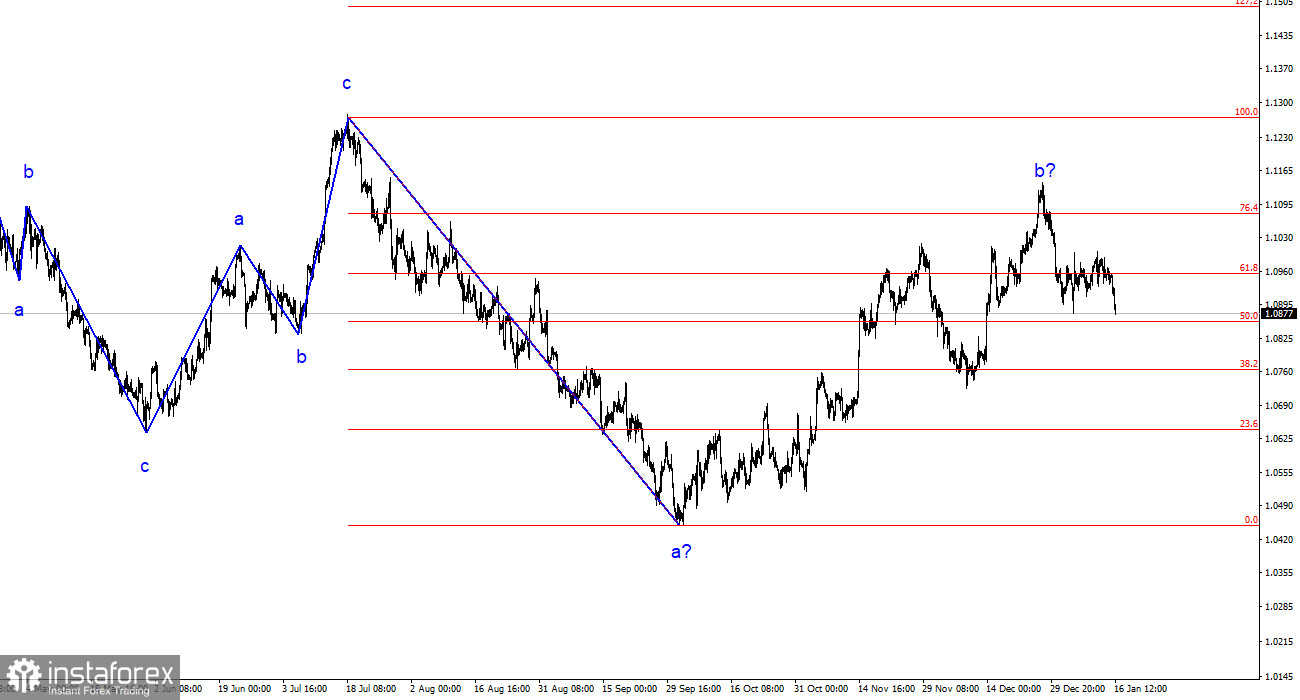

The wave analysis of the 4-hour chart for the euro/dollar pair remains unchanged. Over the past year, we have seen only three-wave structures that constantly alternate with each other. Currently, the construction of another three-wave downward structure is ongoing. The assumed wave 1 has been completed, but wave 2 or b has become more complex three or four times, and there are no guarantees that it will not be complicated further.

Although the news background cannot be considered "supportive of the European currency," the market keeps finding new reasons to increase demand for the pair. This situation is not normal. Even if the upward trend section is resumed, its internal structure will become unreadable.

The internal wave structure of the assumed wave 2 or b has changed. Since the last downward wave was disproportionately large, I now interpret it as wave b. If this is the case, wave c is currently being built, and wave 2 or b may still end at any moment (or may have already ended). The current retreat from the highs looks convincing, so we can expect a transition to wave 3 or c construction.

The market woke up after the holidays.

The exchange rate of the euro/dollar pair decreased by 60 basis points on Tuesday. However, the day is not over yet, so by the end, the losses of the European currency may be even more significant. We are witnessing a reasonable movement, as the wave pattern has been suggesting an increase in demand for the US dollar for several weeks. Wave 2 or b turned out to be too lengthy, and the market could not endlessly delay the construction of wave 3 or c. Therefore, the pair has shifted to constructing an impulsive downward wave.

Today, the news background for the European currency is quite weak. I can only mention the December German inflation report, which rose to 3.7% year-on-year, in line with market expectations. The acceleration of inflation in the European Union means that the ECB may keep interest rates at their current levels for longer than expected by the market. Earlier, many ECB's Governing Council members said the same thing – there is no need to rush with the first easing of monetary policy.

This is a "bullish" factor for the European currency. However, we saw a decline in the euro today because the market cannot keep buying constantly when most news background is about selling.

Another escalation may have helped the US dollar in the Middle East. The market often increases demand for the US dollar due to its status as a "reserve currency" and safe haven. Based on everything above, I expect further strengthening of the US dollar, almost regardless of the news background.

General Conclusions

Based on the analysis conducted, the construction of a bearish wave set continues. Wave 2 or b has taken on a completed form, so in the near future, I expect the continuation of the construction of an impulsive downward wave 3 or c with a significant decrease in the pair. The unsuccessful attempt to break through the 1.1125 level, corresponding to 23.6% Fibonacci, indicated the market's readiness for sales.

On a larger wave scale, it can be seen that the construction of corrective wave 2 or b continues, which in length is already more than 61.8% Fibonacci from the first wave. As I have already mentioned, this is not critical; the scenario with the construction of wave 3 or c and a decrease in the pair below the 1.4 figure remains valid.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română