What is more important for the U.S. dollar? The Federal Reserve or Donald Trump? Deutsche Bank warns that much of the Fed's monetary policy easing has already been factored into the dollar pair quotes. It will be difficult for EUR/USD to grow on expectations of even more significant monetary expansion. However, the situation is different with the 45th president of the U.S., who is again striving for power. If he wins the rematch anticipated by investors with Joe Biden, the consequences could be unpredictable.

It is still hard to say whether Donald Trump's victory would be good or bad for the dollar. However, everything that happens around the eccentric Republican contributes to the growth of the USD index. Perhaps the reason should be sought not in the U.S. dollar but in other currencies. Protectionist policies will be unequivocally lethal for the Chinese yuan, Mexican peso, or euro.

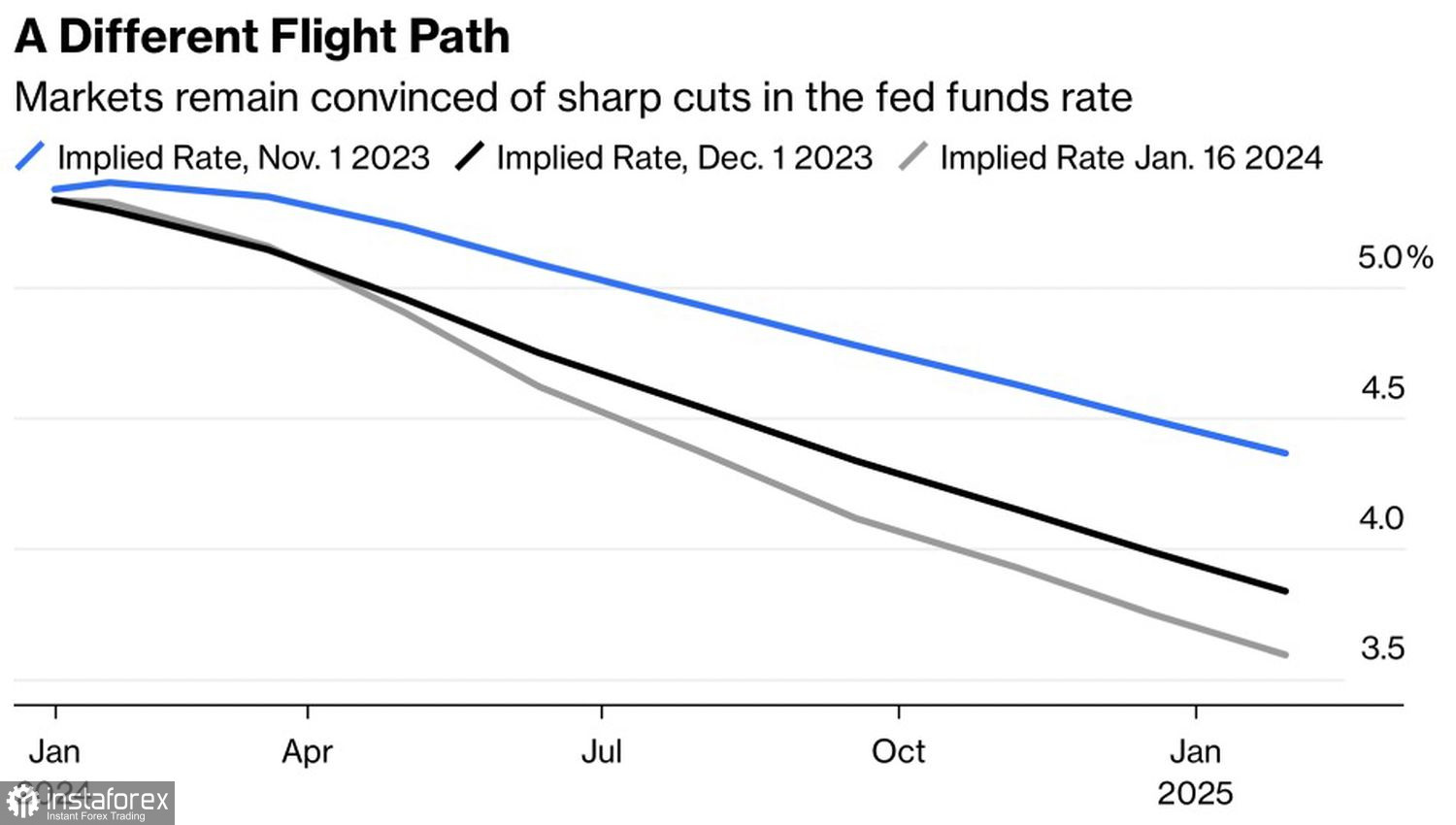

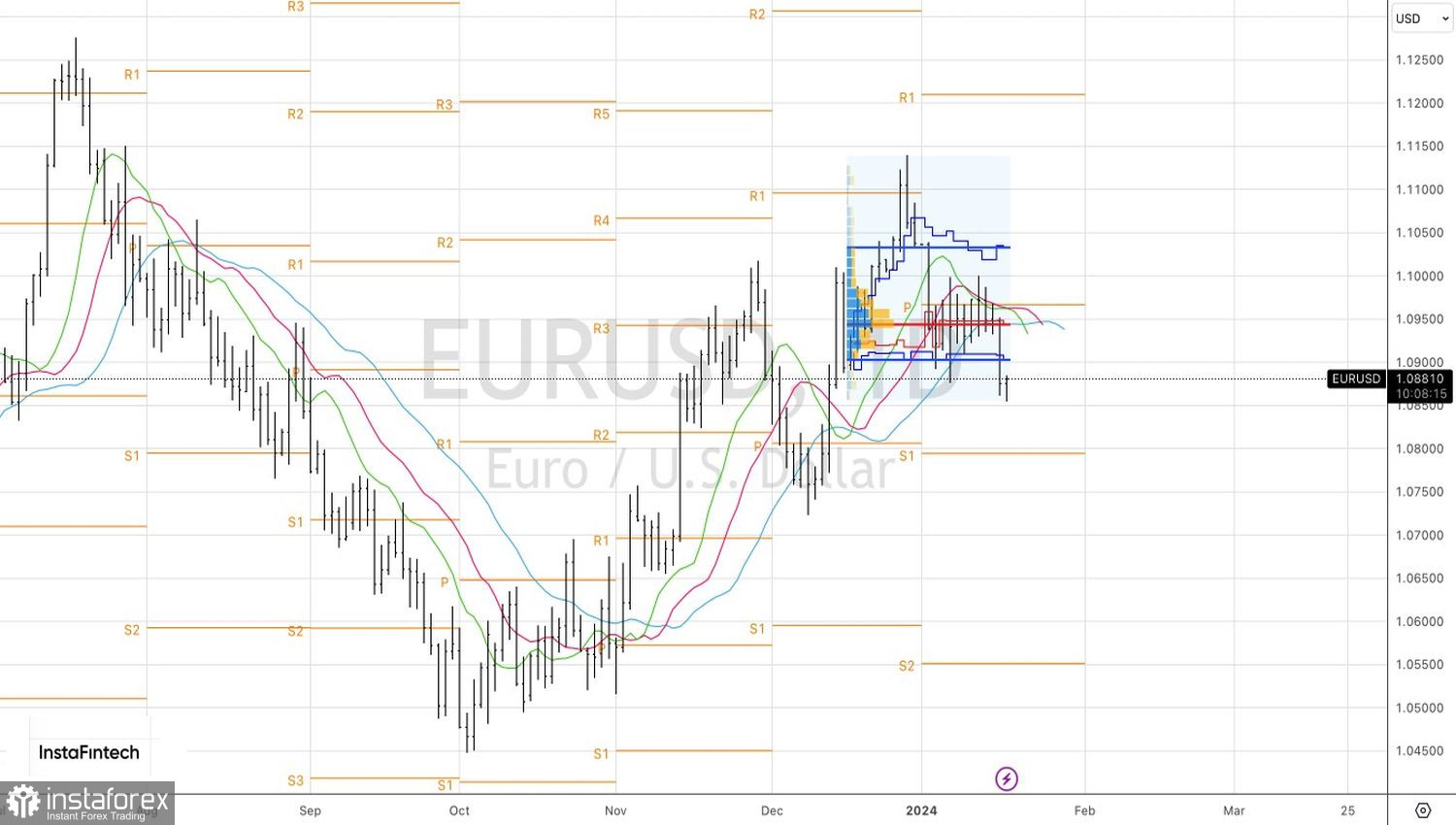

The fall of EUR/USD is facilitated by overly "bullish" forecasts for the pair at the end of 2023. Despite the fact that market pricing of the federal funds rate suggests even more cuts than in December, the U.S. dollar is growing. Investors planned to sell it, but a series of positive macroeconomic reports from the U.S. changed the rules of the game. Now, Danske Bank advises its clients to sell the main currency pair on the rise and expects to see it at 1.05 by the end of 2024.

Dynamics of Market Expectations for the Fed Rate

