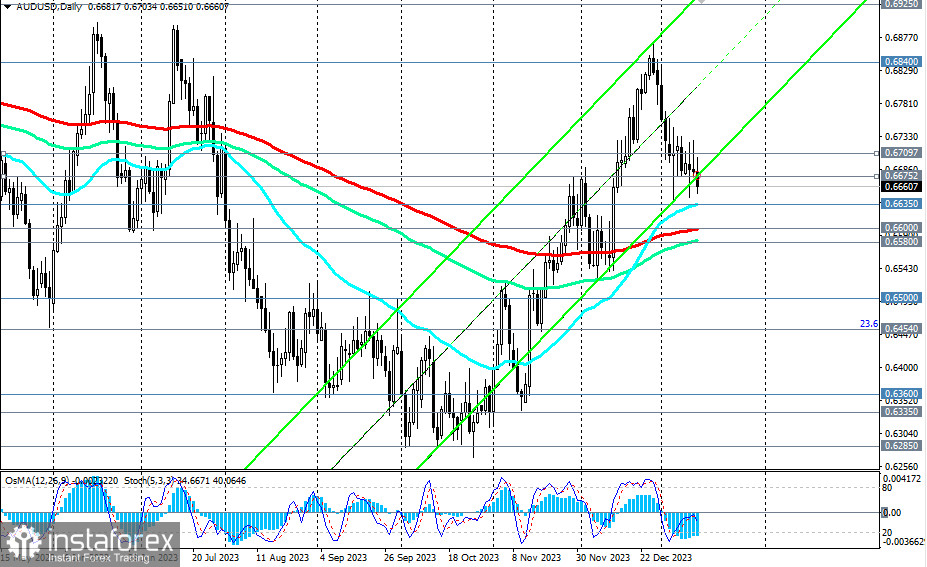

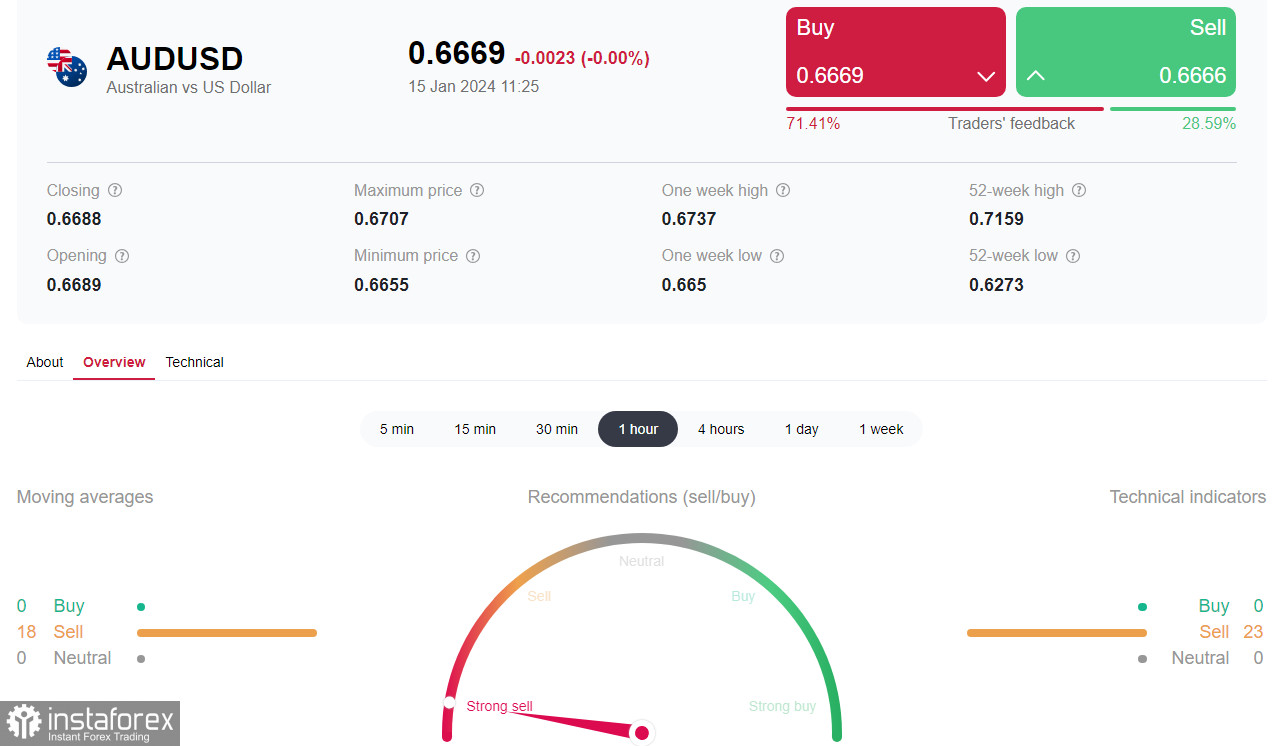

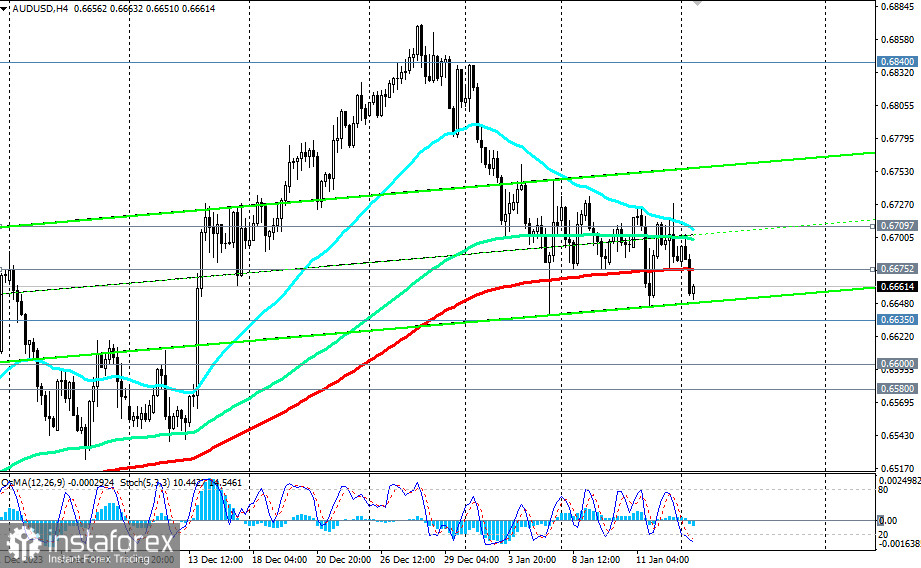

AUD/USD intensifies the downward momentum after breaking through another important short-term support level of 0.6675 (200 EMA on the 4-hour chart) at the beginning of today's European trading session.

At the same time, technical indicators OsMA and Stochastic on the 4-hour, daily, and weekly charts have turned towards short positions, siding with the sellers.

The nearest target in case of further decline would be the important support level of 0.6635 (50 EMA on the daily chart). Breaking through it, in turn, would open the way towards the key medium-term support level of 0.6600 (200 EMA on the daily chart). Further decline and breaking through another important medium-term support level of 0.6580 (144 EMA on the daily chart) would lead AUD/USD into the medium-term bearish market zone with the potential of dropping to multi-month lows near the 0.6300 mark.

