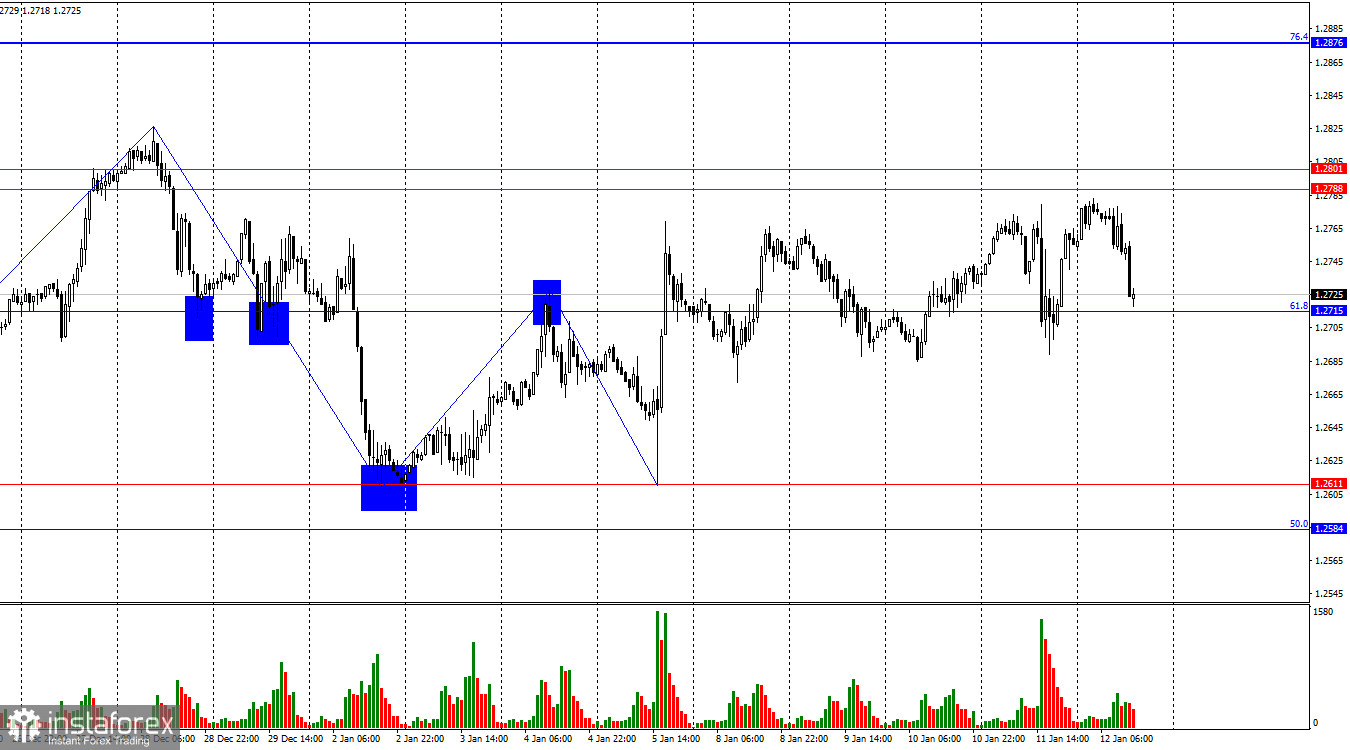

On the hourly chart, the GBP/USD pair experienced a drop to the corrective level of 61.8% (1.2715) on Thursday, followed by a rebound and new growth. On Friday, there was a new reversal in favor of the US dollar, leading to a drop to 1.2715. A new bounce from this level will again favor the British pound and a resumption of growth towards the resistance zone at 1.2788-1.2801. Closing quotes below the level of 1.2715 will increase the chances of continuing the decline toward the support zone at 1.2584-1.2611.

The wave situation remains very ambiguous. Current trends are quite short-term, and we often see single waves representing a complete trend. The bullish sentiment persists due to the absence of a decline in the British pound, but the waves do not clarify what is happening in the market. The last downward wave failed to break the level of 1.2611, around which the lows of all previous waves are located. The new upward wave has broken the peak of the previous one, but several smaller waves can be observed inside it, making the current picture very complex. The British pound may expect a return to the zone of 1.2788-1.2801, but I believe that the current movement exhibits all the characteristics of a horizontal trend, and I do not see the pound rising above 1.2801.

