EUR/USD

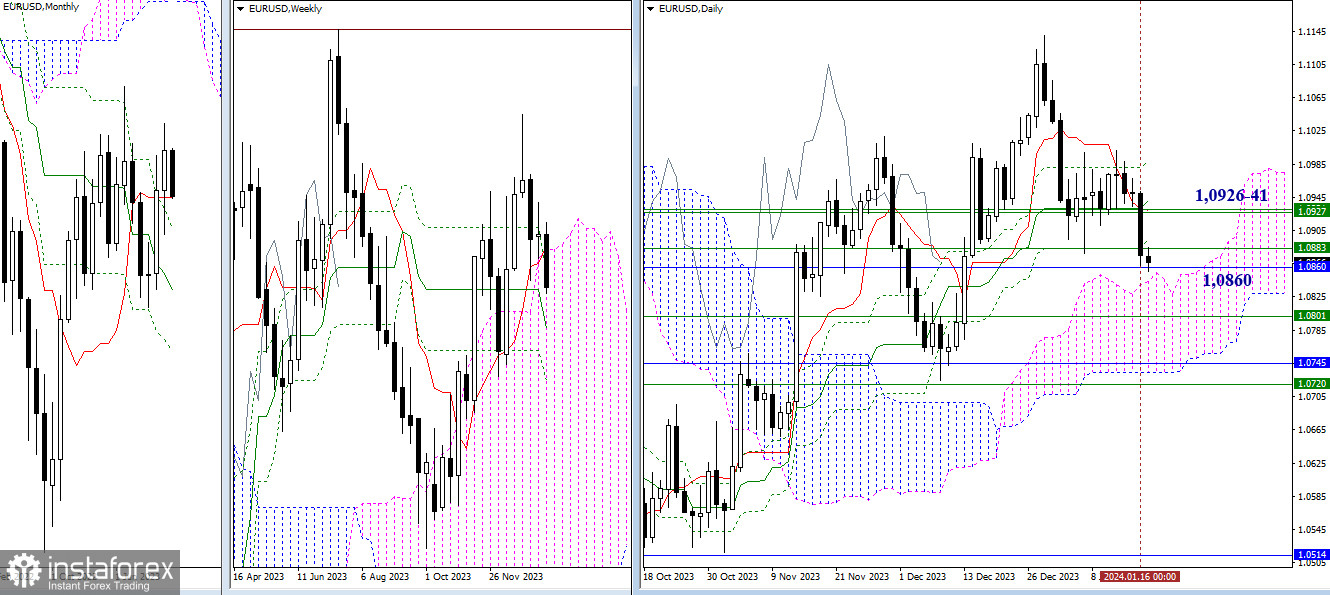

Higher Timeframes

The pair descended to the area of the monthly short-term trend (1.0860) and began testing it. A breach of this level and consolidation in the daily Ichimoku cloud (1.0844) will allow for considering new opportunities for bearish players. The formation of a rebound and the recovery of positions to the area of accumulation of levels for the daily (1.0941 – 1.0928) and weekly (1.0926 – 1.0932) timeframes may return the pair to a state of uncertainty and consolidation.

