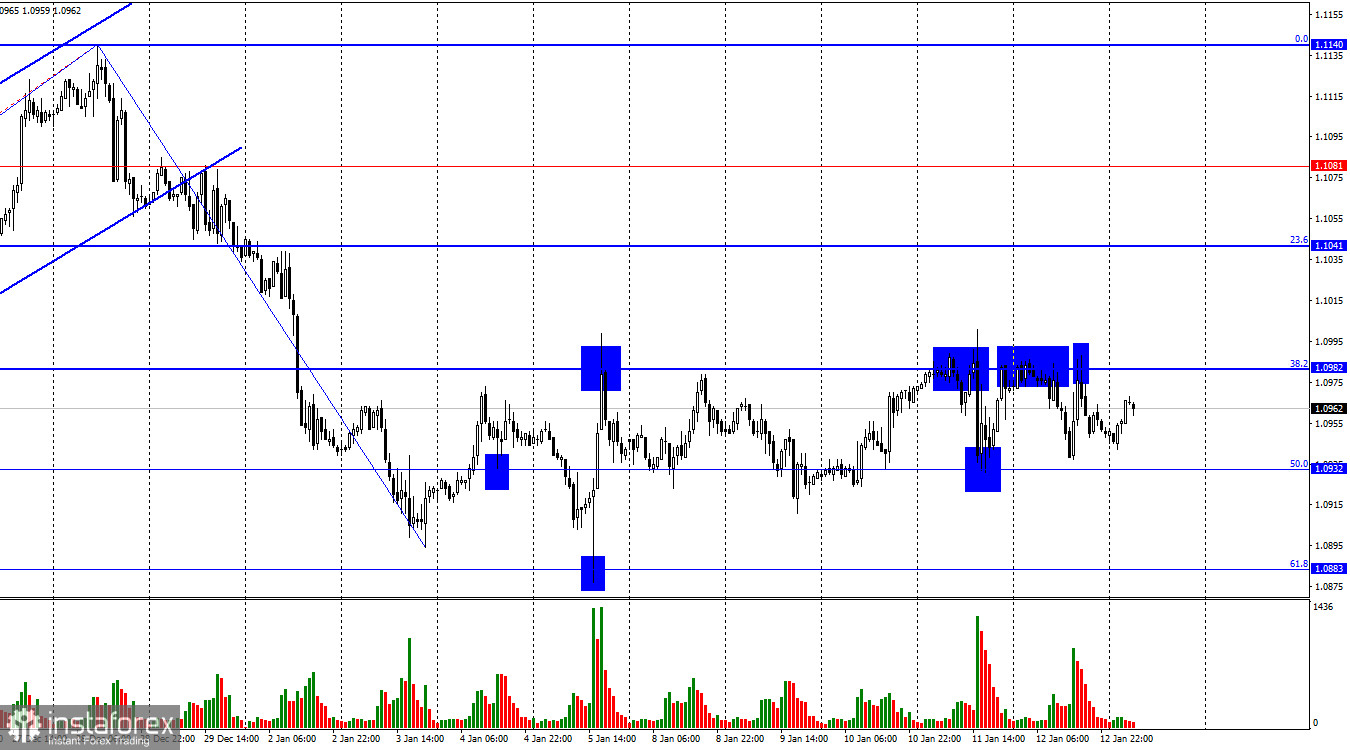

On Friday, the EUR/USD pair experienced two new rebounds from the corrective level of 38.2% (1.0982). In both cases, there was a reversal in favor of the US dollar and a slight decline towards the corrective level of 50.0% (1.0932). On Monday, a new rebound from 1.0982 will again favor the US dollar, and closing above this level will increase the chances of further growth towards the next Fibonacci level at 23.6% (1.1041).

The wave situation remains unchanged. The last downward wave ended exactly where the previous wave ended (around the level of 1.0890). Thus, there is a break of the low from December 15th, but the price only refreshed it by a few pips, which is not sufficient to declare a trend change to "bearish." The new upward wave is rather weak and does not have a chance to break the peak from December 28th. However, even this fact does not indicate the end of the "bullish" trend. Another downward wave is needed to break the low from January 5th confidently. Until then, horizontal movement and the "bullish" trend persist.