Societe Generale notes that investors are demanding the impossible from the Federal Reserve, based on previous cycles. On average, it took six months from the last rate hike to its first reduction. Therefore, the easing of monetary policy should start in January. However, given the continuing strength of the economy and slowing inflation, this seems unlikely. Federal Reserve Governor Christopher Waller himself warned the markets against hoping for a repeat of the history of previous cycles.

Meanwhile, the European Central Bank is making titanic efforts to change investors' rate expectations. For instance, ECB President Christine Lagarde noted that a reduction by mid-year is quite likely. The ECB depends on data, and some indicators do not yet meet requirements. Market forecasts for lower borrowing costs complicate the fight against inflation. Currently, derivatives expect a 140 bps drop in the deposit rate. This involves five acts of monetary expansion with a 60% probability of a sixth step in easing monetary policy.

Thus, FOMC officials advise against rushing, but market expectations for the Fed rates do not change much. Meanwhile, the Trump factor supports the U.S. dollar.

Technically, on the EUR/USD daily chart, the Spike and Ledge pattern is realized. If the pair does not return to the middle of the trading channel at 1.09-1.099 soon, the "bears" will maintain control. In such a scenario, the risks of the euro falling towards 1.08 and 1.07 are significant. It is advisable to maintain a focus on selling.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română