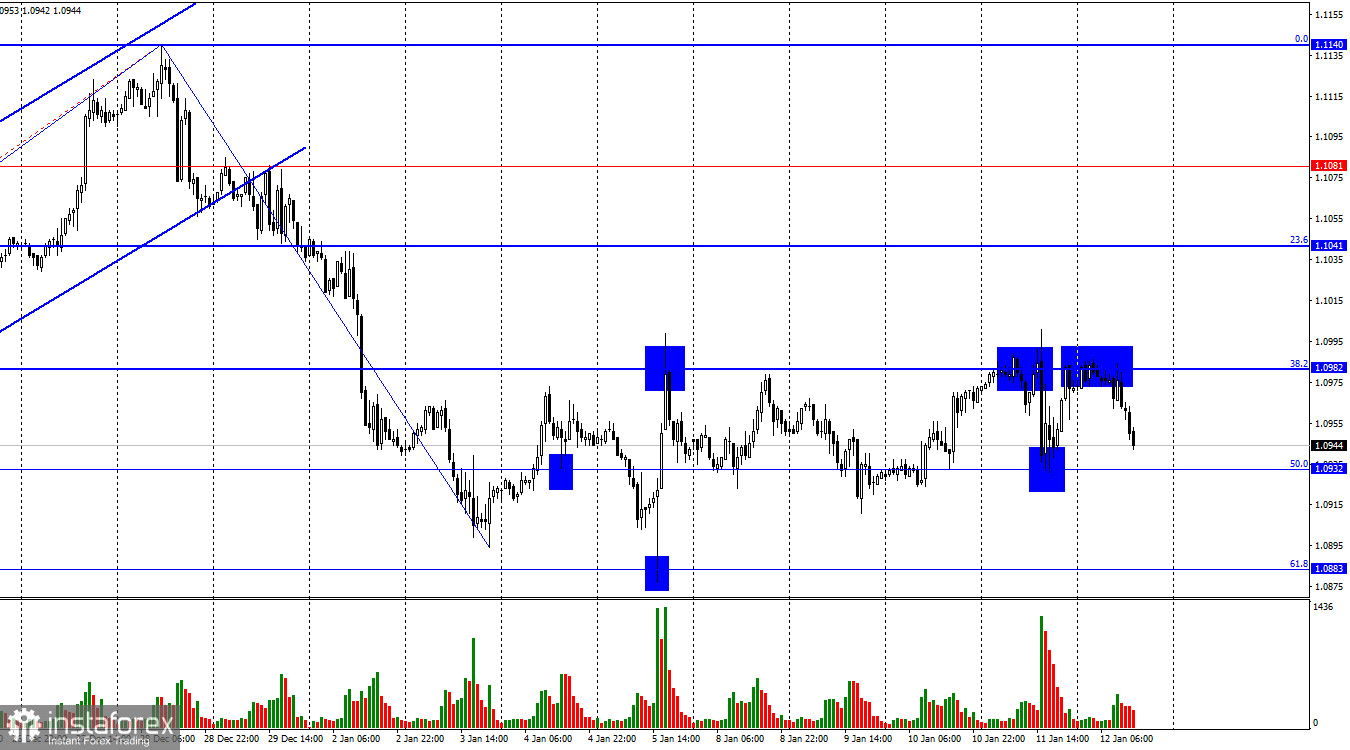

On Thursday, the EUR/USD pair first rebounded from the corrective level of 38.2% (1.0982) and then rebounded from the Fibonacci level of 50.0% (1.0932). On Friday, it returned to the corrective level of 38.2% and another bounce from it. Thus, another reversal in favor of the US dollar was executed, and a new downward process began toward 1.0932. Another bounce from this level will again favor the European currency and a return to 1.0982. If the pair's rate consolidates below 1.0932, it will increase the chances of a further decline toward the next corrective level of 61.8% (1.0883).