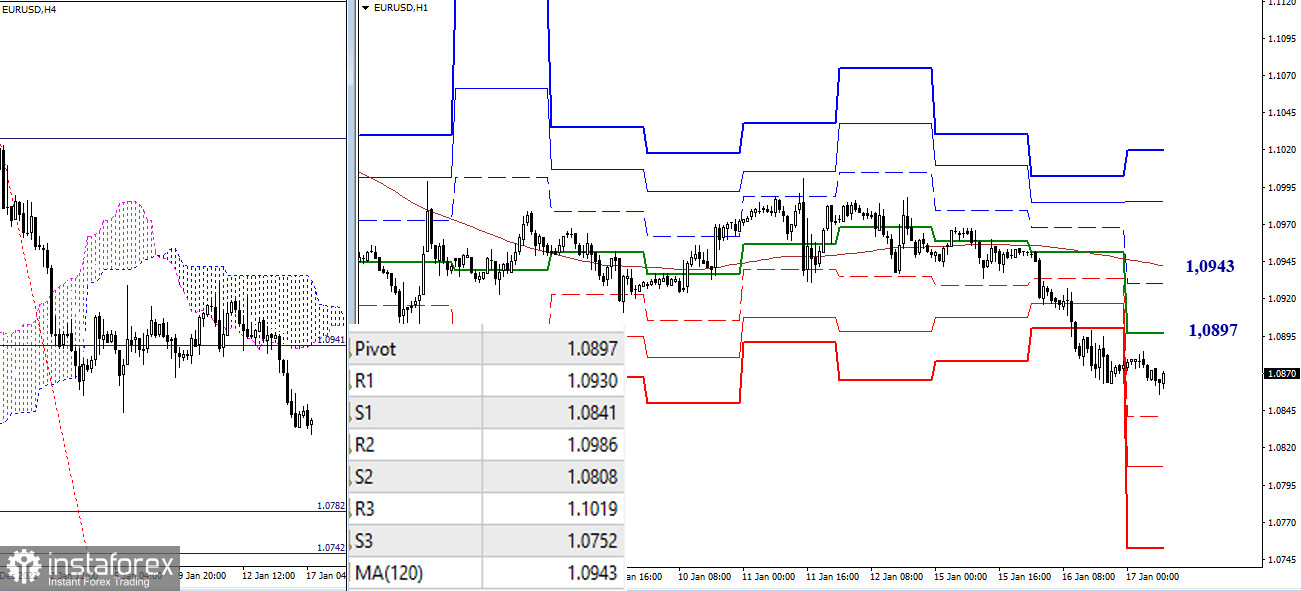

H4 – H1

On the lower timeframes, bearish players currently have the main advantage and are developing a downward trend. Intraday bearish targets today include classic pivot points (1.0841 – 1.0808 – 1.0752) and the target for breaking the H4 cloud (1.0782 – 1.0742). A change of priorities and the development of an upward correction will allow focus on testing key levels, which today are located at 1.0897 (central pivot point of the day) and 1.0943 (weekly long-term trend). Resistance to the weekly trend will be strengthened by R1 (1.0930) and the lower boundary of the H4 cloud (1.0942).

