It seems that one overlooked fact is that at the beginning of the year, the market had not yet fully accelerated, and many investors who had fixed their positions at the end of last year had not yet been able to establish new ones. This means that we are in conditions akin to a thin market, and even the dollar's strengthening over a couple of days, not particularly large in scale, could have led to local overbuying. This is indicated by the illogical market reaction to the American macroeconomic statistics.

Despite extremely positive data, the dollar was losing its positions. Specifically, the pace of growth in retail sales accelerated from 4.0% to 5.6%, whereas a slowdown from 4.1% to 4.0% was expected. Meanwhile, the pace of decline in industrial production at -0.6% shifted to a growth of 1.0%, although forecasts suggested it should have merely slowed down from -0.5% to -0.1%.

If this assumption is correct, then it is difficult to forecast anything today, as the market situation is such that it can behave almost any way it wants. Relying on jobless claims is probably not advisable due to their extremely minor changes. The total number of claims will likely increase by 4,000. Of course, they should not be completely ignored, but action should only be taken based on actual data, as the figures could differ significantly from the forecasts.

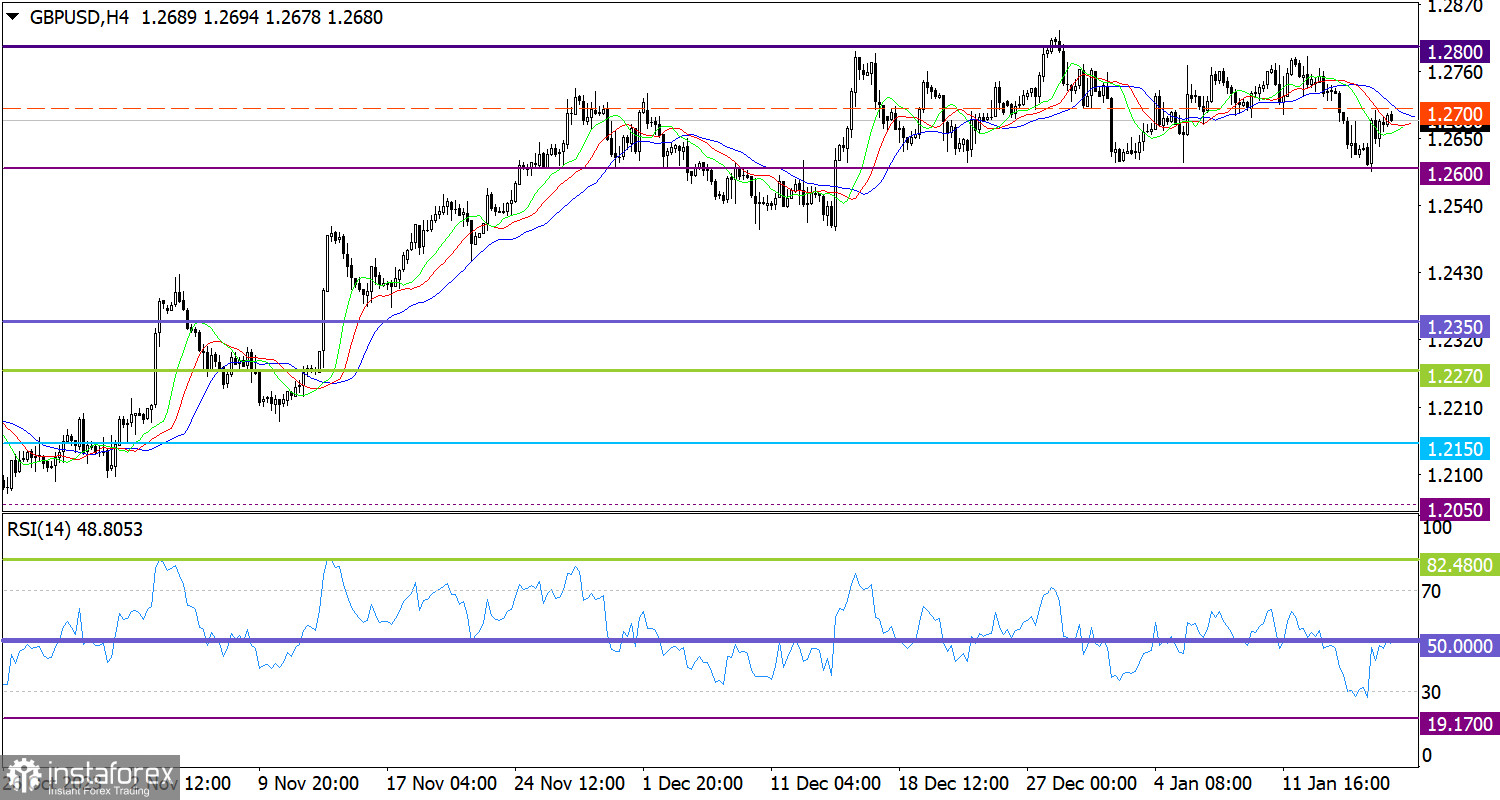

The GBP/USD currency pair bounced off the lower boundary of the sideways channel 1.2600/1.2800 with surgical precision. As a result, there was an increase in the volume of long positions on the British pound, which led the quote to return to the average level of the flat at 1.2700.

On the four-hour chart, the RSI is similarly moving in the same cycle, in accordance with the price fluctuation within the flat. Initially, we saw the touch of the oversold level at 30, followed by a rebound to the average level of 50.

On the same time frame, the Alligator's MAs are moving in accordance with the boundaries of the price channel. There is no deviation at this stage.

Outlook

In this situation, trading within the boundaries of the sideways channel continues. The strategy based on the method of price bouncing off one or another boundary of the flat remains relevant among market participants. However, note that a flat is only a temporary manifestation of the market, which leads to the accumulation of trading forces. Eventually, impulsive price jumps will occur, leading to its conclusion and indicating the subsequent movement in the market. For this reason, it is always worth considering a strategy based on breakout tactics.

The comprehensive indicator analysis in the short-term and intraday periods indicates an upward trend in the structure of the channel.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română