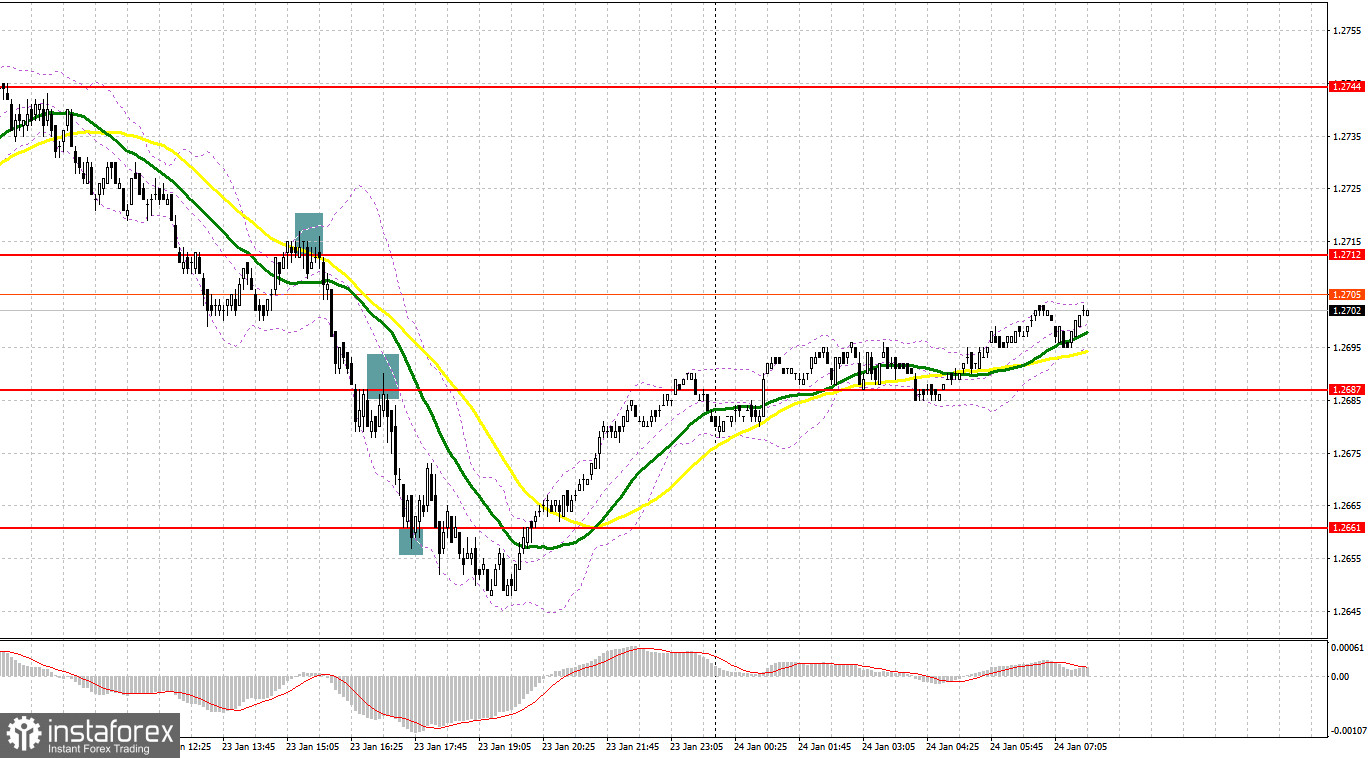

Yesterday, GBP/USD generated several signals to enter the market. Now let's look at the 5-minute chart and try to figure out what actually happened. In my previous forecast, I indicated the level of 1.2737 and planned to make decisions on entering the market from there. After testing the next daily high, a rise and a false breakout at this level suggested an entry point for sell positions, which sent the pair down by 30 pips. In the afternoon, a breakdown and retest of 1.2712 enabled opening short positions. As a result, the pound fell by another 30 pips. A similar story happened with 1.2687 and the pound was down by 30 pips. Protecting the support level of 1.2661 and opening longs from it did not bring immediate results.

For long positions on GBP/USD:

