EUR/USD

The markets reaffirmed their commitment to risk-taking on Friday, with the S&P 500 setting a new all-time high, a level not seen since January 2022. The US dollar index fell by 0.24%, while the euro gained a modest 22 pips. However, we do not expect a prolonged interest in risk, primarily due to geopolitical tensions in the Middle East and Taiwan. A market downturn could occur suddenly and significantly at that.

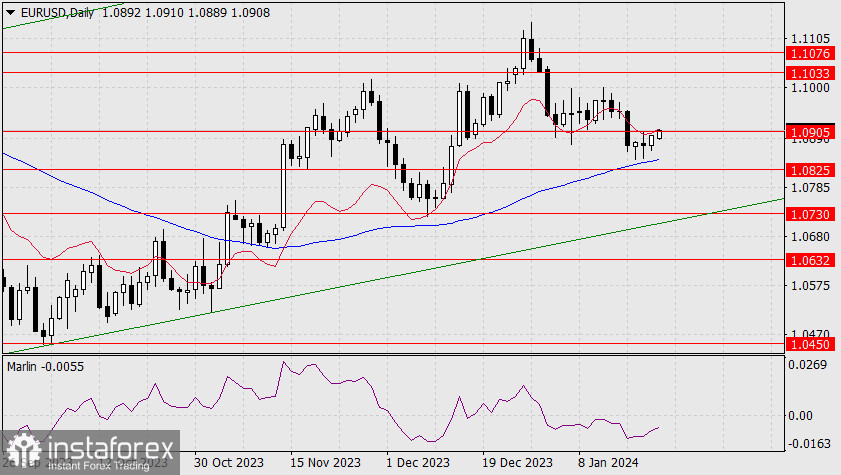

At the moment, the euro is trying to break through the resistance at 1.0905 and along with it the balance indicator line, which would make it possible for the price to reach the target levels of 1.1033 and 1.1076 (the high from April 14, 2023). The Marlin oscillator has gained strength on the daily timeframe, moving towards the border of the uptrend territory.

On the 4-hour chart, the Marlin oscillator has moved into the bullish territory. The only thing left to do is for the price to settle above 1.0905, which would also be a move above the MACD indicator line, and then the price could continue to rise.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română