The weak data from the UK labor market set the tone for the entire day yesterday, allowing the dollar to noticeably strengthen. This was especially true against the single European currency, which eventually fell below 1.0900, a level that had long served as the lower boundary of the range. However, it's too early to claim that the situation in the market has radically changed.

It is likely that the decline of the euro is only temporary, and things may return to normal today. This is not due to European inflation, which is expected to rise from 2.4% to 2.9%. This fact has been known to the market since the publication of preliminary estimates. The likely cause will be American macroeconomic statistics, primarily retail sales, which are expected to slow down from a growth of 4.1% to 4.0%. This decrease should not be dismissed as insignificant as it concerns December data—when Christmas and New Year's gifts are traditionally purchased, so consumer activity typically increases.

Thus, even such a minor slowdown in the growth of retail sales is quite significant. Nevertheless, the dollar may receive some support from industrial production, the decline of which may slow from -0.4% to -0.1%. However, this won't be of much help, as it still indicates a continuing decline in production.

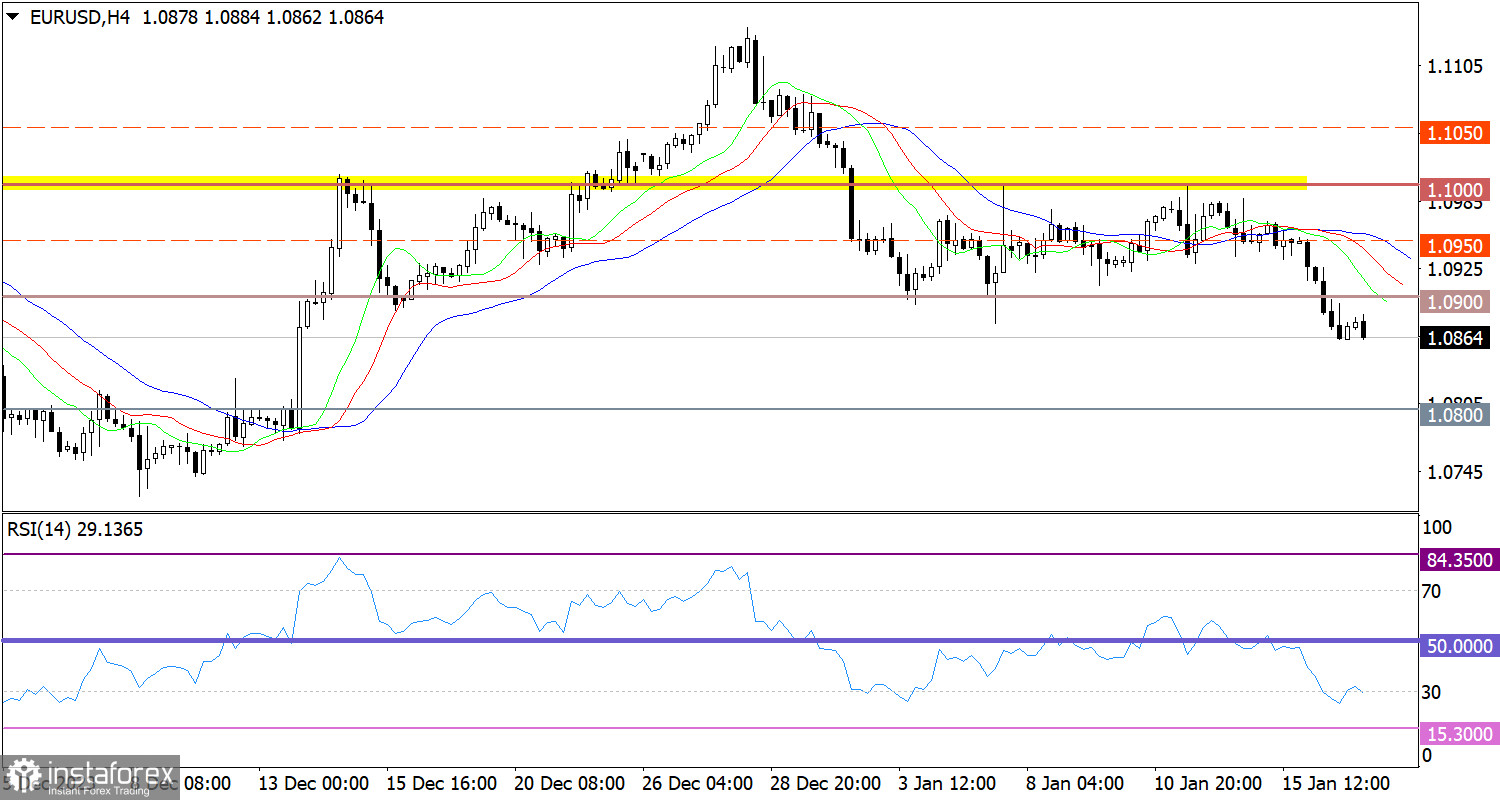

The long-standing sideways channel of 1.0900/1.1000 in the EUR/USD currency pair was broken on a downward trajectory. During the breakdown, there was an increase in short positions, which ultimately led to the prolongation of the corrective cycle in the market from the local high of last December.

On the four-hour chart, the RSI is crossing the oversold zone, indicating a local overheating of the euro's short positions. However, it should be noted that critically important oversold areas were not affected.

On the same time frame, the Alligator's MAs are directed downwards, confirming the price's exit from the stagnation phase.

Outlook

A stable holding of the price below 1.0850 could lead to a subsequent increase in short positions, contrary to the technical factor of the euro's course being oversold. In this case, a movement towards 1.0800 is possible. As for the alternative scenario, for its consideration, the quote first needs to return above the 1.0900 level.

The comprehensive indicator analysis for short-term and intraday periods indicates a downward trend due to the breakdown of the lower boundary of the flat range.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română