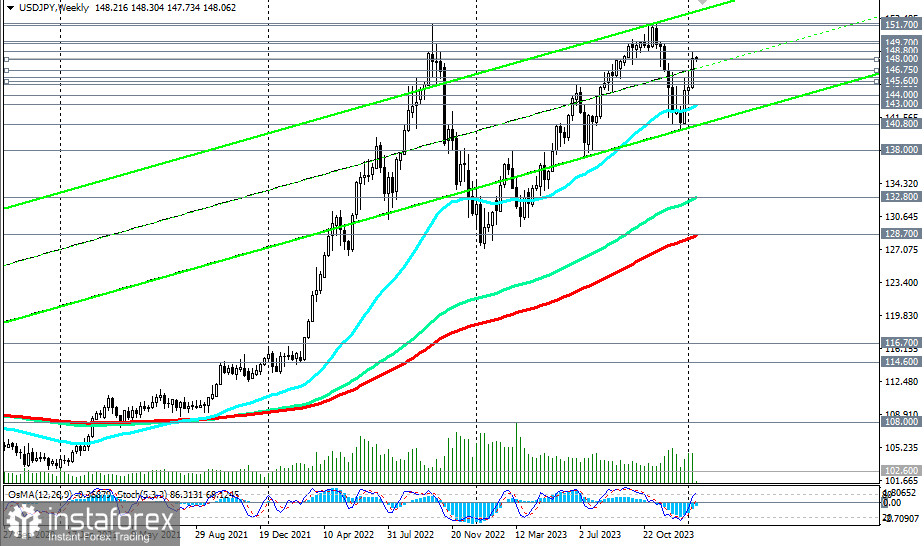

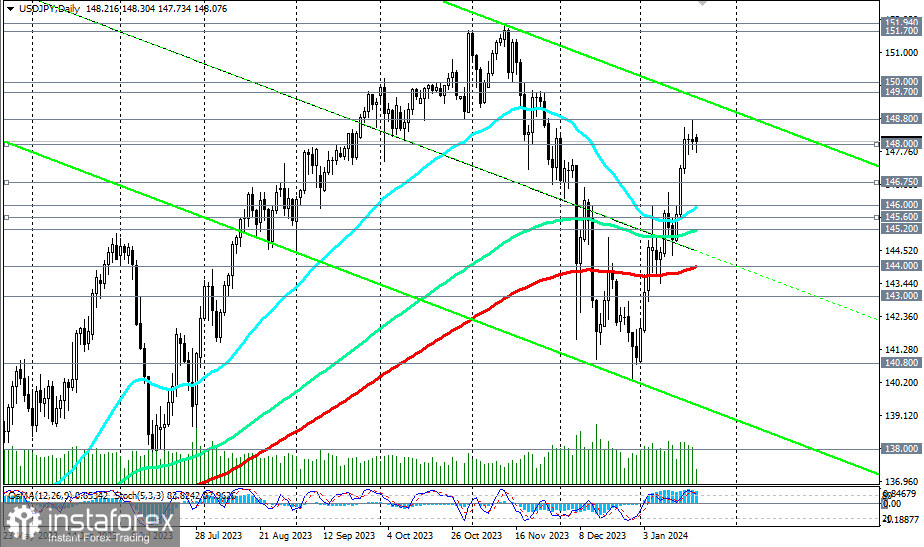

Having reached a local 5-month low at the level of 140.25 at the end of December, the USD/JPY pair completed a 2-month downward correction and, after breaking through the key resistance level of 144.00 (200 EMA on the daily chart), returned to the medium-term bullish market zone.

At the same time, it remains in the long-term bullish market zone, above the key support level of 128.70 (200 EMA on the daily chart).

