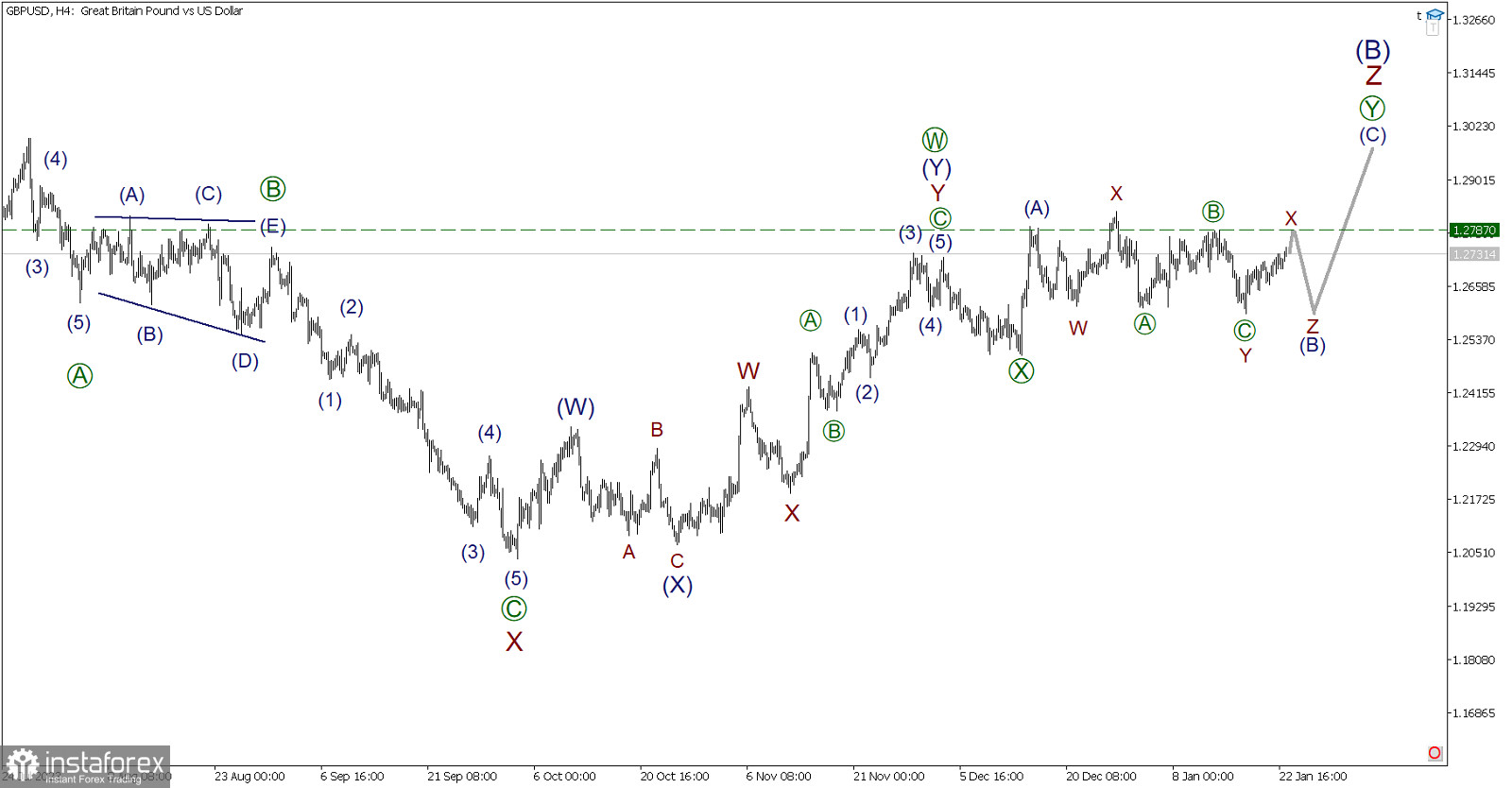

From a wave analysis point of view, an active wave [Y] is forming on the GBP/USD currency pair, which may complete a larger active wave Z. Wave [Y] consists of three parts—sub-waves (A)-(B)-(C). As of writing, the first impulse wave (A) appears to be fully completed, consisting of five sub-waves 1-2-3-4-5.

Following the completion of the impulsive growth, the market began to move horizontally within the correction (B). This correction has the structure of a triple three. In the last segment of the chart, we can observe a rise in the second wave of the X sequence.

The price increase in this wave may rise to the previous high, where the correction [B], part of the active wave Y, was completed. After reaching the level of 1.2787, market participants may expect a fall in the final active wave Z, as shown on the chart.

In the current situation, it is recommended to consider opening long positions.

Trading recommendations: Buy at 1.2731, take profit at 1.2787.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română