Investors will be keeping an eye on the release (at 15:00 GMT) of the preliminary Consumer Sentiment Index from the University of Michigan on Friday. An increase in the index is expected in January to 70 from December's 69.7, which could give a short-term boost to the U.S. dollar.

The following week will "open" with meetings of the Central Banks of China and Japan. On Tuesday (at 21:45 GMT), the Statistics New Zealand will publish the Consumer Price Index for the 4th quarter.

As is well known, the CPI is a key indicator of inflation, reflecting the dynamics of retail prices for a basket of goods and services.

Previous CPI values: +1.8% (+5.6% YoY) in the 3rd quarter of 2023, +1.1% (+6.0% YoY) in the 2nd quarter of 2023. The forecast suggests a decrease in the 4th quarter to +0.6% (+4.7% YoY), which could negatively impact the NZD. On the other hand, inflation in the country still remains high, significantly above the target range of 2–3%, which could lead the Reserve Bank of New Zealand to maintain high interest rates for an extended period. This is a positive factor for the NZD.

Following the meeting at the end of November, the Reserve Bank of New Zealand's leaders kept the interest rate unchanged at 5.50%, the 5th consecutive neutral decision. In their accompanying statement, they mentioned the possibility of further rate hikes if needed to achieve the inflation target of 2.0%–3.0%.

Speaking at a press conference after the meeting, Reserve Bank of New Zealand Governor Adrian Orr stated that "the risk to inflation still remains elevated," adding that "it's convenient to wait until the February meeting." This meeting is scheduled for February 27th.

Investors are also continuing to monitor news regarding the geopolitical situation in the Middle East. Commodity prices, stock indices, and the quotes of commodity currencies are highly sensitive to sudden changes in geopolitics. A new escalation of the conflict in Gaza or a new exchange of strikes between the U.S. and the Houthi rebels could trigger renewed interest in buying the safe-haven dollar. It is not excluded that Monday may open with another gap in such a scenario.

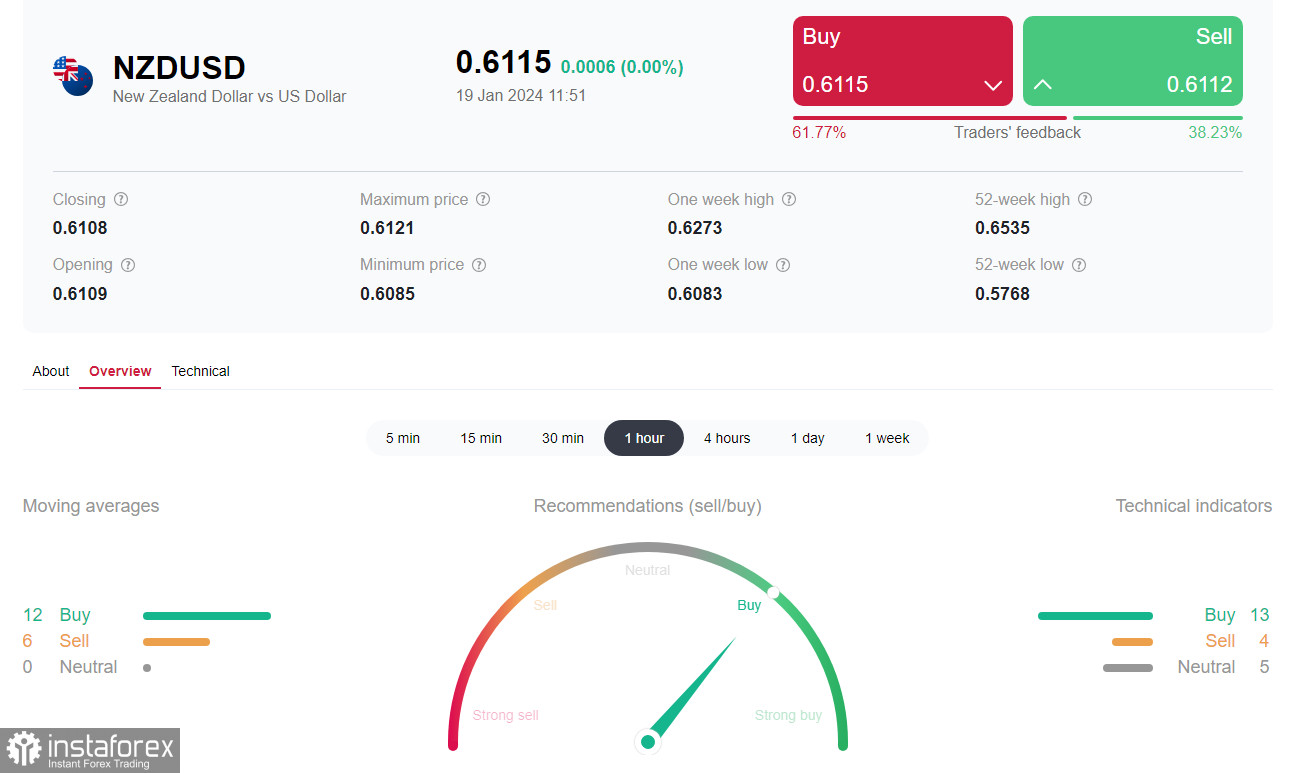

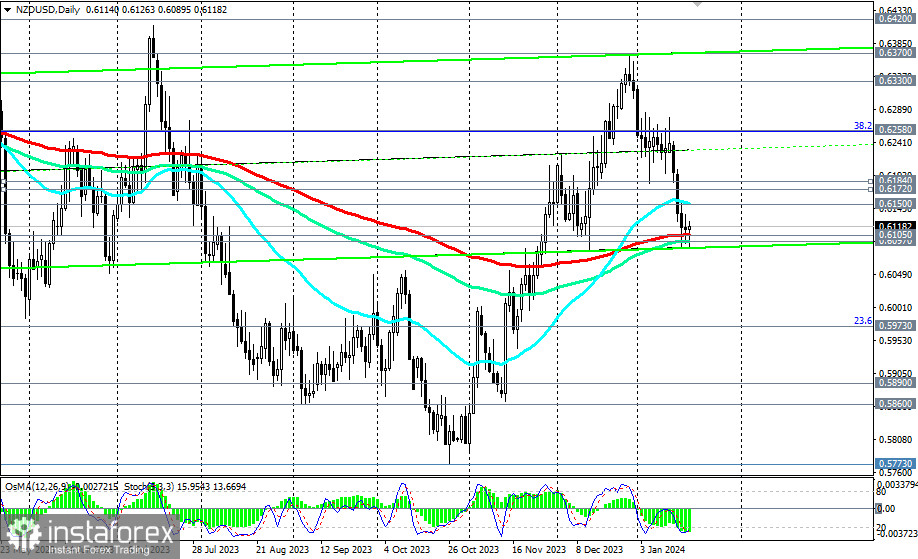

From a technical standpoint, despite a 10% rise to the 0.6370 level from the local low of 0.5773 reached at the end of October, NZD/USD remains in a long-term bearish zone. To break into the long-term bullish zone, the price needs to overcome key resistance levels at 0.6400, 0.6420, and 0.6485. However, a break below the 0.6100 level could trigger a new wave of decline for the pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română