The information background on Friday could have been stronger. The only report of the day was the US Producer Price Index (PPI). In December, the PPI was -0.1% MoM and +1.0% YoY. After the release of this report, the dollar slightly declined, but the horizontal movement was maintained because traders failed to exit the 1.0932–1.0982 zone. Thus, everything currently revolves around this range, which will be challenging to break out of, considering the weak information background last week and today. The price may remain within this range for another day or two. Neither bulls nor bears currently have the market initiative.

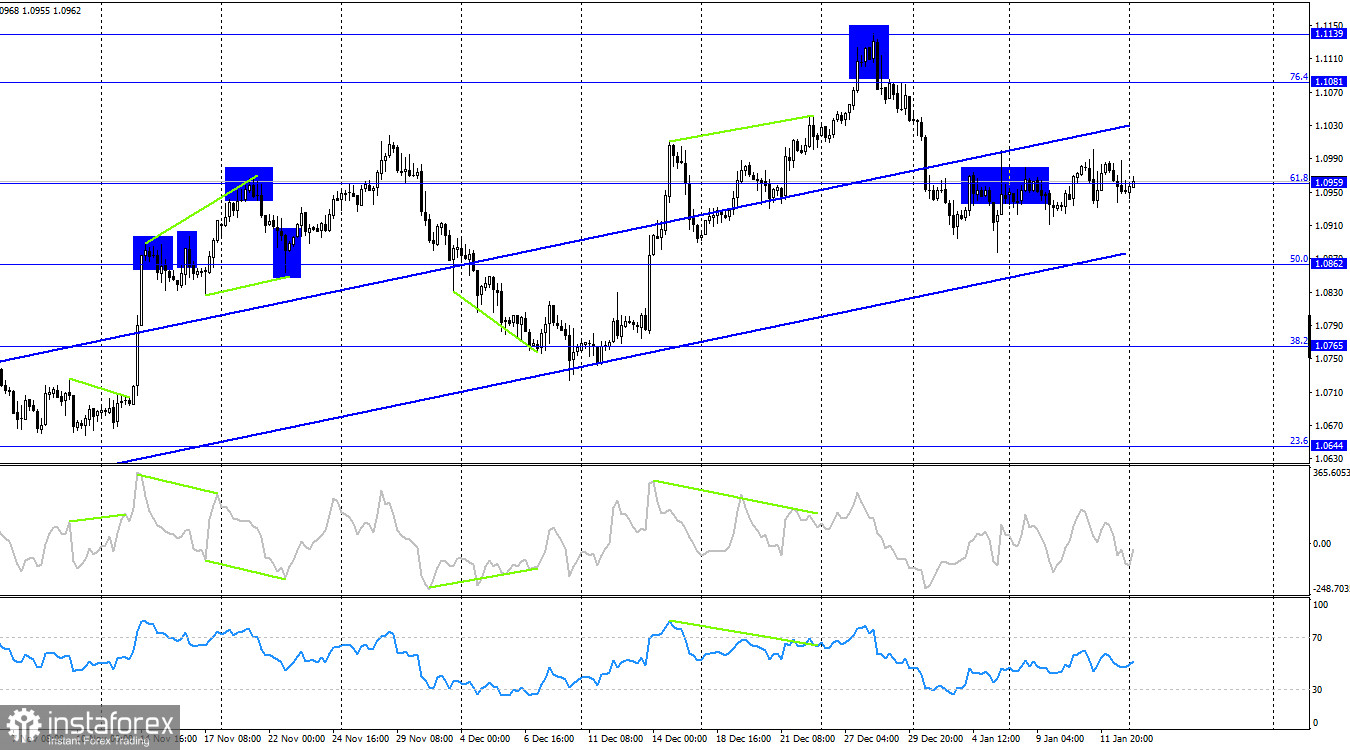

On the 4-hour chart, the pair reversed in favor of the European currency and closed above the Fibonacci level of 61.8% (1.0959). Previously, it did not even come close to the lower line of the ascending trend corridor, indicating the persistence of "bullish" sentiment in the market without alternatives. I will wait for a strong decline in the euro only after the quotes below the corridor are firmly fixed. In the near future, the euro may show growth towards the corrective level of 76.4% (1.1081) if it exits the horizontal corridor on the hourly chart.