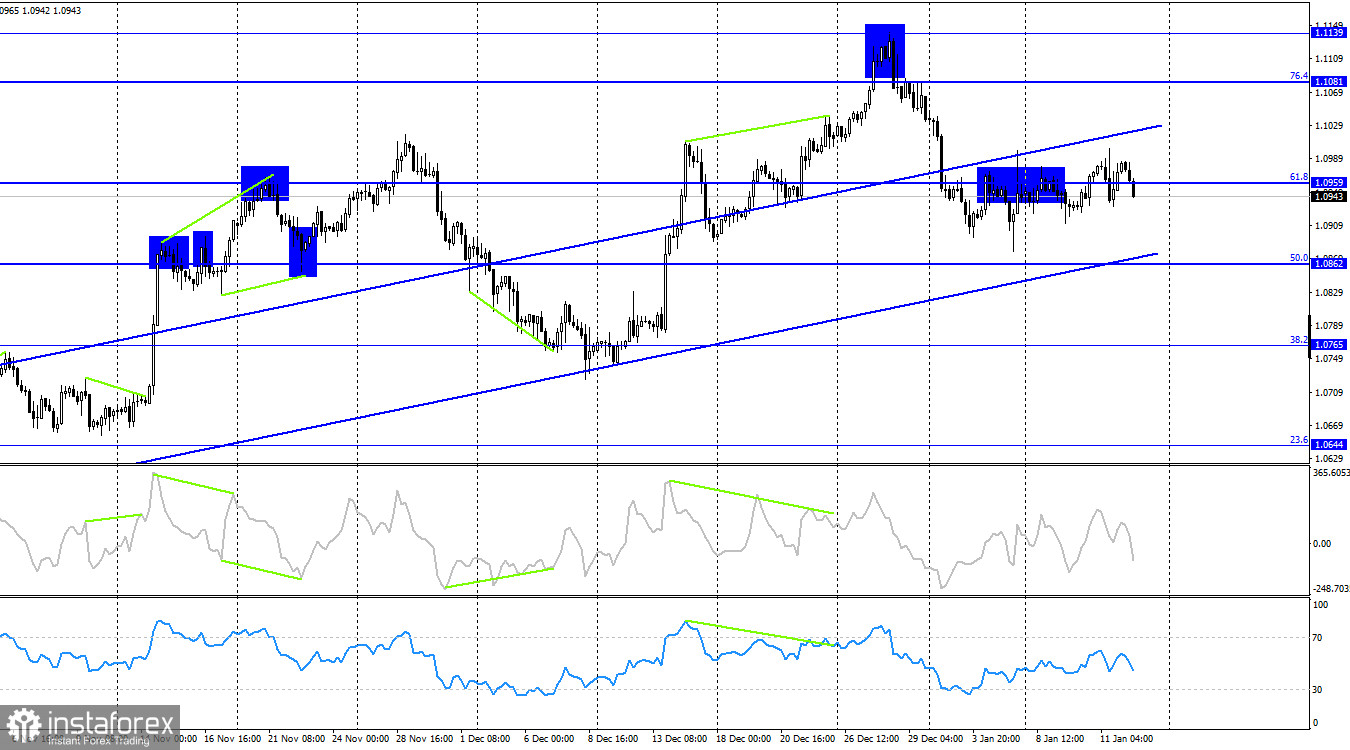

The wave situation remains unchanged. The last downward wave ended exactly where the previous wave ended (around the 1.0890 level). Thus, there is a breakout of the lows from December 15, but the price has been updated by only a few points, which is insufficient to declare a trend change to "bearish." The new upward wave is quite weak and has no chance of breaking the peak from December 28, but even this fact does not indicate the end of the "bullish" trend. Another downward wave is needed, which will confidently break the lows from January 5. Until then, horizontal movement and the "bullish" trend continue.

The information background on Thursday was quite strong, but it was expressed only by a report on US inflation for December. Unexpectedly for traders, the indicator rose to 3.4%, while core inflation decreased to 3.9%. After these reports, the dollar sharply rose, but its growth could have been more-lived. Since the bears failed to establish themselves below the 1.0932 level, the inflation report did not matter. It did not allow the dollar to continue its rise, although the probability of a Fed FOMC rate hike in early 2024 sharply decreased, which should have supported the bears.

On the 4-hour chart, the pair reversed in favor of the European currency and closed above the Fibonacci level of 61.8% (1.0959). The pair did not even come close to the lower line of the ascending trend corridor, which means that the "bullish" sentiment on the market remains without alternatives. I will wait for a significant decline in the euro currency only after the quotes consolidate below the corridor. In the near future, the euro may show growth towards the corrective level of 76.4% (1.1081), especially if it breaks out of the horizontal corridor on the hourly chart.

