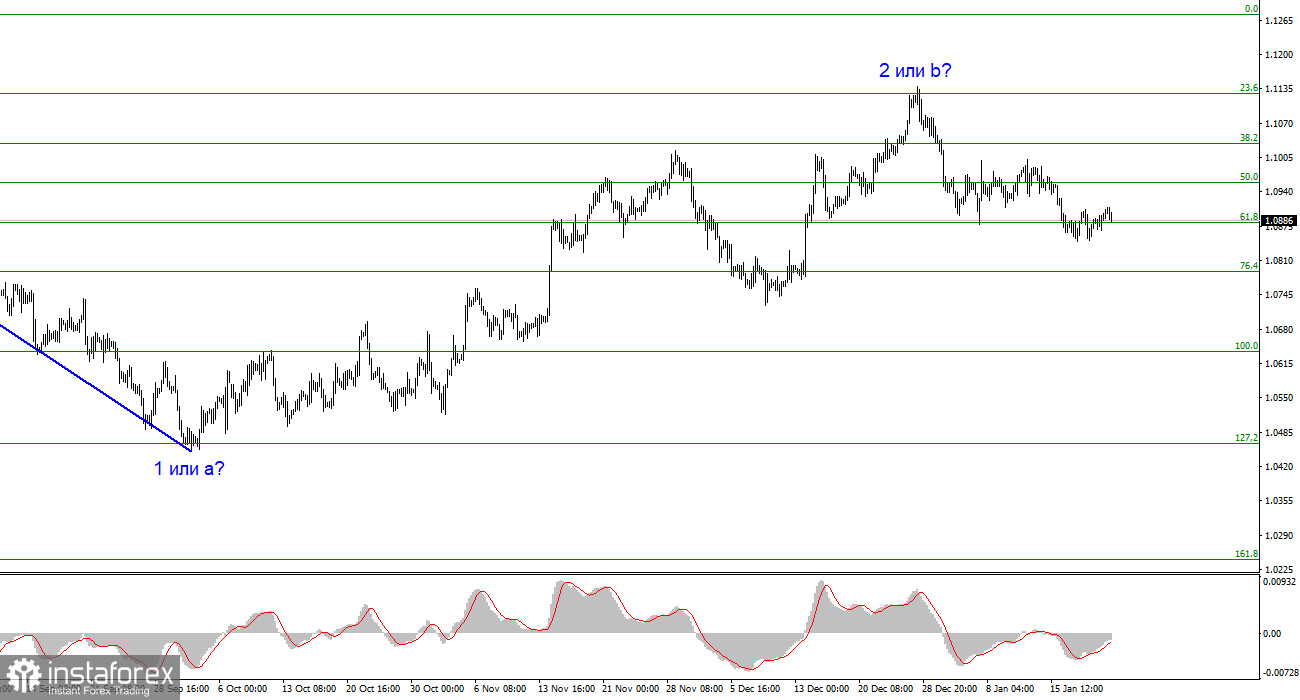

Demand for the euro is gradually decreasing, which I find pleasing. I would like to remind you that according to the current wave analysis, the EUR/USD instrument should move on to building a descending wave 3 or c, which is impulsive. This wave implies that the euro could at least fall to the 1.0449 level, where wave 1 or a have been built. Based on this, I expect the instrument to fall by at least 450 basis points.

Wave 3 or c can be extended, I have only mentioned its minimum size. Therefore, in 2024, the instrument could potentially return to price parity. However, its dynamics entirely depend on the central banks' actions this year.

At the moment, the market is not in a rush to sell the euro, although if you look more closely at the charts, it becomes clear that the euro is falling at approximately the same pace as it rose from October to December 2023. There is no need to expect that the pair would instantly fall by 100-200-300 points. The decline will be as gradual as the upward movement.

Meanwhile, European Central Bank President Christine Lagarde, who spoke for the fourth time in the last eight days, said that inflation in the European Union is still too high. The ECB is on the right path, but it is still too early to celebrate victory. According to Lagarde, inflation must reach a stable level of 2% before we can talk about victory. The ECB closely monitors wage data, profits, supply chains, and other indicators. Nobody is currently thinking about raising interest rates, as it would come as a shock for the economy.

