Forecasts for inflation in 2024 are as uncertain and vague as interest rate predictions. Making forecasts is much easier during calm times, as many key indicators hardly change. However, in the past few years, we have seen many ups and downs caused by geopolitical conflicts and the coronavirus. Central banks have tried to fix the situation and bring the economy back to normal. But even now, when they have almost achieved the goal, making forecasts for the year ahead is like fortune-telling.

It's easy to assume that inflation will continue to fall, and it's likely that it will. But at what cost, and at what rate? These are very difficult questions to answer. Monetary policies of the European Central Bank, the Federal Reserve, the Bank of England, and other central banks depend on reports that address these questions. Therefore, I personally adhere to the view that there is no need to rush into anything. "Take things easy and think before doing them." We can see that the demand for the dollar is not increasing, even though the wave analysis of both instruments suggests such a scenario.

The market continues to draw conclusions based on its own assumptions. There are many opinions on how the situation with inflation and interest rates will progress, and it is clear that many analysts could turn out to be wrong. Goldman Sachs CEO David Solomon warned that inflation could remain more stubborn than expected. This means that the Fed may keep the interest rate at its peak level longer than currently anticipated. This is good news for the dollar, but at the same time, the U.S. economy will remain under pressure from monetary policy. Goldman Sachs expects the U.S. economy to avoid a big slowdown this year. Based on this, the dollar may still receive support.

However, everything doesn't only depend on the Fed and US inflation. The interest rate in the UK will remain high for a long time, which may continue to prevent the dollar from rising against the pound for some time. The situation with the euro is a bit simpler, but we can still expect some surprises. You may consider short positions on the euro at the moment, while it is advisable to wait for a break above the 1.2627 level in regards to the pound.

