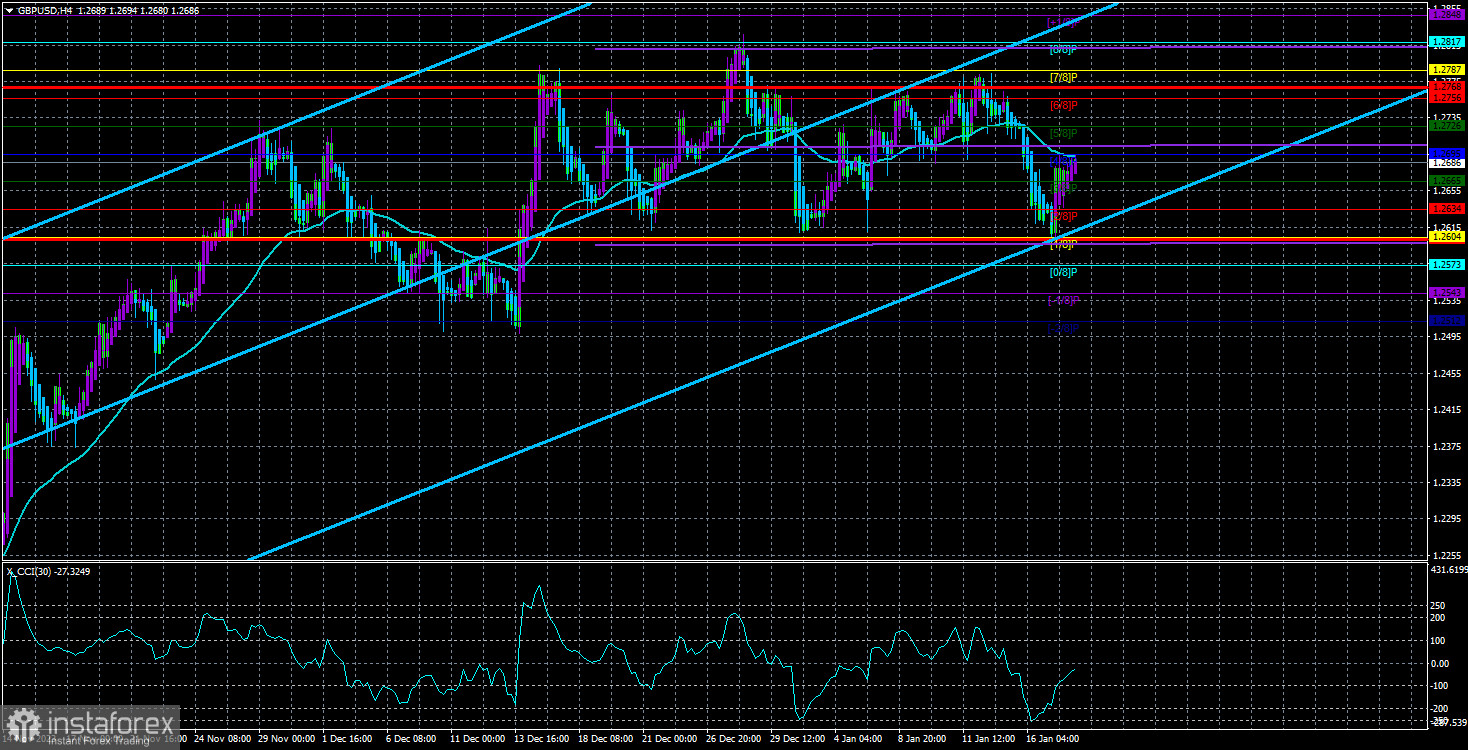

The GBP/USD currency pair attempted to break out of the sideways channel of 1.2611-1.2787 on Wednesday, but these plans were again thwarted. Yesterday, it was not the technical picture that hindered this breakout (specifically, the sideways channel from which it is always difficult to break free) but rather the macroeconomic background. In the UK, another inflation report was released (for December), which showed that prices accelerated in their growth to 4.0%. At the same time, core inflation remained at 5.1%, showing no signs of slowing down.

What do these figures mean? Only the Bank of England has slightly fewer reasons to begin easing its monetary stance. Although inflation for 2023 decreased more than Andrew Bailey had expected, it is still too early to talk about victory over high prices. Thus, the British regulator will have to keep the rate at its peak for a longer period, which supported the British currency yesterday.

Even with a longer hold of the rate at its maximum value, the pound has already exhausted its growth factors. The British currency has not been growing in the past month, although it has been on an upward trend for three months overall. We consider all recent movements to be correction. Unfortunately, the market's attitude towards the dollar and the pound has not changed despite receiving many sell signals recently.

The "head and shoulders" pattern has formed, but what matters if the price cannot break out of the sideways channel? Four overbought conditions of the CCI indicator have long predicted a decline in the British currency, but what do they matter if the market refuses to sell the pound?