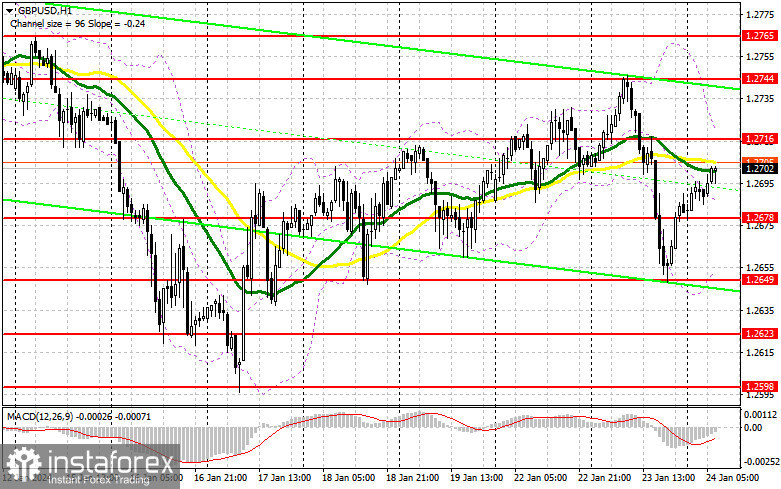

Today, the pound may continue to fall, so I advise you to save your strength and wait for the release of January's UK advanced Manufacturing and Services PMI for fresh impetus. If the reports turn out to be disappointing, the pair will resume its decline, in which case the bears will test the monthly low. If the figures turn out to be more or less, we can expect GBP/USD to recover and test the weekly high. In case the reports exert pressure on the pair, I will try to buy near the nearest support at 1.2678. A false breakout on this mark will give an entry point in development of an uptrend with the goal of testing 1.2716. A breakout and consolidation above this range will strengthen the demand for the pound and open the way to 1.2744. The farthest target will be the 1.2765 high, where I will take profits. In a scenario where GBP/USD falls and there are no buyers at 1.2678, this will put pressure on the bulls. If this happens, I will postpone long positions until the test of 1.2649. Only a false breakdown there will confirm the correct entry point. You can open long positions on GBP/USD immediately on a dip from 1.2623, bearing in mind an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Sellers have asserted themselves. Now we need weak UK data and talk that the Bank of England will be forced to lower rates sooner than predicted. This will be enough to set up a bigger GBP/USD sell-off. In case the market shows a positive reaction to the PMI data, the bears will have to think about defending the nearest resistance at 1.2716, just below which the moving averages are passing, playing on the bears' side. A false breakout at this level would confirm the presence of major players in the market, creating a sell signal with the expectation of the pair's decline and we can aim for 1.2678. A breakout and an upward retest of this range will deal a more serious blow to the bulls' positions, leading to the removal of stop orders and open the way to 1.2649. A lower target will be 1.2623, where I will take profits. If GBP/USD grows and there are no bears at 1.2716, which is most likely the case, the bulls will regain the opportunity to develop a new uptrend. I would delay short positions until a false breakout at 1.2744. If there is no downward movement there, I will sell GBP/USD immediately on a bounce right from 1.2765, considering a downward correction of 30-35 pips.

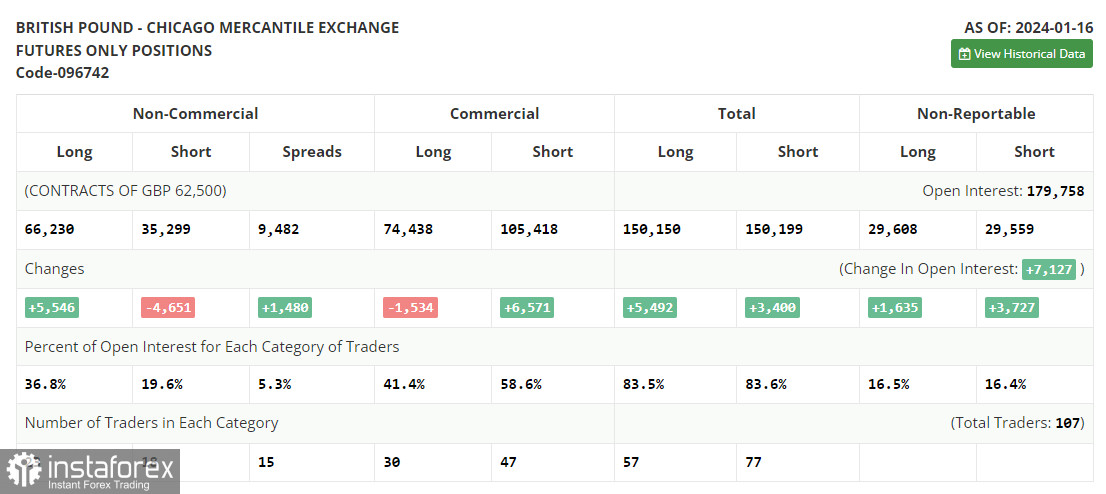

COT report:

In the COT report (Commitment of Traders) for January 16, we find a decline in short positions and an increase in long ones. Macroeconomic data released recently, especially any report related to inflation, allow the British pound to stay afloat. Lately, Bank of England's policymakers have made it clear that they will continue to keep interest rates at current highs and struggle against stubborn inflation even despite ongoing economic woes. This is both good and bad for the pound sterling. GBP may benefit in the short term, but the outlook is bearish in the long term, since normalization of GDP growth rates will take longer than expected. In the near future, activity data for January will shed light on the current state of affairs. The latest COT report said that long non-commercial positions rose by 5,546 to 66,230, while short non-commercial positions fell by 4,651 to 35,299. As a result, the spread between long and short positions increased by 1,480.

Indicator signals:

Moving Averages

Trading just around the 30- and 50-day moving averages indicates sideways movement

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower boundary near 1.2650 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română