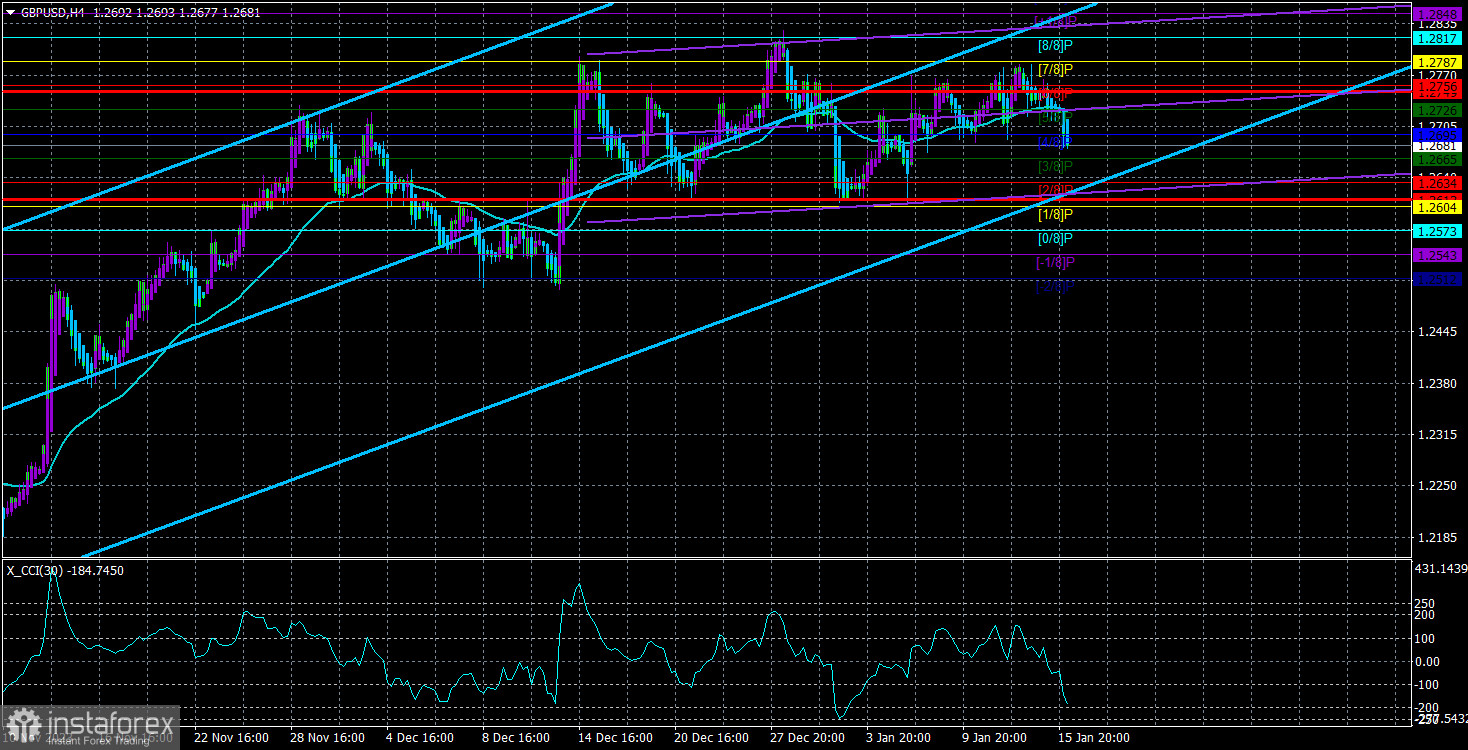

The GBP/USD currency pair continues its overall upward movement. This movement of the British currency has been illogical for quite some time. We have repeatedly mentioned the overbought condition of the CCI indicator, its triple or quadruple divergence, the "head and shoulders" pattern, and the overly strong upward correction. However, this is insignificant if the market's major players continue to maintain demand for the British currency at its peak.

Talking about the reasons for such market behavior is also challenging because any explanation will seem like an attempt to present the desired as reality. For example, one can always say that the market is waiting for the Bank of England to lower its interest rates later than the Fed. And this explanation is quite plausible because, in reality, no one knows what most major players are thinking. They may not be making plans and simply buying the currency they need.

Therefore, we can only state the obvious: the pound should be falling, but it isn't. The key level to watch is 1.2760 (61.8% Fibonacci level) in the 24-hour timeframe. Since the pair has been unable to overcome it for several weeks, the probability of a trend reversal downward remains. However, at the same time, we have many signals indicating a trend reversal downward, but the trend does not reverse.

Of course, this can happen anytime, as it has happened many times before. But predicting the timing of such a reversal is impossible. This week, the British pound will have another illusory chance to retreat, as fundamentals and technicals require. An inflation report for December will be published. Continuing the disinflation process may convince the market of the possibility of a key rate cut by the Bank of England in the first half of the year. And this factor, in turn, could put pressure on the British currency.