Therefore, we can only wait for the price to break out of the range of 1.2610–1.2787. Until that happens, it's pointless to speculate on the pound's near-term dynamics. In the 24-hour timeframe, the pound failed to overcome the important Fibonacci level of 61.8%, which gives grounds to expect a decline in quotes. But it should start soon in this case, as the flat has clearly dragged on.

However, the dollar will also need strong support to overcome the "concrete" level of 1.2610. This week, there are very few macroeconomic publications in the United States and the United Kingdom. And those that could break the pair out of the month-long sideways channel are absent altogether.

Today in America, reports on housing starts, building permits issued, and initial jobless claims will be released. In the UK, retail sales data will come out tomorrow, while in the United States, the University of Michigan Consumer Sentiment Index and new home sales will be reported. All these reports are only capable of causing a local reaction and cannot affect the overall market sentiment.

Thus, the British pound remains overbought and unreasonably expensive, but more is needed to start a decline. Today, we may already observe a new rise in the British currency, as it has rebounded from the lower boundary of the sideways channel. This means that there is no need for growth reasons for the pair at the moment. In a sideways channel, prices usually move from one boundary to another. Therefore, the pound may return to the level of 1.2787 for the fourth time soon.

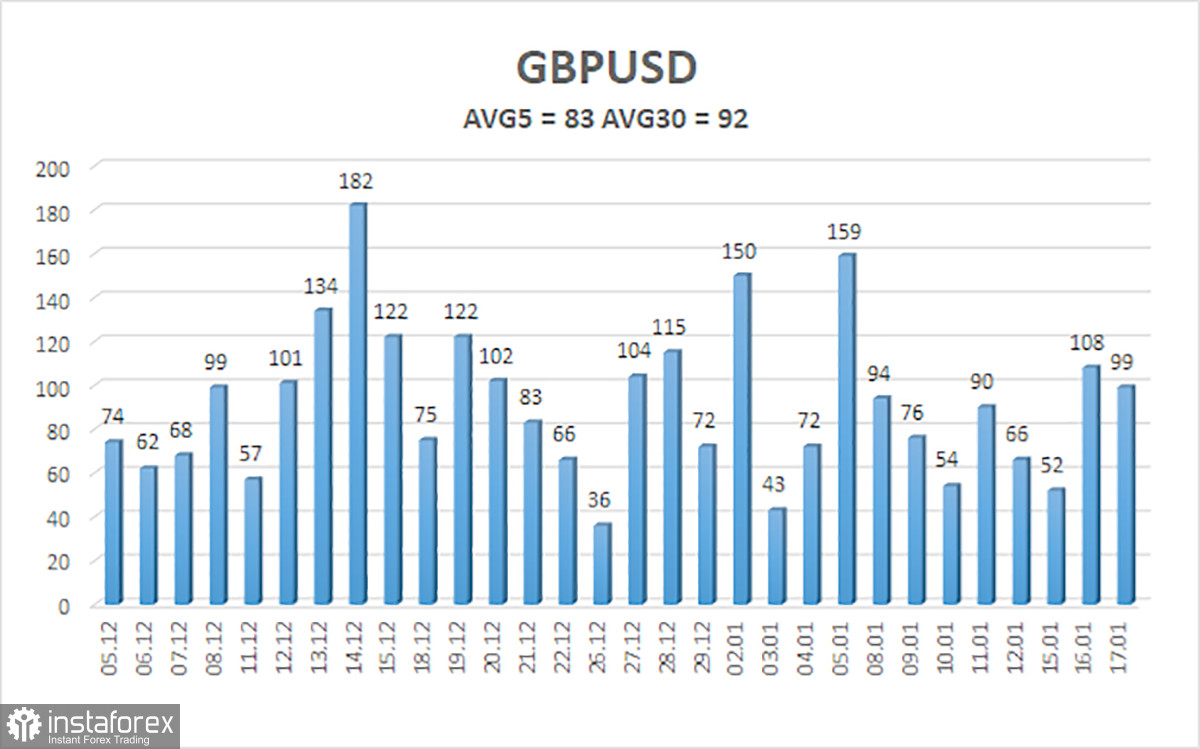

The average GBP/USD pair volatility for the last five trading days as of January 18th is 83 points. For the pound/dollar pair, this value is considered "average." Thus, on Thursday, January 18th, we expect movement within the range limited by the levels of 1.2602 and 1.2768. A downward reversal of the Heiken Ashi indicator will indicate a new attempt to start a downtrend.

Nearest support levels:

S1 - 1.2665

S2 - 1.2634

S3 - 1.2604

Nearest resistance levels:

R1 - 1.2695

R2 - 1.2726

R3 - 1.2756

Trading recommendations:

The GBP/USD currency pair has settled below the moving average line, so it has a chance for a new return to the lower boundary of the sideways channel at 1.2610. We still need help considering buying the British pound now, as its growth is illogical. Therefore, it seems more reasonable to consider short positions with targets at 1.2634 and 1.2604. However, yesterday, the price bounced off the infamous level of 1.2610, so there are reasons to expect growth to 1.2787. The price is in a sideways channel and moves between its boundaries.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. The trend is currently strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold territory (below -250) or the overbought territory (above +250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română