The news background on Friday could have supported the bears strongly, but they failed to close below the 1.2715 level, which eloquently demonstrates their strength. Today, reports on industrial production and GDP were released in the UK. As expected by traders, industrial production volumes increased by 0.3% in November, and GDP in November increased by 0.3%, slightly above traders' expectations. Therefore, the British pound had some potential for further growth today, but instead, it started a new decline. Bulls maintain the initiative in the market, but pushing the British pound significantly higher from current levels will be quite challenging. The British pound has been rising for over three months, and substantial reasons are needed for the growth to continue.

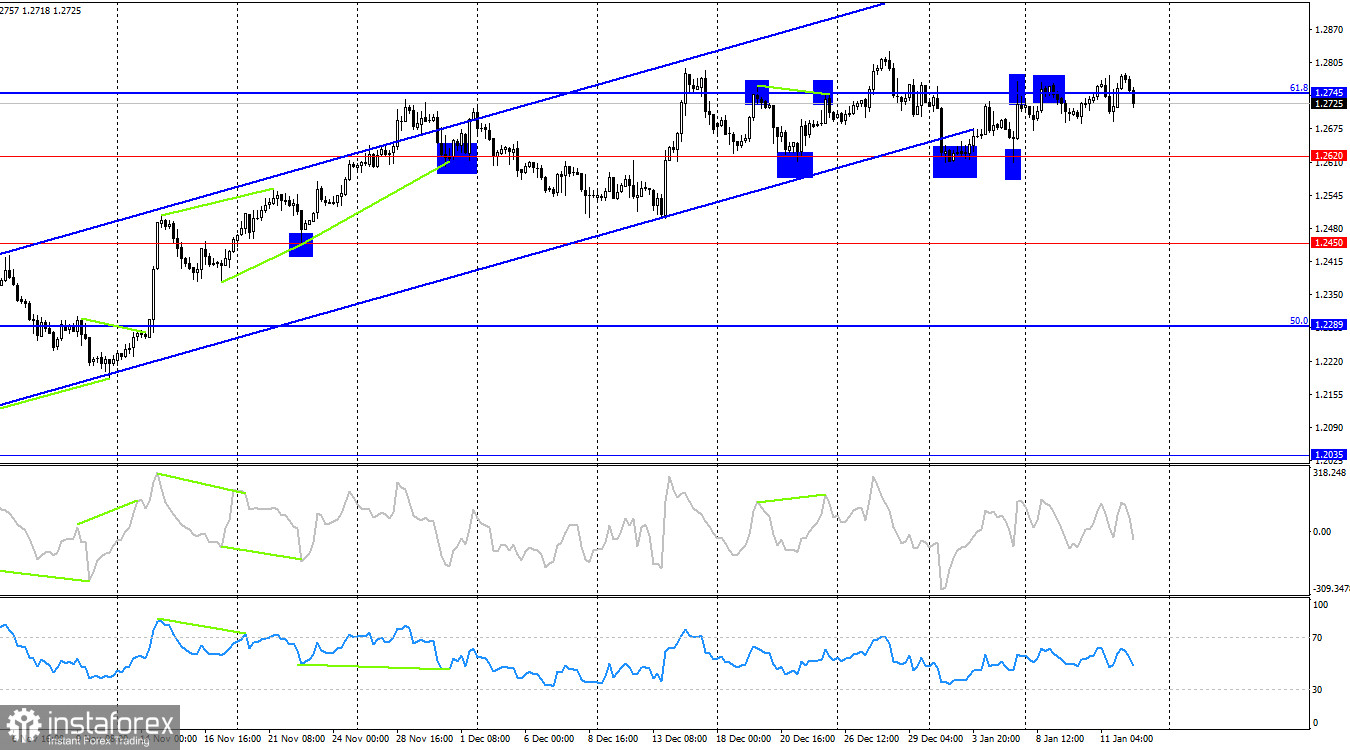

On the 4-hour chart, the pair has made several returns to the Fibonacci level of 61.8% (1.2745). A new bounce from this level will favor the US dollar and a decline towards 1.2620. On the 4-hour chart, the horizontal movement between the levels of 1.2620 and 1.2745 is visible. There are no emerging divergences for any indicators, and the ascending trend corridor has been left behind. The trend may continue to shift towards "bearish," but it will take time and significant efforts from the bears.