However, we remind you once again that there have been plenty of opportunities for the pound to fall in the last one and a half to two months. But if the market refuses to sell, how can the pair fall? It is also important to remember that inflation in the UK, although decreasing, remains relatively high (3.9% according to the November report). In December, it is expected to decrease to 3.8%, which is only a 0.1% decrease. If this value is confirmed, it is unlikely that we should expect a significant drop in the British pound.

We may see another weak correction or even a small pullback, after which everything will remain the same. The market must completely change its attitude toward the British currency before we can expect a logical and systematic downward trend.

The same applies to reports on unemployment and the labor market in the UK. Even if they turn out worse than expected, the market will only start selling the pound after a while. We will likely see a small downward correction, and that will be it.

Therefore, at this time, the consolidation of the price below the moving average does not guarantee a decline in the pair. Rather, on the contrary, the probability of a resumption of growth after this is higher than the probability of a decline. In any case, caution should be exercised with purchases, as many sell signals currently exist. We would consider selling if the level of 1.2760 on the 24-hour timeframe is not overcome, as there has been no talk of a bounce from this level for a long time.

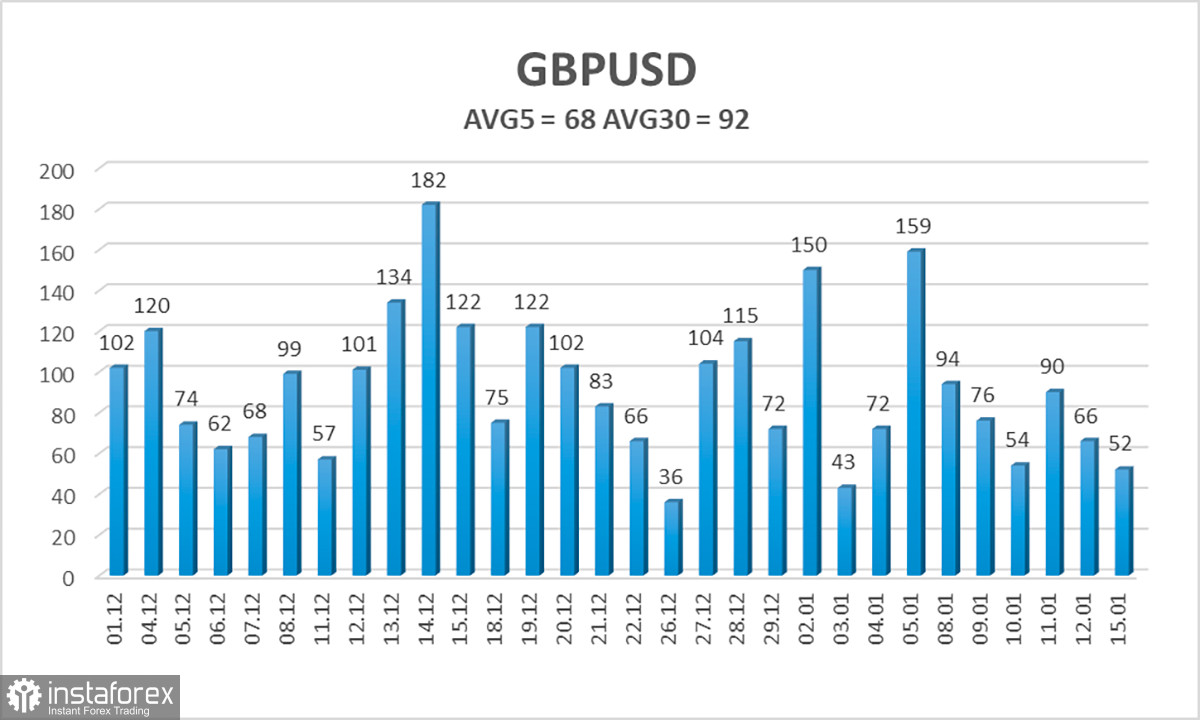

The average volatility of the GBP/USD pair over the past five trading days as of January 16th is 68 points, considered "average" for the pound/dollar pair. On Tuesday, January 16th, we expect movement within the range limited by the levels of 1.2612 and 1.2748. A downward reversal of the Heiken Ashi indicator indicates a new attempt to start a downward trend.

Nearest support levels:

S1 – 1.2665

S2 – 1.2634

S3 – 1.2604

Nearest resistance levels:

R1 – 1.2695

R2 – 1.2726

R3 – 1.2756

Trading recommendations:

The GBP/USD currency pair has consolidated below the moving average, so there is a chance of a decline soon toward the lower boundary of the sideways channel at 1.2620. We still find it difficult to consider buying the British pound at this time because its growth is illogical. Short positions with targets at 1.2634 and 1.2604 are more reasonable. We would only consider buying orders after consolidating above the level of 1.2787, which is the upper boundary of the sideways channel. However, the pound remains significantly overbought and unreasonably expensive.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both point in the same direction, the trend is currently strong.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and direction to trade.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the likely price channel the pair will trade within in the next 24 hours, based on current volatility indicators.

CCI indicator – its entry into the overbought area (below -250) or oversold area (above +250) indicates an imminent trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română