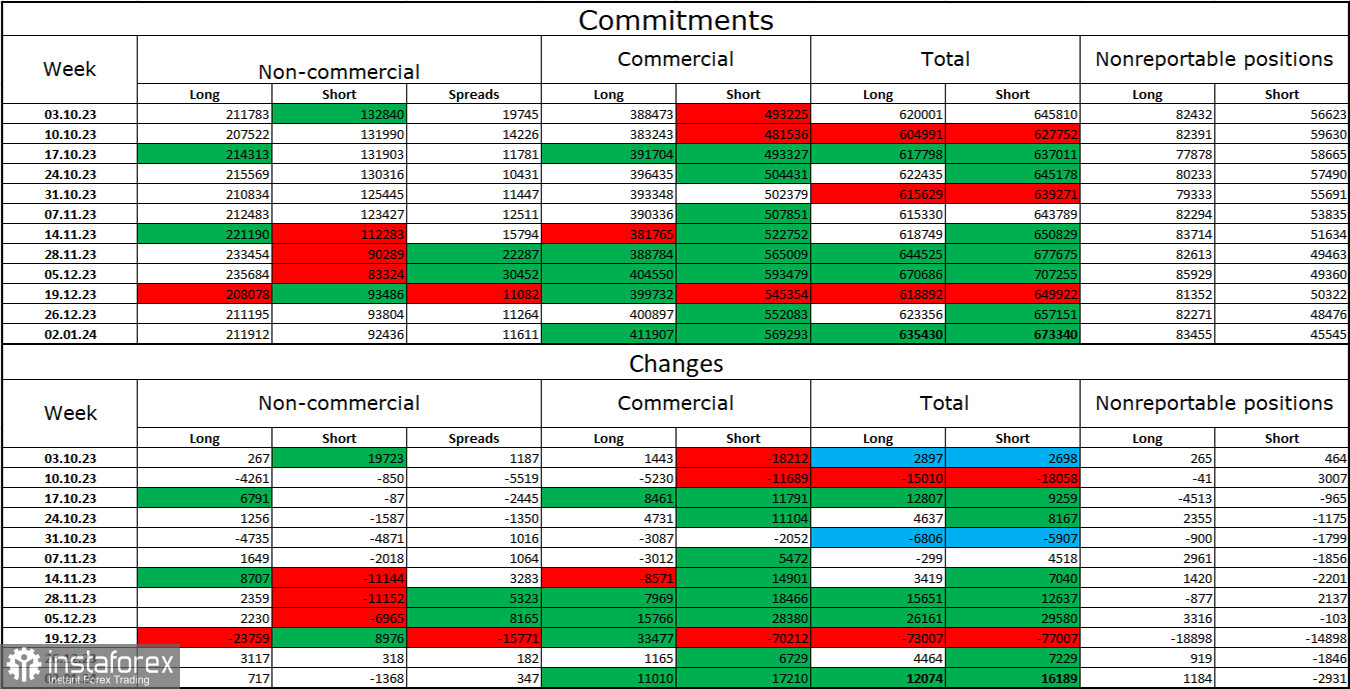

Commitments of Traders (COT) Report:

In the last reporting week, speculators opened 717 long contracts and closed 1368 short contracts. The sentiment of major traders remains "bullish" and overall weakens. The total number of long contracts held by speculators now stands at 212,000, while short contracts are only 92,000. Despite the significant difference, the situation will shift toward the bears. Bulls have dominated the market for too long, and now they need strong news to maintain the "bullish" trend. I do not see such a news background at the moment. Professional traders may resume closing their long positions soon. The current figures allow for a resumption of the euro currency's decline in the coming months.

News Calendar for the US and the Eurozone:

US - Producer Price Index (13:30 UTC).

On January 12, the economic events calendar includes only one entry, with extremely low chances of breaking the pair out of the sideways movement. Therefore, the impact of the news background on trader sentiment today may be weak.

Forecast for EUR/USD and Trader Recommendations:

Sales of the pair were possible on a rebound from the 1.0982 level on the hourly chart, with targets at 1.0932 and 1.0883. The first target was worked out yesterday and may be retested today. Purchases on the hourly chart can be considered on a rebound from the 1.0932 level with a target of 1.0982.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română