The pound failed to capitalize on the positive macroeconomic statistics from the UK released this morning, briefly and marginally strengthening thereafter.

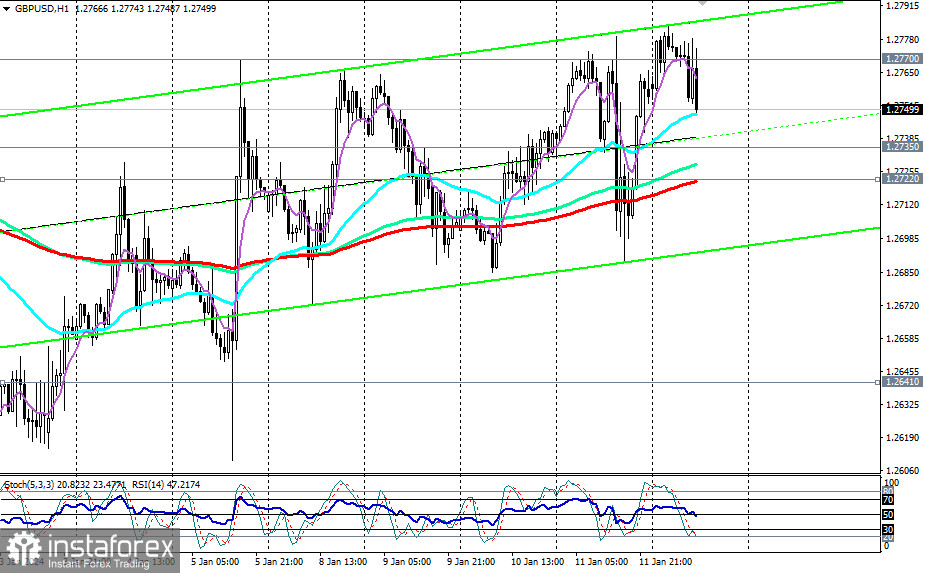

During today's Asian trading session, GBP/USD made another attempt to break into the zone above the crucial long-term resistance level at 1.2770 (50 EMA on the monthly chart) but then resumed its decline, ignoring the positive data from the UK.

As of writing, the GBP/USD pair continued to move lower towards the key support level at 1.2735 (200 EMA on the weekly chart), which separates the long-term bullish market from the bearish one.

If today's publication of U.S. manufacturing inflation data has a positive impact on the dollar, we can expect a new wave of dollar strength and a decline in the GBP/USD pair after yesterday's CPIs.

A breakdown of the support level at 1.2735 and the short-term support level at 1.2722 (200 EMA on the 1-hour chart) may signal the start of a downward correction with targets at support levels 1.2641 (200 EMA on the 4-hour chart), 1.2595 (50 EMA and the lower boundary of the upward channel on the daily chart).

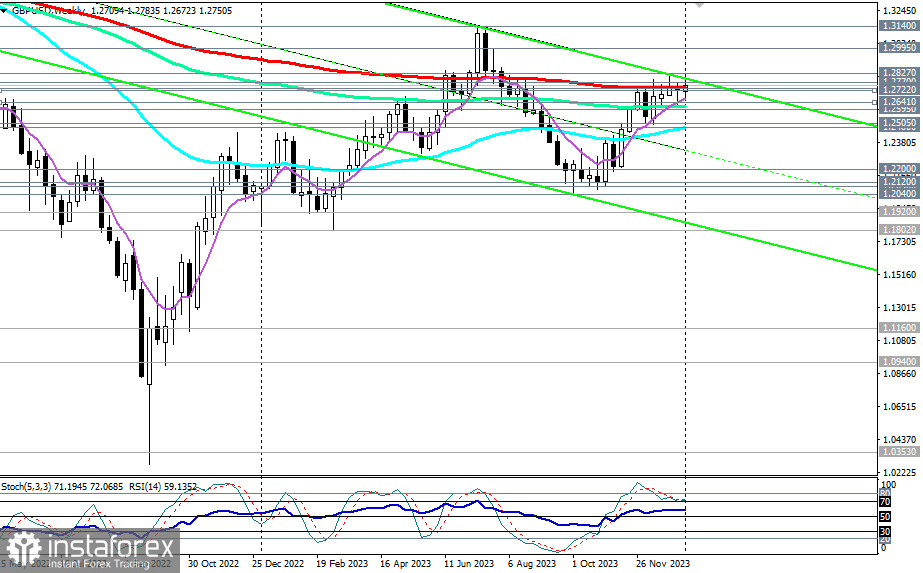

If they are broken, the decline of the pair may continue to the key medium-term support levels at 1.2505 (144 EMA on the daily chart) and 1.2480 (200 EMA on the daily chart). Breaking through these levels will lead GBP/USD into the zone of the medium-term bearish market.