The most significant statement was "the central bank is likely to cut interest rates this summer." I would like to remind you that several members of the ECB Governing Council have made a comment on interest rates, but almost all of them used vague wordings when it came to timing. "Too early," "too late," "not in the near future," "a bit later" - all of this does not explain when monetary easing will actually begin.

Nevertheless, we see that the ECB is on the path to lowering rates in the second quarter, which does not align with the market's initial expectations. Based on everything mentioned above, I still expect the euro to fall. Both wave analysis and the news background support this. The ECB meeting could further increase the market's confidence in the dovish scenario.

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b has taken on a completed form, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. An unsuccessful attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci retracement, suggests that the market is prepared to sell.

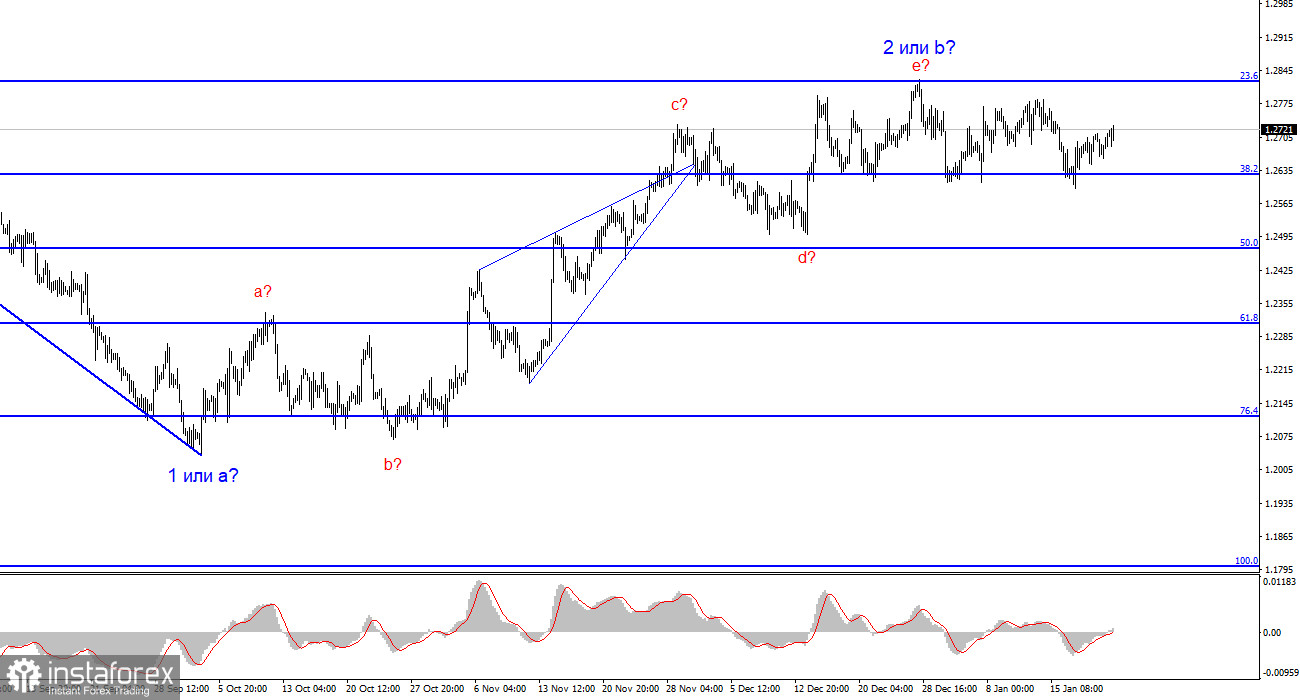

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. In fact, we are already seeing some signs of its end. However, I wouldn't rush to conclusions and short positions. I would wait for a successful attempt to break below the 1.2627 level, afterwards it will be much easier to expect the pair to fall further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română