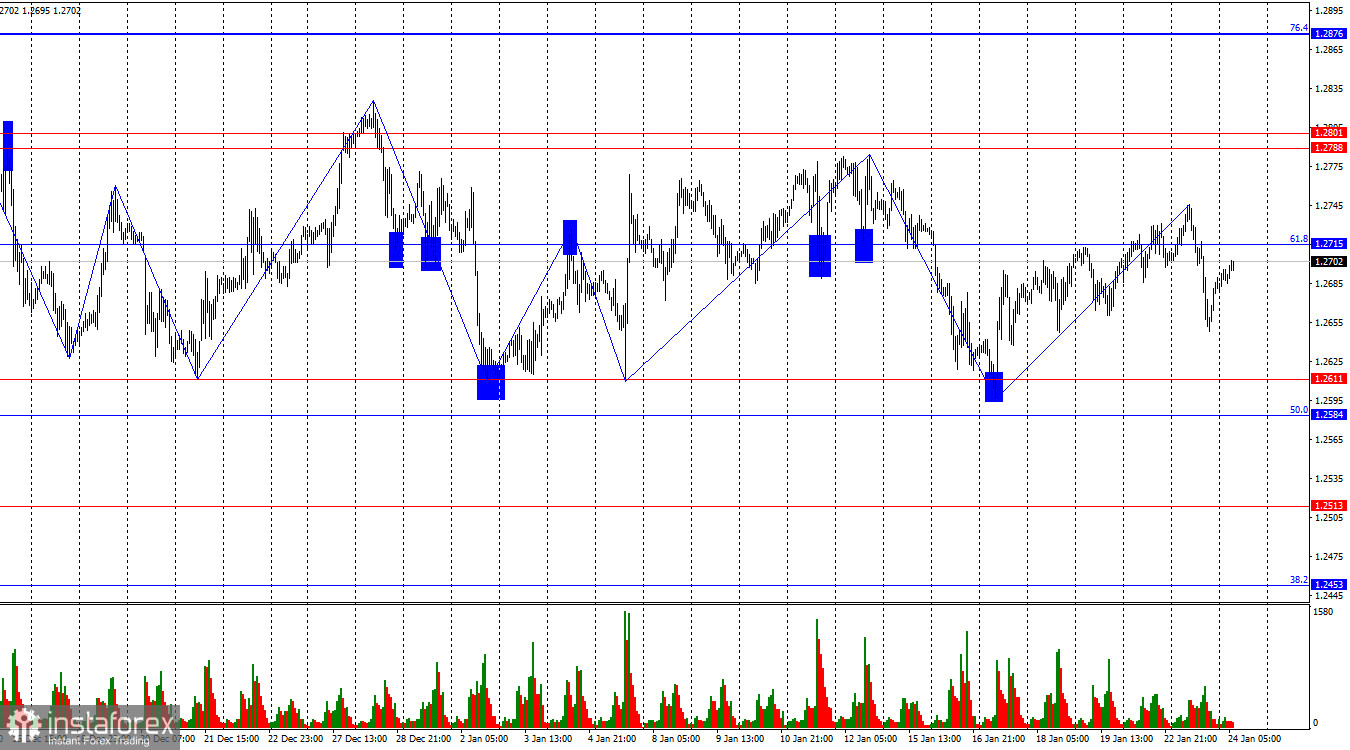

Good afternoon, dear traders! On the 1-hour chart, the GBP/USD pair reversed on Tuesday in favor of the US dollar and consolidated under the correction level of 61.8% or 1.2715. The fall did not last for long. Currently, the price is still declining to the level of 1.2715. A rebound in the instrument from this level will again work in favor of the US currency because GBP/USD will resume the fall towards the support zone of 1.2584–1.2611. If the price settles above 1.2715, this will increase the likelihood of a climb in the direction of the resistance zone of 1.2788–1.2801.

The situation with the waves remains very ambiguous. Trends are now quite short-term, we often see single waves. Traders retain the bullish mood because the pound sterling has not dropped below 1.2584 yet. The last downward wave once again failed to break through the level of 1.2611. The lows of all previous waves are located close to this level. The last ascending wave also did not break through the important zone of 1.2788–1.2801 and did not even break through the peak of January 12. Thus, the sideways trend is still valid and will continue until the pair leaves the 1.2584–1.2801 zone.

The economic calendar was empty on Tuesday. Today the information background will be more interesting. In the UK, PMIs will be released in a few hours, followed by PMIs in the US in the afternoon. In my opinion, as long as GBP/USD remains in the sideways channel, it makes no difference whether these reports turn out to be positive or negative. Yesterday we saw a strong fall in the British currency. Today we can see a strong growth (which may have already begun). However, he instrument remains in the range-bound market. Trading sideways has always been complicated and at least ineffective. Perhaps the situation will change next week when the Federal Reserve and the Bank of England are due to hold their policy meetings. Meanwhile, I do not see the preconditions for the end of the sideways trend.