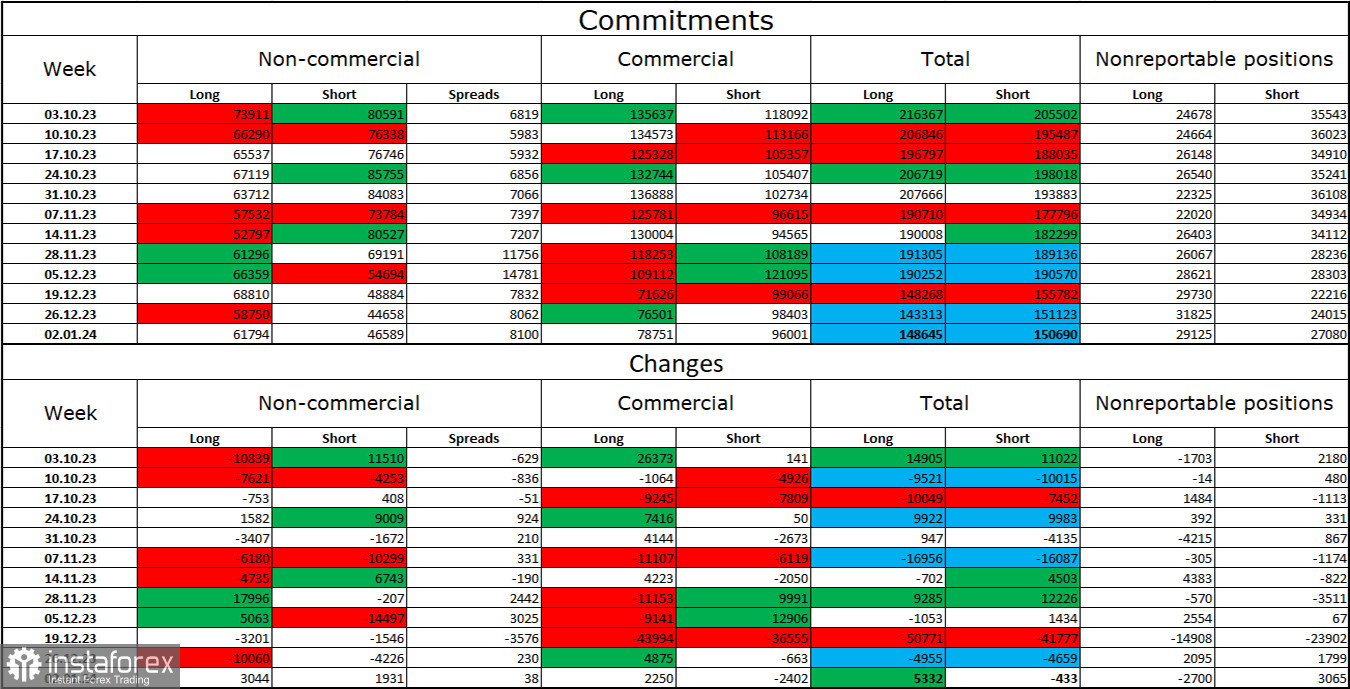

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category changed in favor of the bulls during the last reporting week. The number of long contracts held by speculators increased by 3,044 units, while the number of short contracts increased by 1,931. Overall, the sentiment of major players changed to "bearish" a few months ago, but currently, bulls have a slight advantage. There is a gap between the number of long and short contracts: 62 thousand versus 46 thousand, but the gap is small and almost not increasing.

The British pound still has excellent prospects for a decline. I do not expect a strong rise in the British pound. Over time, bulls will continue to get rid of their Buy positions since all possible factors for buying the British pound have already been priced in. The rise we have seen in the last three months is corrective.

News Calendar for the US and the UK:

US - Producer Price Index (13:30 UTC).

On Friday, the economic events calendar only includes the Producer Price Index in the US. The impact of the news background on the market sentiment today may be relatively weak.

Forecast for GBP/USD and Trader Recommendations:

Sales of the British pound were possible today around the 1.2788-1.2801 zone on the hourly chart with a target of 1.2715, although there was no rebound from it. You can continue to hold sales in case of a close below 1.2715 with a target of 1.2611. Buying today can be considered in case of a rebound from the level of 1.2715 with a target of 1.2788.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română