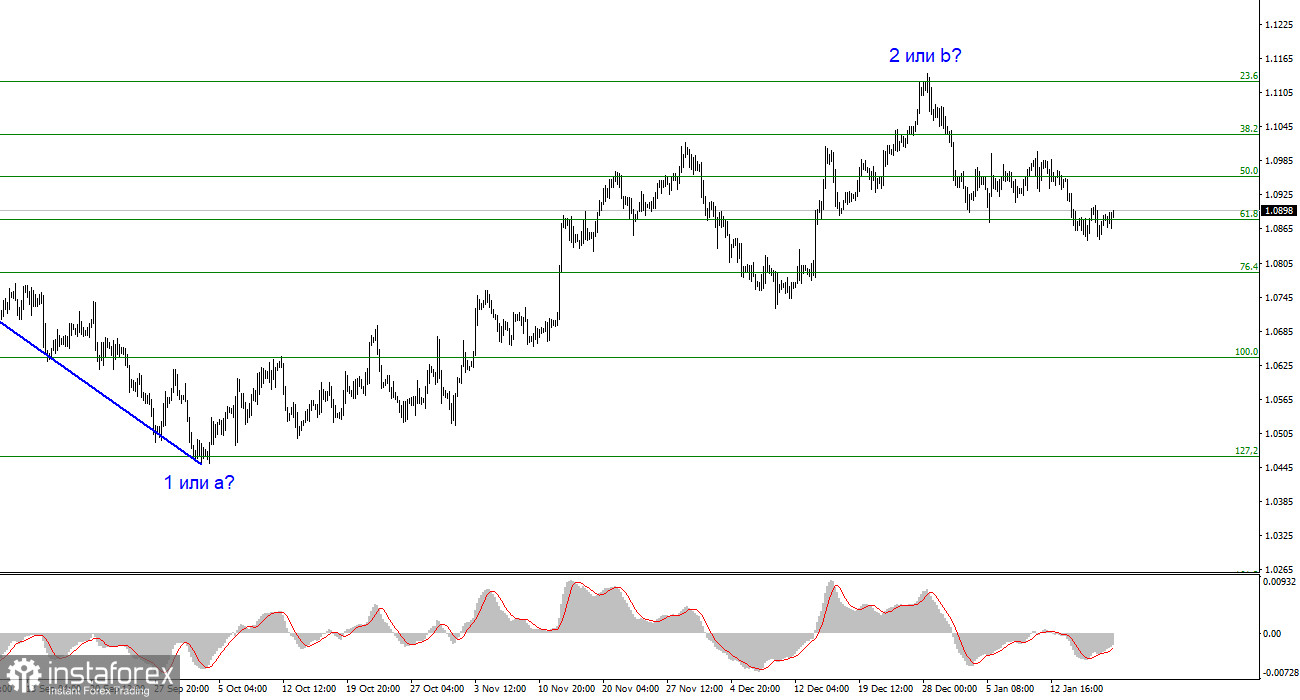

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b has taken on a completed form, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. An unsuccessful attempt to break above the 1.1125 level, which corresponds to the 23.6% Fibonacci retracement, suggests that the market is prepared to sell. I am currently considering short positions.

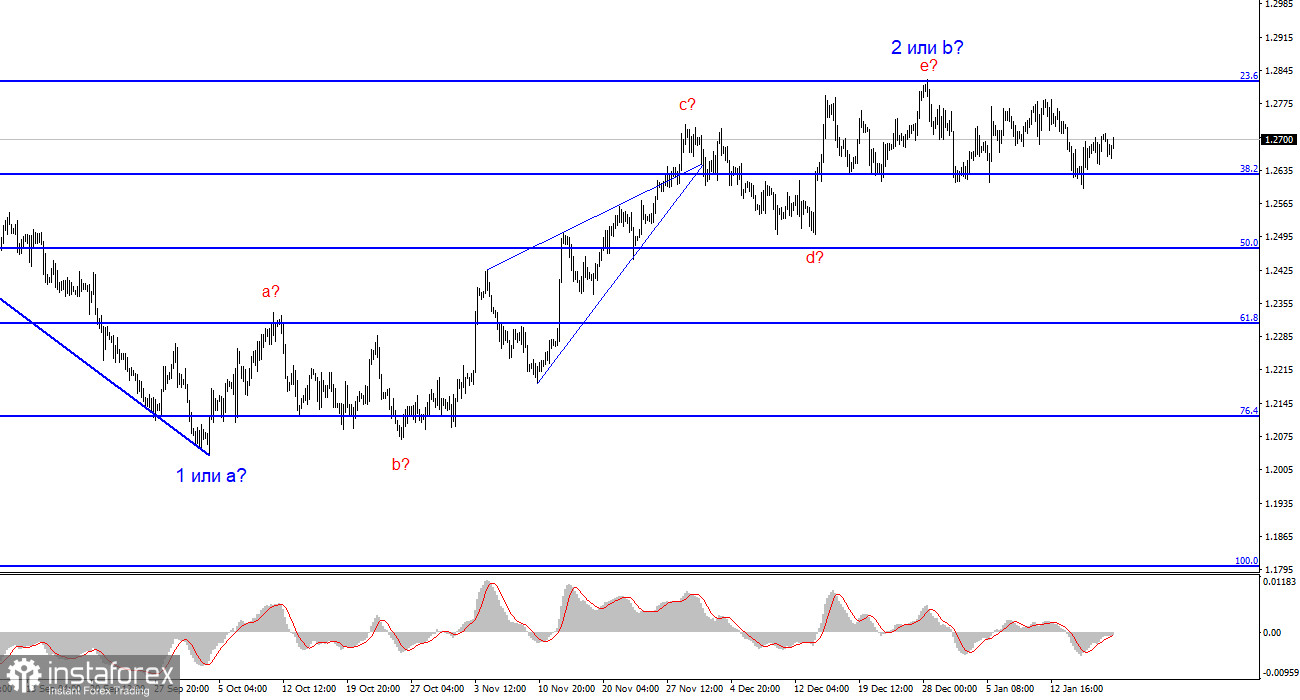

The wave pattern for the GBP/USD pair suggests a decline. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. In fact, we are already seeing some signs of its end. However, I wouldn't rush to conclusions and short positions. I would wait for a successful attempt to break the 1.2627 level, afterwards it will be much easier to expect the pair to fall further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română