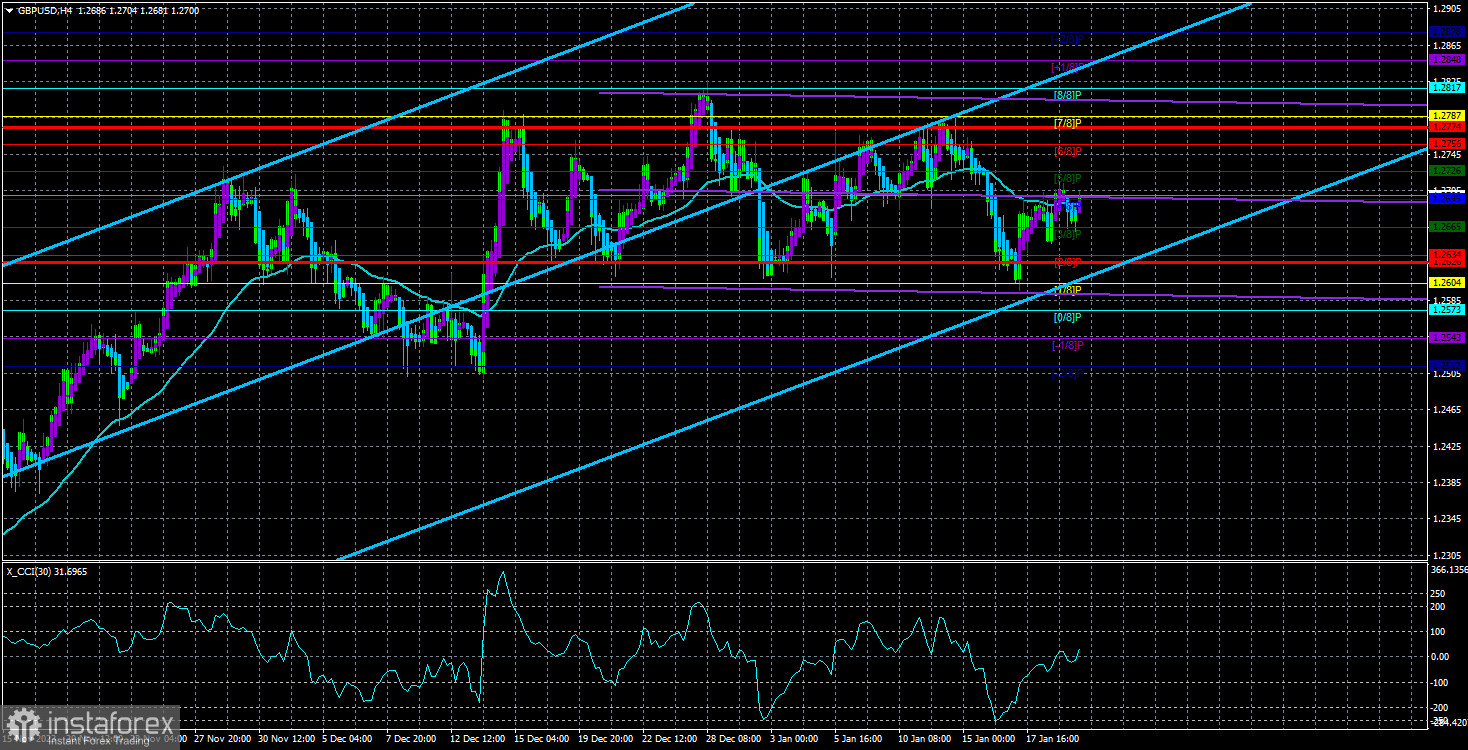

The currency pair GBP/USD was also practically immobile on Friday. However, this doesn't matter much, as the price has long been within a sideways channel, roughly between 1.2610 and 1.2787. The upper boundary of the channel has been tested three times, and the lower boundary five times. It's hard to say how long the pound will remain in this range. It's challenging for the British currency to show growth, as British statistics leave much to be desired. But it's also difficult for the dollar to rise, as the Bank of England will begin lowering its interest rate later than the Fed.

While there is a certain understanding that both central banks, the ECB and the Fed, may start reducing rates at roughly the same time, in the case of the Bank of England and the Fed, the gap could be much more significant. This fact supports the demand for the pound. Of course, the reasons for the flat can also be purely technical – there may be significant pending buy orders near the level of 1.2610, keeping the pair from falling, but the essence remains the same.

According to the latest information, the Bank of England will start lowering the key rate in August. Moreover, this expected reduction is so speculative that it cannot even be called a forecast based on concrete facts and macroeconomic indicators. Inflation in the UK is at 4%, so it's too early to lower the rate. Even thinking about it is premature. In December, inflation accelerated, and core inflation did not slow down. These indicators may be sufficient to lower them to at least 3% and 4% in six months. Then, we can talk about a softer monetary policy.

