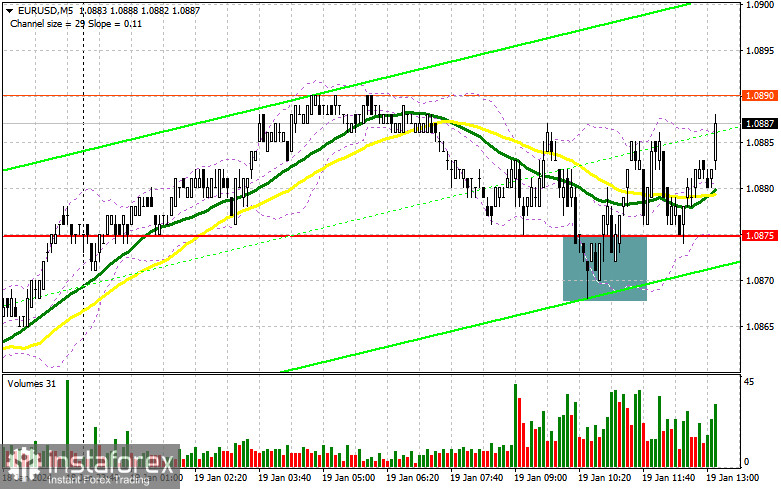

In my morning forecast, I emphasized the level of 1.0875 and planned to make market entry decisions based on it. Let's take a look at the 5-minute chart and analyze what happened there. The decline and the formation of a false breakout around 1.0875 led to an excellent buying entry point in continuation of yesterday's trend. However, at the time of writing this article, the pair has only moved up about 10 points from the entry point. Hopefully, the signal will perform much better in the second half of the day. The technical picture has not changed for the American session.

For opening long positions on EUR/USD, the following is required:

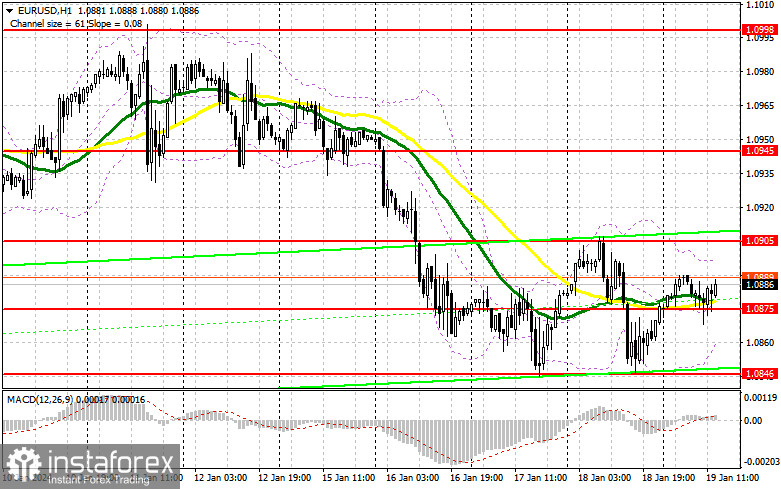

The German data did not have a significant impact on the euro, although buyers managed to show themselves. Now, the focus will shift to reports on existing home sales, the University of Michigan Consumer Sentiment Index, and inflation expectations. It's important to understand that if inflation expectations rise in the United States, we might see a repeat of yesterday's scenario with a support breakdown. For today, that level is 1.0875, but it has already been tested once, so be cautious when making decisions. I prefer to act, as in the morning, on a decline after the formation of a false breakout around 1.0875. If this level fails to hold, similar to what I discussed earlier, it would be a suitable entry point for a market entry, with an upward movement towards 1.0905. Only a breakout and a renewed test from top to bottom of this range after weak U.S. statistics would be a suitable condition for buying with further upward correction and a prospect of reaching 1.0945. The ultimate target would be the high at 1.0998, where I will take profit. In the case of a decline in EUR/USD and the absence of activity at 1.0875 in the second half of the day, pressure on the pair will increase. In such a scenario, I plan to enter the market only after the formation of a false breakout around 1.0846. I will consider opening long positions after a rebound from 1.0817 with a target of a 30-35 point intraday upward correction.

For opening short positions on EUR/USD, the following is required:

Bears still have a chance for a euro decline, but strong U.S. data and a sharp rise in inflation expectations are necessary for this, as secondary labor market data is unlikely to lead to a surge in volatility. The entry point would be the formation of a false breakout around 1.0905, indicating the presence of sellers in the market and the potential for a new downward movement to around 1.0875. Missing this area would pose problems for buyers. After a breakout and consolidation below 1.0875, as well as a retest from bottom to top, I expect to receive another selling signal with a target of 1.0846. The ultimate target would be the low at 1.0817, where I will take profit. In the case of an upward movement of EUR/USD in the second half of the day and the absence of bears at 1.0905, demand for EUR/USD will increase, potentially offsetting losses incurred earlier in the week. In such a case, I will postpone selling until testing the next resistance at 1.0945. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions on a rebound from 1.0998 with a target of a 30-35 point downward correction.

Indicator signals:

Moving averages:

Trading is carried out around the 30 and 50-day moving averages, indicating a sideways market.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator at 1.0860 will act as support.

Indicator Descriptions:

- Moving Average (MA): Period 50. Marked in yellow on the chart.

- Moving Average (MA): Period 30. Marked in green on the chart.

- Moving Average Convergence/Divergence (MACD): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

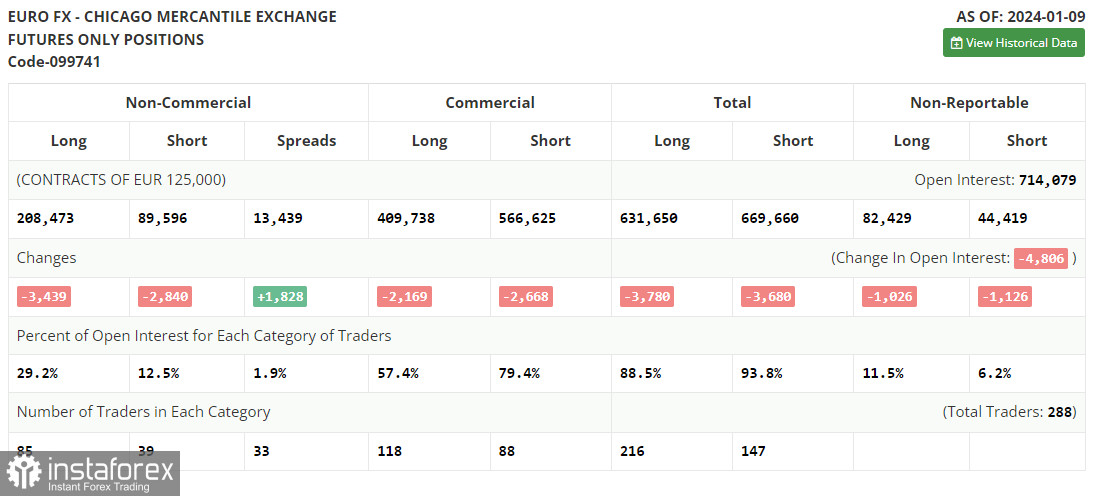

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română