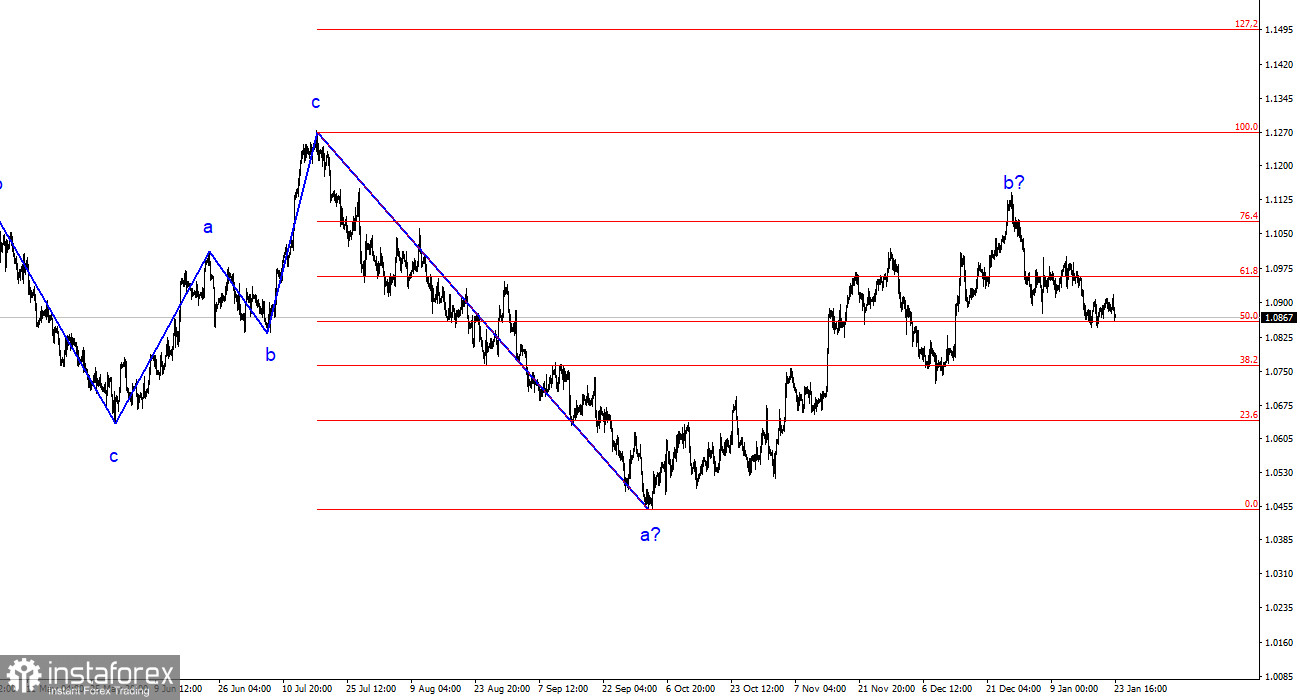

The wave analysis on the 4-hour chart for the euro/dollar pair remains unchanged. Over the past year, we have observed only three wave structures that continually alternate with each other. Currently, another three-wave move to the downside is in progress. The presumed wave 1 is completed, but wave 2 or b has become more complex three or four times, with no guarantees that it will be simple.

Although the news backdrop cannot be considered "supportive of the European currency," the market consistently finds new reasons to increase demand for the pair. Such a situation is not normal. Even if the upward trend segment is resumed, its internal structure will become unreadable.

The internal wave analysis of the presumed wave 2 or b has changed. Since the recent downward wave turned out disproportionately large, I now interpret it as a wave b. If this is the case, wave 3 or c is currently being constructed, and wave 2 or b is presumably completed. The current pullback from the reached highs appears convincing.

In anticipation of the ECB meeting, the market is still determining what to expect.

The euro/dollar currency pair experienced a 15-point drop on Tuesday. The intraday volatility was higher, but the market remains perplexed due to the upcoming ECB meeting, followed by the Fed meeting. There have been almost no significant events in the last few working days. ECB and Fed board members are refraining from speaking (as both central bank meetings are approaching), and economic statistics are scarce. Therefore, the sluggish market conditions are familiar to me.

Since market movements are very weak and non-trending, I suggest shifting your attention to the ECB and Fed meetings. The ECB meeting will begin tomorrow, and its results will be known on Thursday. Interest rates, the most critical indicator, are unlikely to change this time. All market attention will be focused on Christine Lagarde's speech, although there might also be some disappointment here. The point is that the ECB President has spoken at least thrice in the last one and a half weeks. She shared genuinely important information on one occasion, stating that rate cuts may begin closer to the summer.

In reality, Lagarde indicated there would be enough information closer to summer to discuss rate cuts, which essentially means the same thing. Therefore, the key question for Thursday is whether Lagarde will reiterate a decisively "dovish" rhetoric or whether her stance will soften even further. If the discussion still revolves around a rate cut in May-June, the demand for the European currency may decline, but not significantly. If the conversation shifts towards a later start of the easing process, it could negatively impact the dollar.

General Conclusions:

Based on the analysis conducted, the construction of a bearish wave set continues. Wave 2 or b has taken on a completed form, so I expect the further development of the impulsive downward wave 3 or c with a significant decrease in the pair. The unsuccessful attempt to break above the 1.1125 level, corresponding to the 23.6% Fibonacci, indicated the market's readiness for sales a month ago. I am considering selling with targets near the calculated level of 1.0462, corresponding to the 127.2% Fibonacci.

On a larger wave scale, we can see that the construction of corrective wave 2 or b continues, which is already more than 61.8% in length compared to the first wave. As I have mentioned, this is not critical, and the scenario of constructing wave 3 or c with a decline in the pair below the 1.04 level is still in effect.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română