If negative dynamics prevail in the future, GBP/USD will head deeper into the downward channel on the weekly chart, the lower boundary of which is near the local support levels of 1.1920 and 1.1800.

In an alternative scenario, the price will overcome the zone of key resistance levels at 1.2735 (200 EMA on the weekly chart), 1.2770 (50 EMA on the monthly chart), and move towards the high of 2023, reached in December at 1.2827, with the prospect of further growth. This, in turn, will mean the GBP/USD's entry into the long-term bullish market, making long-term long positions relevant.

Support levels: 1.2735, 1.2722, 1.2700, 1.2641, 1.2600, 1.2595, 1.2505, 1.2500, 1.2480, 1.2400

Resistance levels: 1.2770, 1.2800, 1.2827, 1.2900, 1.2995, 1.3100, 1.3140, 1.3200

Trading Scenarios

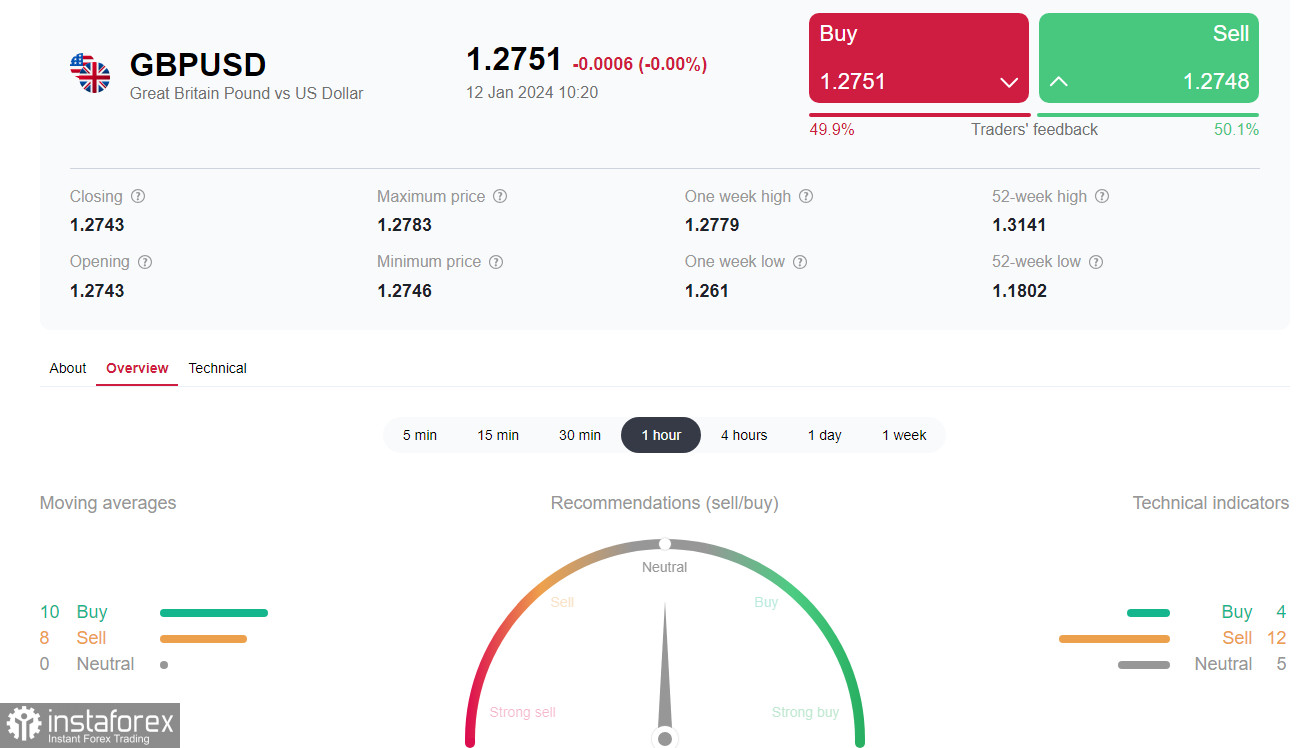

Main Scenario: Sell Stop at 1.2720. Stop-Loss at 1.2780. Targets at 1.2735, 1.2722, 1.2700, 1.2641, 1.2600, 1.2595, 1.2505, 1.2500, 1.2480, 1.2400

Alternative Scenario: Buy Stop at 1.2780. Stop-Loss at 1.2720. Targets at 1.2800, 1.2827, 1.2900, 1.2995, 1.3100, 1.3140, 1.3200

"Targets" correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but can serve as a reference when planning and placing your trading positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română