In an alternative scenario, AUD/USD will break through the key long-term resistance level of 0.6925 (200 EMA on the weekly chart) and head towards the important resistance level of 0.7505 (200 EMA on the monthly chart at the 50.0% Fibonacci retracement level of the decline wave from the level of 0.9500 to 0.5510). Breaking above these levels will lead AUD/USD into the global bull market zone.

The first signal for realizing this scenario will be on the breakout of the 0.6675 resistance level, and the confirmation will be the breakout of the 0.6710 resistance level (200 EMA on the 1-hour chart) and the resistance zone near the 0.6730 mark.

Support levels: 0.6635, 0.6600, 0.6580, 0.6500, 0.6454, 0.6400, 0.6360, 0.6335, 0.6300, 0.6285, 0.6200, 0.6170

Resistance levels: 0.6675, 0.6710, 0.6730, 0.6800, 0.6840, 0.6900, 0.6925, 0.7000, 0.7040

Trading Scenarios

Main scenario: Sell Stop 0.6645. Stop-Loss 0.6715. Targets 0.6635, 0.6600, 0.6580, 0.6500, 0.6454, 0.6400, 0.6360, 0.6335, 0.6300, 0.6285, 0.6200, 0.6170

Alternative scenario: Buy Stop 0.6715. Stop-Loss 0.6645. Targets 0.6730, 0.6800, 0.6840, 0.6900, 0.6925, 0.7000, 0.7040

'Targets' correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but can serve as a guide in planning and placing your trading positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română