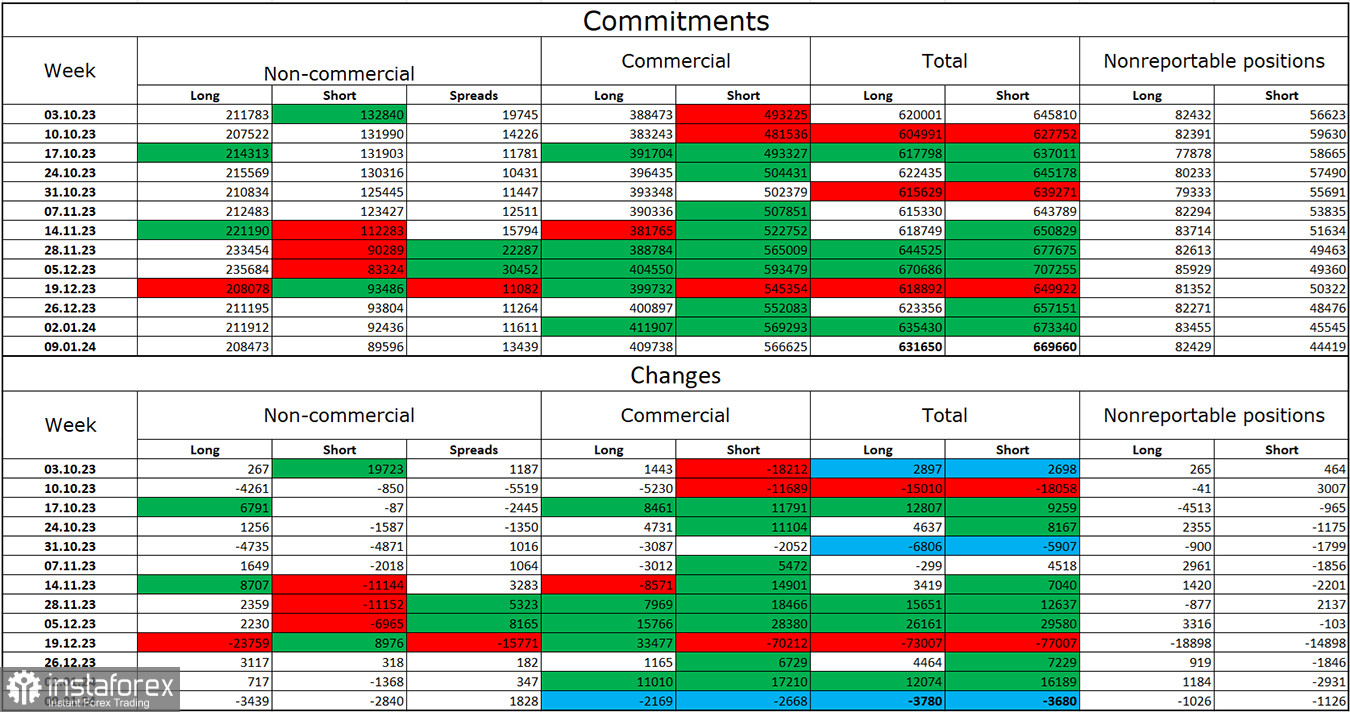

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 3,439 long contracts and 2,840 short contracts. The sentiment of large traders remains "bullish" but is weakening overall. The total number of long contracts held by speculators now stands at 208 thousand, while short contracts total only 89 thousand. Despite the significant difference, the situation will shift toward the bears. Bulls have dominated the market for too long, and now they need a strong background of information to maintain the "bullish" trend. I don't see such a background currently. Professional traders may resume closing their long positions soon. The current figures allow for the resumption of the euro's decline in the coming months.

Economic Calendar for the US and the European Union:

European Union - Industrial Production Change (10:00 UTC).

On January 15th, the economic events calendar contains only one entry, with extremely low chances of breaking the pair out of its sideways movement. The impact of the information background on trader sentiment today may be weak.

Forecast for EUR/USD and Trader's Advice:

Sales of the pair are possible upon a rebound from the level of 1.0982 on the hourly chart, with targets at 1.0932 and 1.0883. Purchases can be considered upon a rebound from the level of 1.0932 on the hourly chart with a target of 1.0982 or upon closing above the level of 1.0982 with a target of 1.1041.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română