From our point of view, the pound has already reacted to all the "bullish" factors, so we expect it to fall in the medium term regardless. Even if the Bank of England starts easing its policy six months later than the Fed, it does not mean it will not lower the interest rate. Thus, the pound will also come under pressure sooner or later due to the rate cut in the UK. It doesn't matter when this happens because the fact remains the same: both central banks will implement monetary policy easing.

However, the market is sensitive to the temporary divergence between the Fed and the Bank of England. There are high chances of a pound decline below 1.2763 (61.8% Fibonacci on the 24-hour TF), but what is the point of these chances if the price cannot even drop below 1.2611? We need to wait for the end of the flat.

Recently, we have talked about the "head and shoulders" pattern, which was supposed to mark the beginning of a new downtrend. But even this pattern makes no sense right now, as the pound still cannot overcome the nearest level of 1.2611. Therefore, we should only rely on the sideways channel that we have. When the price exits, we can discuss the dollar and pound prospects.

We believe the pound is still significantly overbought, but the market is not expecting any "dovish" signals from the Bank of England soon. However, the first meeting of 2024 will take place next week. Andrew Bailey may provide new, important information, allowing us to leave the flat.

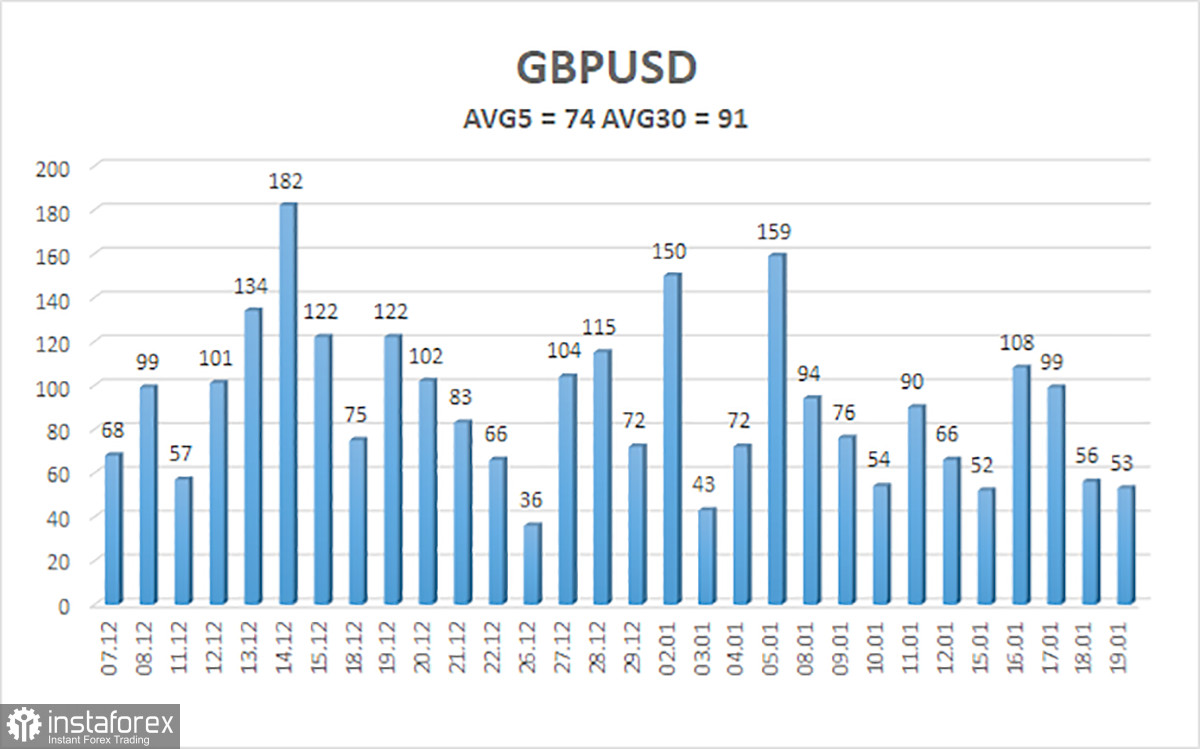

The average volatility of the GBP/USD pair over the last five trading days as of January 21st is 74 points. For the pound/dollar pair, this value is considered "average." Therefore, on Monday, January 22nd, we expect movement between 1.2626 and 1.2774. A downward reversal of the Heiken Ashi indicator will indicate a new attempt to start a downtrend.

Nearest support levels:

S1 – 1.2665

S2 – 1.2634

S3 – 1.2604

Nearest resistance levels:

R1 – 1.2695

R2 – 1.2726

R3 – 1.2756

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both point in the same direction, the trend is currently strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will trade over the next day based on current volatility indicators.

CCI indicator - its entry into the overbought zone (above +250) or oversold zone (below -250) indicates an impending trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română