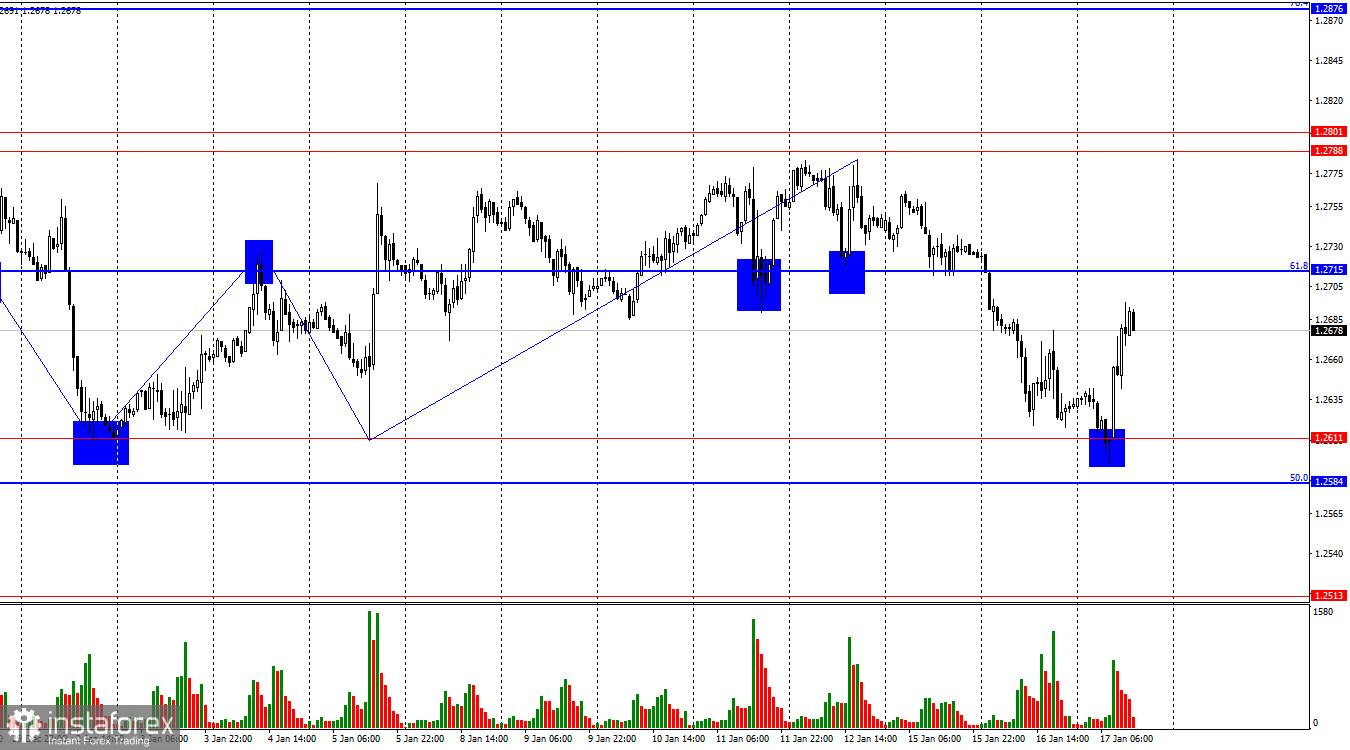

On the hourly chart, the GBP/USD pair experienced a decline to the support zone of 1.2584–1.2611 on Wednesday, bounced off it, reversed in favor of the British pound, and began rising towards the corrective level at 1.2715. A bounce from this level could again favor the US dollar, leading to a return to the zone of 1.2584–1.2611. If quotes consolidate above the level of 1.2715, it will support further growth towards the resistance zone of 1.2788–1.2801. Horizontal movement persists, with neither bulls nor bears holding the advantage.

The wave situation remains very ambiguous. Trends are quite short-term, and we often see single waves. Bullish sentiment among traders continues due to the absence of a decline in the British pound. The recent downward wave failed to break the 1.2611 level, around which the lows of all previous waves are located. The recent upward wave also failed to breach the important zone of 1.2788–1.2801 for the bullish trend to develop. Thus, the sideways movement persists until the pair exits the range of 1.2584–1.2801.

The information background on Tuesday was of moderate strength in the UK. Reports on unemployment, earnings, and jobless claims were released. These reports caused the pair to fall almost to the lower line of the sideways channel. However, today in the UK, the inflation report for December was released, showing an increase rather than the expected decrease, as traders had anticipated.

The rise in the consumer price index suggests that the Bank of England's stance will unlikely shift towards a more "dovish" one soon. This factor allowed the British pound to show growth once again. However, this growth does not hold much significance as the horizontal channel remains unchanged, within which the British pound has been moving for several weeks. Within this channel, the pound can move as it pleases, and this does not alter the trend (or rather its absence).

