GOLD

Higher Timeframes

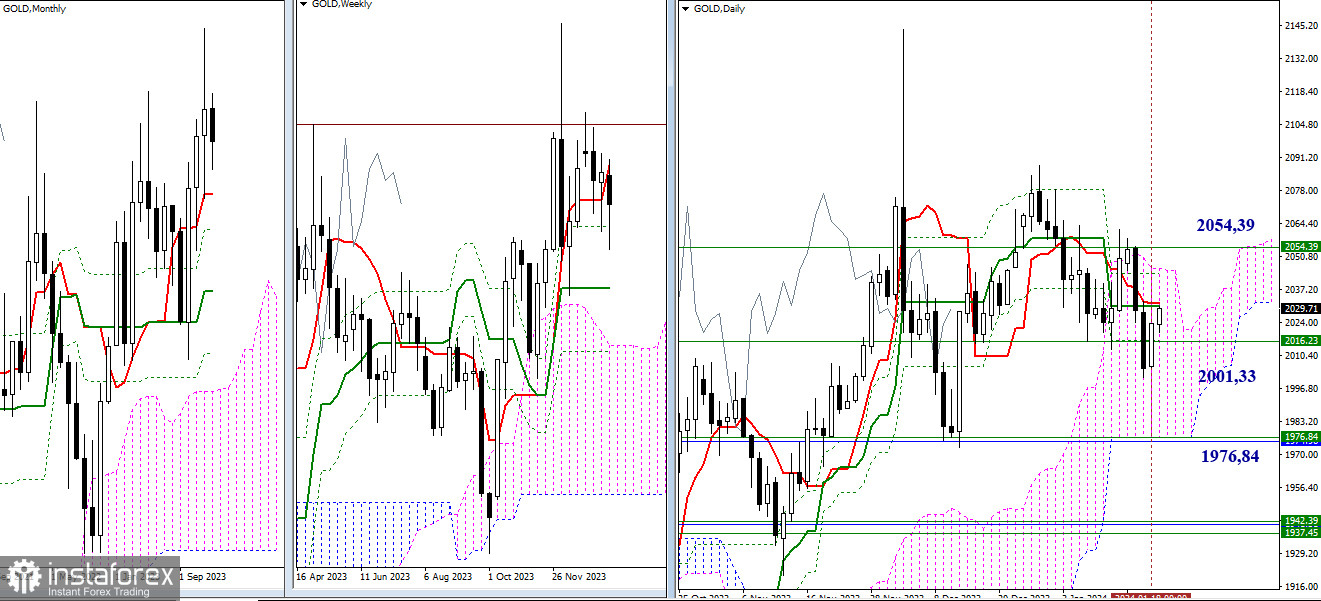

The corrective decline in the past day was somewhat halted. Gold recovered above the 2016.23 level (weekly + daily Fibonacci Kijun). Now, in order to continue regaining positions and strength, buyers need to rise and overcome the resistances of the daily Ichimoku cross (2030.27 - 2031.53 - 2043.89) and the weekly short-term trend (2054.39). Only after securing a position in the bullish zone relative to the daily Ichimoku cloud and gaining support from the weekly short-term trend will gold be again capable of focusing on updating historical highs (2087.97 – 2143.74). However, if the current recovery of positions does not develop, and bears return to the market, continuing the decline (2001.33), then the tasks of bears will focus on gaining support of the monthly short-term trend (1976.84) and the weekly medium-term trend (1976.84). Note that simultaneously with this, gold will leave the daily cloud, forming a bearish target.

H4 – H1

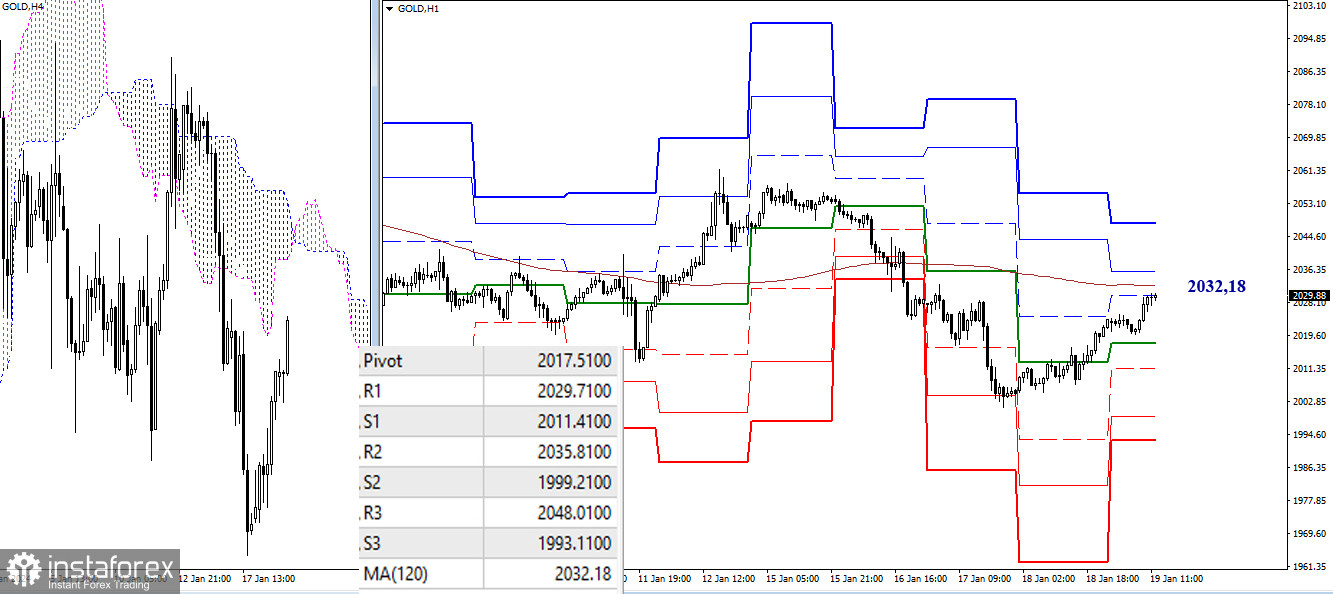

A prolonged corrective rise on the lower timeframes has led to the pair being ready to test the strength of the weekly long-term trend (2032.18). Possession of this level determines the main advantage for buyers on the lower timeframes. Trading above the weekly trend will strengthen the possibilities for bulls. Their targets within the day will be the resistances of classic pivot points, which today are located at 2035.81 (R2) and 2048.01 (R3). A rebound will maintain the main advantage on the side of the bears. New strengthening of bearish sentiments is now possible through testing and passing the supports of classic pivot points, currently located at 2017.51 – 2011.41 – 1999.21 – 1993.11.

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română