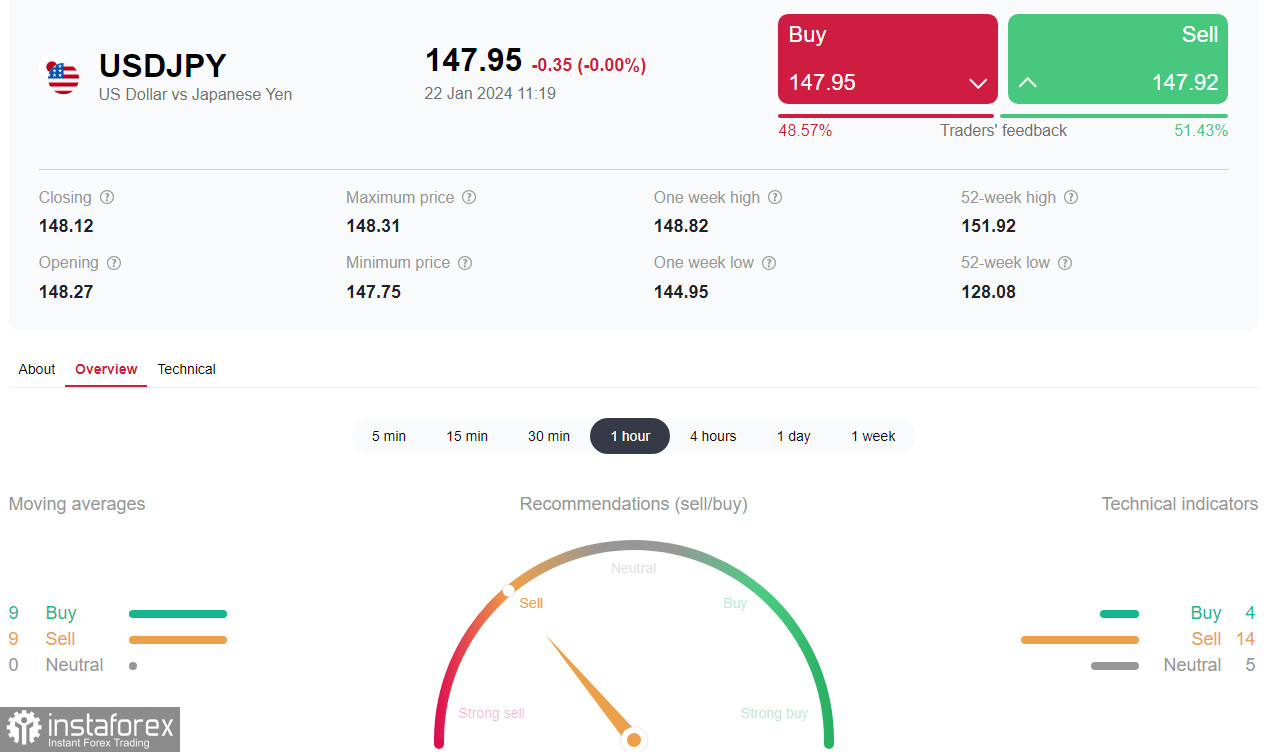

Considering expectations that the Bank of Japan will not yet decide on changes in favor of a more stringent monetary policy, the yen, in terms of the "carry trade" trading strategy, will remain vulnerable to the dollar.

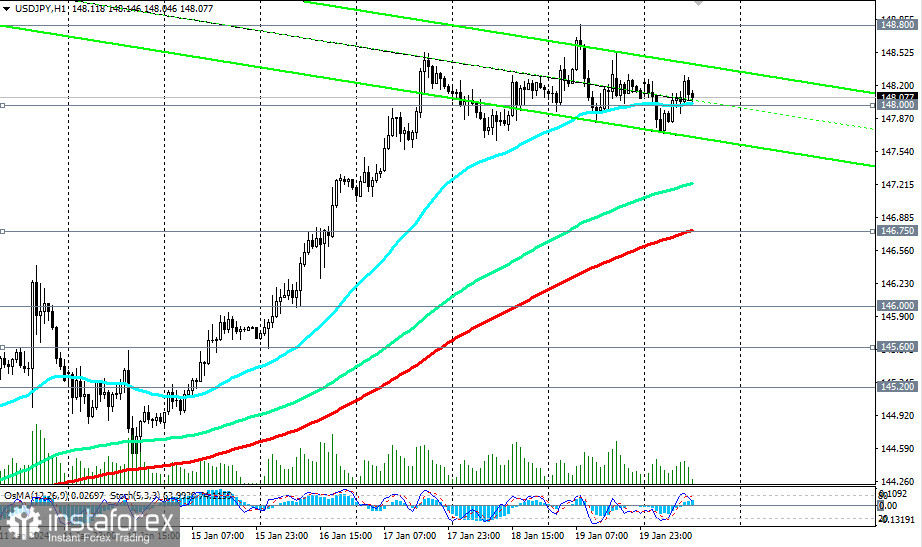

Breaking through the local high of 148.80, reached last Friday, may signal the accumulation of long positions with targets, at a low, at the psychologically significant mark of 150.00.

In an alternative scenario, breaking through the important short-term support level of 146.75 (200 EMA on the 1-hour chart) may be the first signal to open short positions, and breaking through important support levels of 146.00 (50 EMA on the daily chart), 145.60 (200 EMA on the 4-hour chart) will be the confirmation.

Breaking through the key support level of 144.00 will return USD/JPY to the medium-term bearish market zone, also reviving interest in short positions on the pair with the prospect of a decline to the zone of long-term support levels 132.80 (144 EMA on the weekly chart), 128.70 (200 EMA on the weekly chart) with intermediate targets at local support levels 140.80, 138.00.

Support levels: 148.00, 146.75, 146.00, 145.60, 145.20, 144.00, 143.00, 140.80, 138.00, 132.80, 128.70

Resistance levels: 148.80, 149.00, 149.70, 150.00, 151.00, 151.70, 151.95, 152.00, 153.00

Trading Scenarios

Main Scenario

Aggressive: Buy at market. Stop Loss 147.50

Moderate: Buy Stop 148.60. Stop Loss 146.90

Targets 148.80, 149.00, 149.70, 150.00, 151.00, 151.70, 151.95, 152.00, 153.00

Alternative Scenario

Aggressive: Sell Stop 147.50. Stop Loss 148.40

Moderate: Sell Stop 146.90. Stop Loss 148.60

Targets 146.75, 146.00, 145.60, 145.20, 144.00, 143.00, 140.80, 138.00, 132.80, 128.70

"Targets" correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but can serve as a guideline in planning and placing your trading positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română