On the 4-hour chart, the pair has retreated to the Fibonacci level of 61.8% (1.2745) and bounced off it. This rebound again favored the US currency, leading to a decline towards 1.2620. On the 4-hour chart, the horizontal movement between the levels of 1.2620 and 1.2745 is visible. There are no emerging divergences among any indicators today, and the upward trending channel has been abandoned. The trend may continue to shift towards a "bearish" one, but it will take time and require significant efforts from the bears, especially a close below the 1.2620 level.

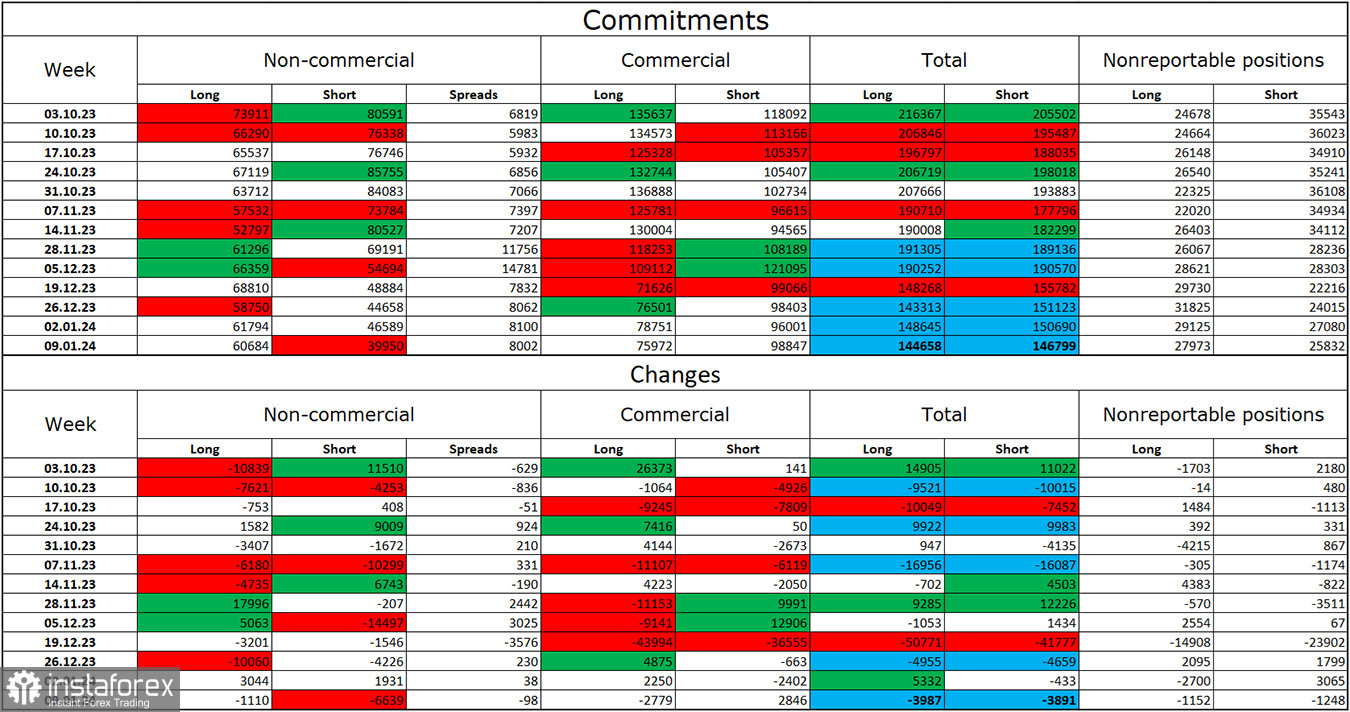

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category changed in favor of the bulls during the last reporting week. The number of long contracts held by speculators decreased by 1110 units, while the number of short contracts decreased by 6639. Currently, bulls have a slight advantage, even though a few months ago, the overall sentiment of major players shifted towards a "bearish" one. There is a gap between the number of long and short contracts: 60,000 versus 39,000, but the gap is small and almost unchanged.

The British pound still has excellent prospects for a decline. Over time, the bulls will continue to get rid of their buy positions, as all possible factors for buying the British pound have already been played out. The growth we have seen in the last three months is corrective. The bulls have been unable to push the 1.2745 level for over a month.

News Calendar for the US and UK:

UK – Consumer Price Index (07:00 UTC).

US – Retail Sales (13:30 UTC).

US – Industrial Production (14:15 UTC).

On Wednesday, the economic events calendar includes an important inflation report (already released) and two moderately significant reports in the US. The impact of the information background on market sentiment for the remaining part of the day will be weak.

GBP/USD Forecast and Trader Recommendations:

Selling the British pound was possible around the zone of 1.2788–1.2801 on the hourly chart with a target of 1.2611. New sales could occur on a bounce from the level of 1.2715 or a close below the zone of 1.2584–1.2611. Buying the British pound was possible for a rebound from the zone of 1.2584–1.2611 with a target of 1.2715.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română