The British pound has led the G10 currency race and eagerly awaits important reports on the labor market, inflation, and retail sales. When markets forecast a slower rate hike by the Bank of England compared to the Fed, this gives the 'bulls' in GBP/USD a significant advantage. Even though the economy of the UK looks weaker than the US's, in Forex, it's always the dynamics, not the statics, that matter. The U.S. GDP slowdown against the backdrop of its British counterpart's improvement instills confidence in the sterling.

According to ING, the easing of monetary policy in Britain will be more effective than in the USA. The reduction in mortgage rates will decrease household spending pressure. Monetary expansion will help the government and allow Chancellor Jeremy Hunt to provide fiscal stimulus in the form of tax cuts ahead of the elections. The fall in bond yields will reduce the budget's spending on their servicing by approximately £12 billion. As a result, the likelihood of a soft landing will significantly increase, favorably reflecting on the pound.

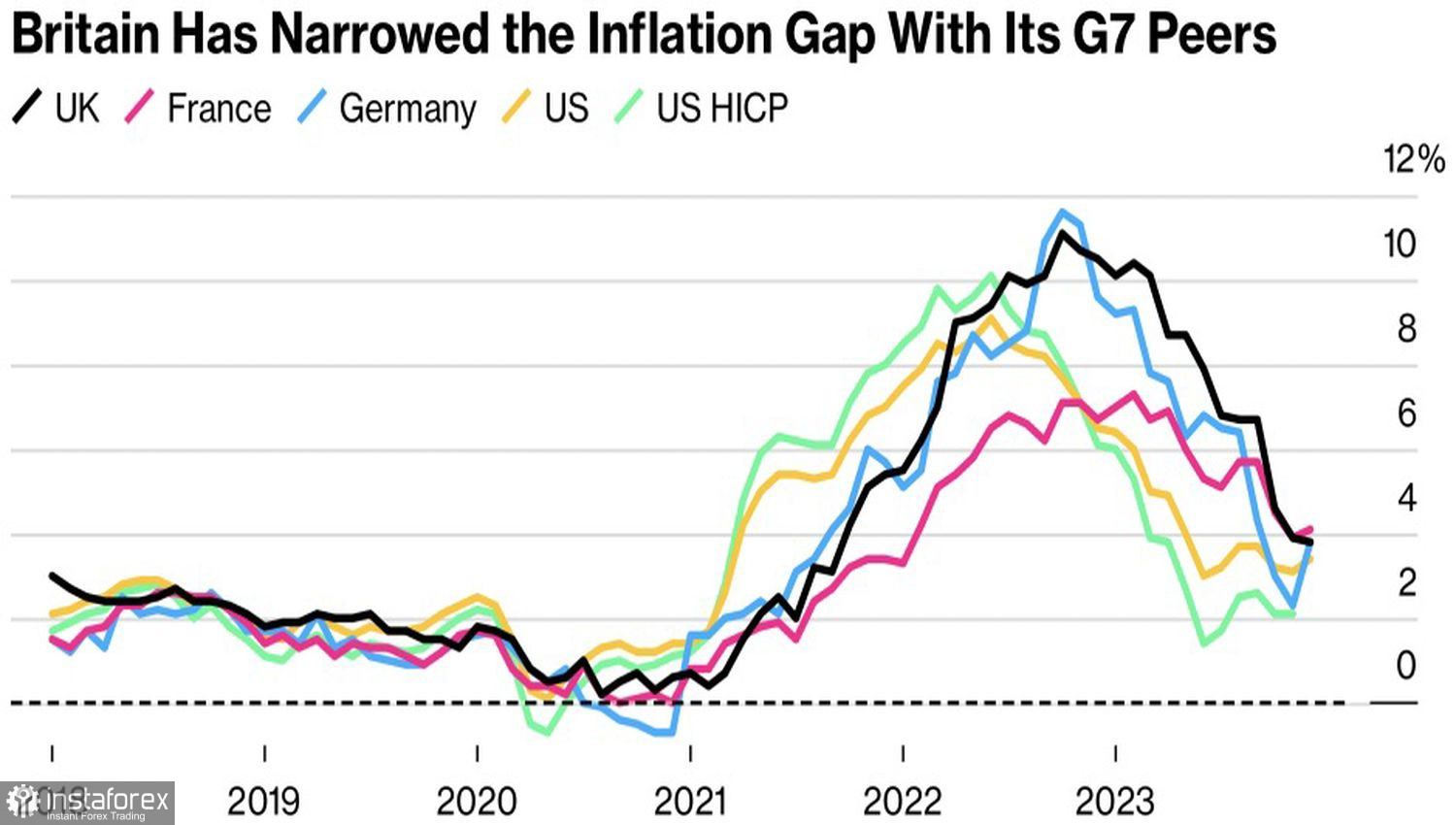

On the other hand, the 'bulls' in GBP/USD might lose their advantage due to an overly rapid slowdown in consumer prices. The UK CPI in November rose by 3.9%, and Bloomberg experts expect it to slow down to 3.8% in December. These figures are significantly higher than in the USA and the Eurozone, allowing the derivatives market to count on a slower easing of monetary policy by the Bank of England compared to the Fed or ECB. Derivatives are expecting five rate cuts from the BoE compared to six for the Fed. They predict the start of London's monetary expansion in May compared to March for Washington.