***

GBP/USD

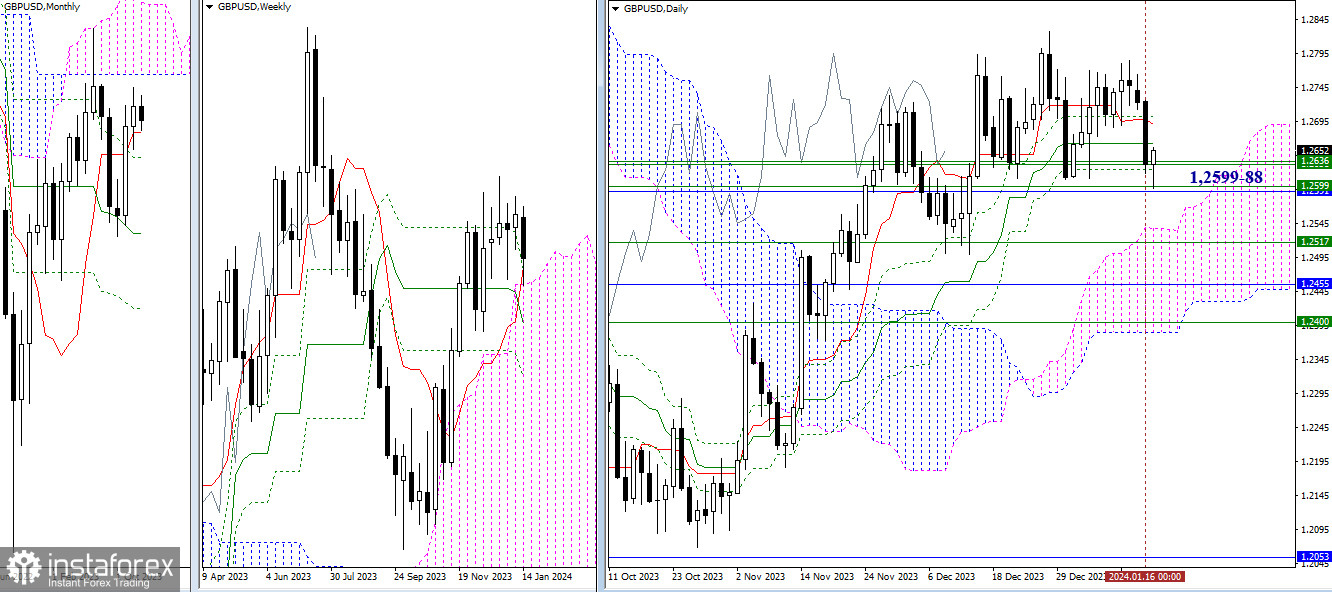

Higher Timeframes

Bearish activity allowed the pair to begin testing an important threshold of this segment (1.2588—monthly short-term trend + 1.2598—upper boundary of the weekly cloud). A break and reliable consolidation below will open up new bearish prospects in the form of a fairly wide support zone formed by levels of various timeframes (1.2517 - 1.2455 - 1.2400). In addition, the strength of the encountered levels (1.2588-98) can now provoke a rebound, which will lead to a retest of the levels of the daily Ichimoku cross (1.2662 - 1.2690 - 1.2701) passed yesterday. A successful rise and return of daily levels to the side of bullish players will bring back plans for a recovery of the upward trend (1.2826).

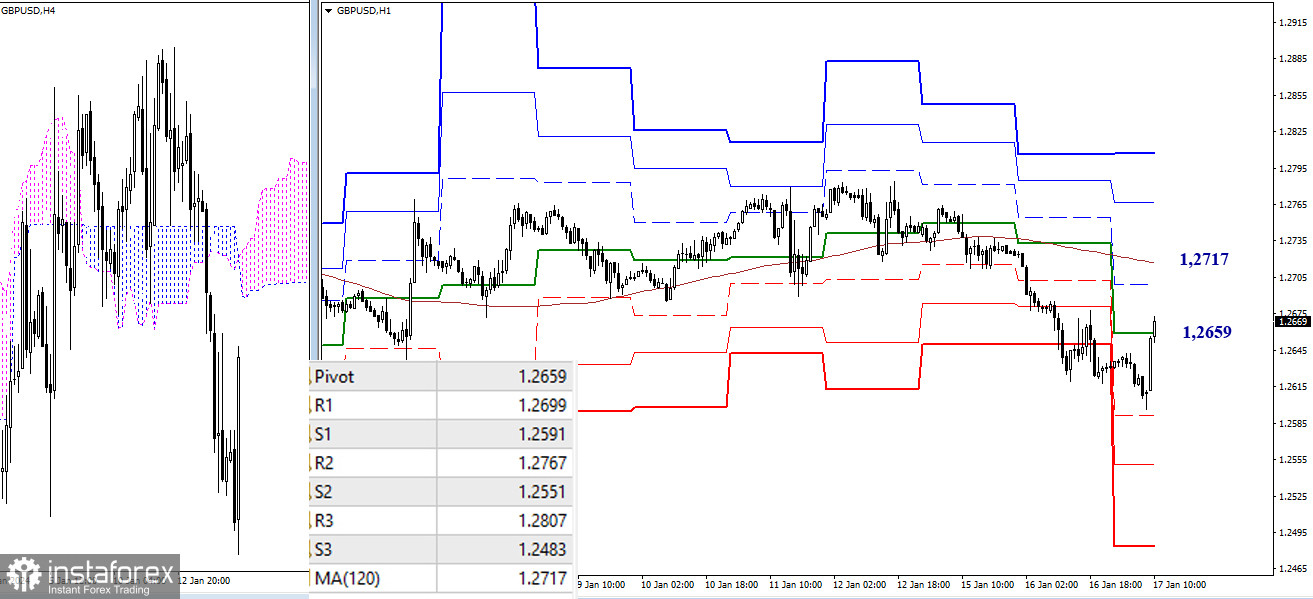

H4 – H1

On the lower timeframes, we are currently observing the development of an upward correction, the main benchmarks of which are the key levels of the lower timeframes 1.2659 and 1.2717 (central pivot point of the day + weekly long-term trend). Consolidation above the trend and its reversal can change the current balance of power in favor of strengthening bullish sentiments. If, however, the corrective rise ends, and bears leave the correction zone, then intraday attention will be directed to the support of classic pivot points (1.2591 - 1.2551 - 1.2483).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română