On the 4-hour chart, GBP/USD rebounded again from 1.2745 and made a reversal in favor of the US currency, which allows the price to return to 1.2620. There are no emerging divergences today in any of the indicators. The instrument has left the ascending trend channel. The trend shift to bearish, but this will take time and require a lot of effort from the bears. In particular, the bears should push the price to close below 1.2620.

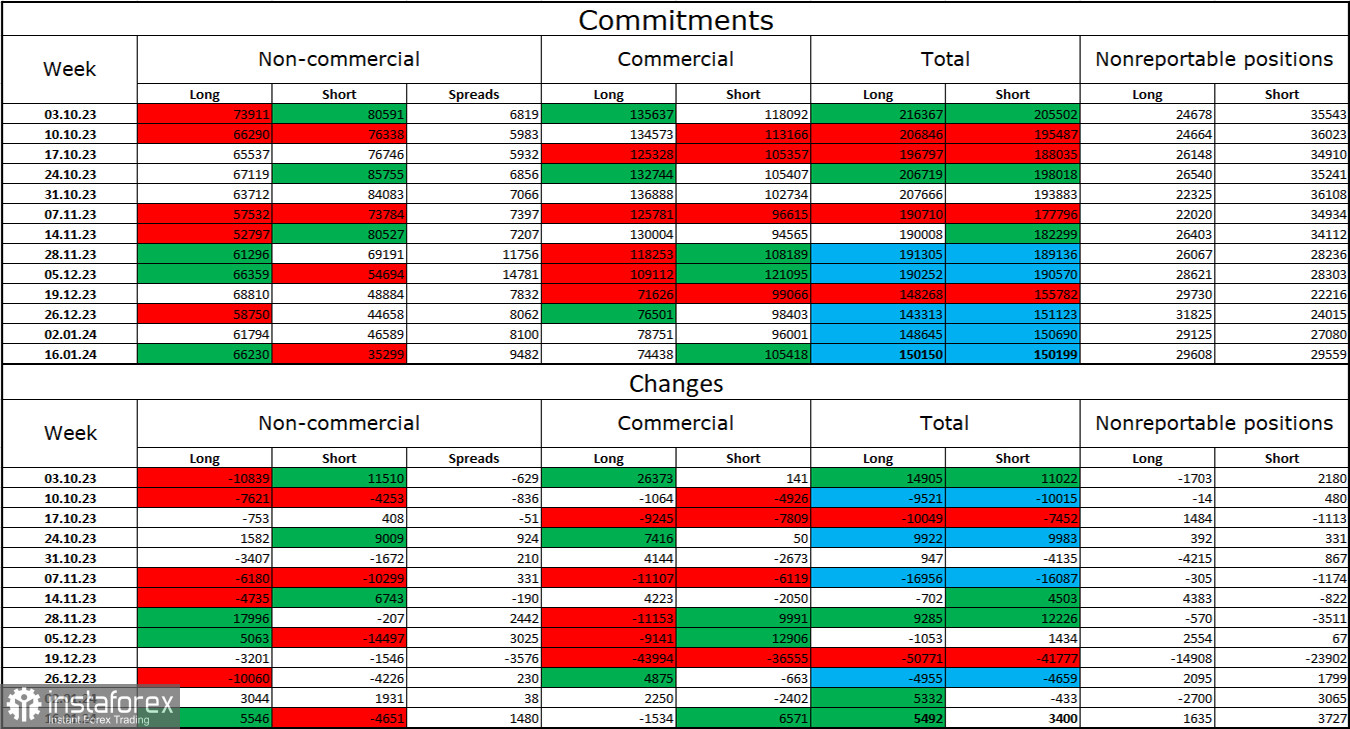

Commitments of Traders (COT):

The sentiment of the "Non-commercial" category of traders changed in favor of the bulls over the last reporting week. The number of Long contracts increased by 5,546, whereas the number of Short contracts decreased by 4,651. The overall mood of major market players changed to bearish a few months ago, but currently, the bulls again have a big advantage. There is an almost twofold gap between the number of Long and Short contracts: 66K versus 35K.

In my opinion, the British currency still has excellent bearish prospects. I believe that over time, the bulls will continue to get rid of buy positions since all possible factors for buying the British pound have already been worked out. The growth that we have seen in the last three months, is correctional. For more than a month, the bulls have not been able to push through 1.2745. However, the bears are in no hurry to go on the offensive and cannot cope with the zone 1.2584 – 1.2611.

Economic calendar for US and UK

UK: S&P Global manufacturing PMI due at 09-30 UTC

UK: S&P Global services PMI due at 09-30 UTC

US: S&P Global manufacturing PMI due at 14-45 UTC

US: S&P Global services PMI due at 14-45 UTC

On Wednesday, the economic calendar contains 4 high-impact reports. The information background might have a medium impact on market sentiment.

Intraday outlook for GBP/USD and trading tips

I'm not planning any sell positions for the British pound today, since GBP/USD is stubbornly moving towards 1.2788, neglecting the level of 1.2715. At the same time, I don't see any buy signals right now. I think that it is better to wait a little under the current market conditions. For example, we could wait for a rebound or close above the zone 1.2788 – 1.2801 (if it ever happens).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română