Inflation Dynamics in Different Countries

However, Capital Economics believes that by April, inflation in Britain will fall to 1.7% due to a higher base at the start of 2023. In the USA, it will be 2.6%, and in the Eurozone – 2%. If this happens, market chances for a reduction in the repo rate will quickly change, dealing an unbreakable blow to the positions of the 'bulls' in GBP/USD.

While Capital Economics' forecasts deserve attention, the power dynamics in the analyzed pair will be determined by macro statistics and decisions of the Bank of England. In this regard, the busy economic calendar for the week leading up to January 19 increases the likelihood of sharp fluctuations in GBP/USD. Along with the slowdown of the CPI from 3.9% to 3.8% and the core inflation from 5.1% to 4.9%, Bloomberg experts expect a decrease in average wage growth rates from 7.3% to 6.6%. Such dynamics of indicators suggest that deflationary processes in the UK are slower than in the USA and the Eurozone.

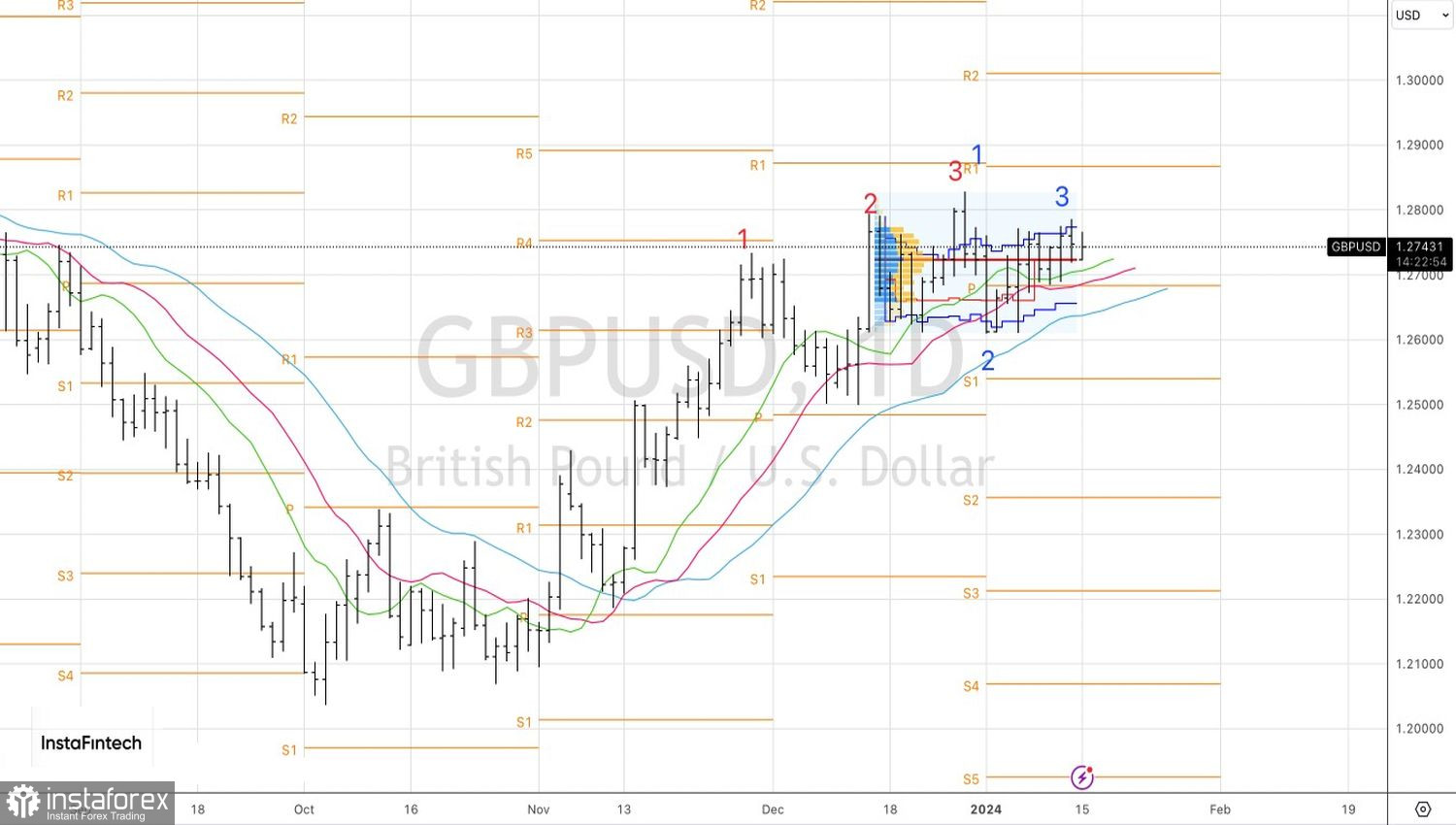

Technically, after forming a combination of patterns like Three Indians and 1-2-3 on the daily chart of GBP/USD, the market entered a consolidation state near the fair value at 1.272. Only its breakdown, followed by a successful assault on the support in the form of a pivot level at 1.268, will allow selling the pair. Conversely, a successful test of resistance at 1.2785 is a reason for its purchase.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română