US inflation was expected to accelerate, but no one anticipated numbers for December 2023 to come in at 3.4%. The worst-case scenario had expected an increase to 3.2%. The main forecast was that inflation would remain unchanged. So now there is no doubt that March is too early for the Federal Reserve to start lowering rates. It's no wonder that the dollar rose after the release of inflation data. However, the upward movement was short lived, and the quotes eventually returned to the levels they were at before the inflation data was published. This was due to the statements made by representatives of the US central bank. Federal Reserve Bank of Richmond President Thomas Barkin suggested that the central bank may soon resume some form of quantitative easing. In addition, just a few days ago, the Fed effectively announced a so-called quantitative tightening. This means that the central bank will not extend the current programs aimed at injecting liquidity into the financial sector. However, given the deteriorating macroeconomic indicators, the Fed may have to continue injecting money into the economy to prevent a full-blown financial crisis.

Nevertheless, the dollar still has the potential to strengthen. Today's Producer Price Index, which is expected to accelerate from 0.9% to 1.0%, could help with that. However, this is the most optimistic of forecasts. Some believe that the PPI will increase to 1.3%. This could completely dash hopes of a rate cut, at least in the short term.

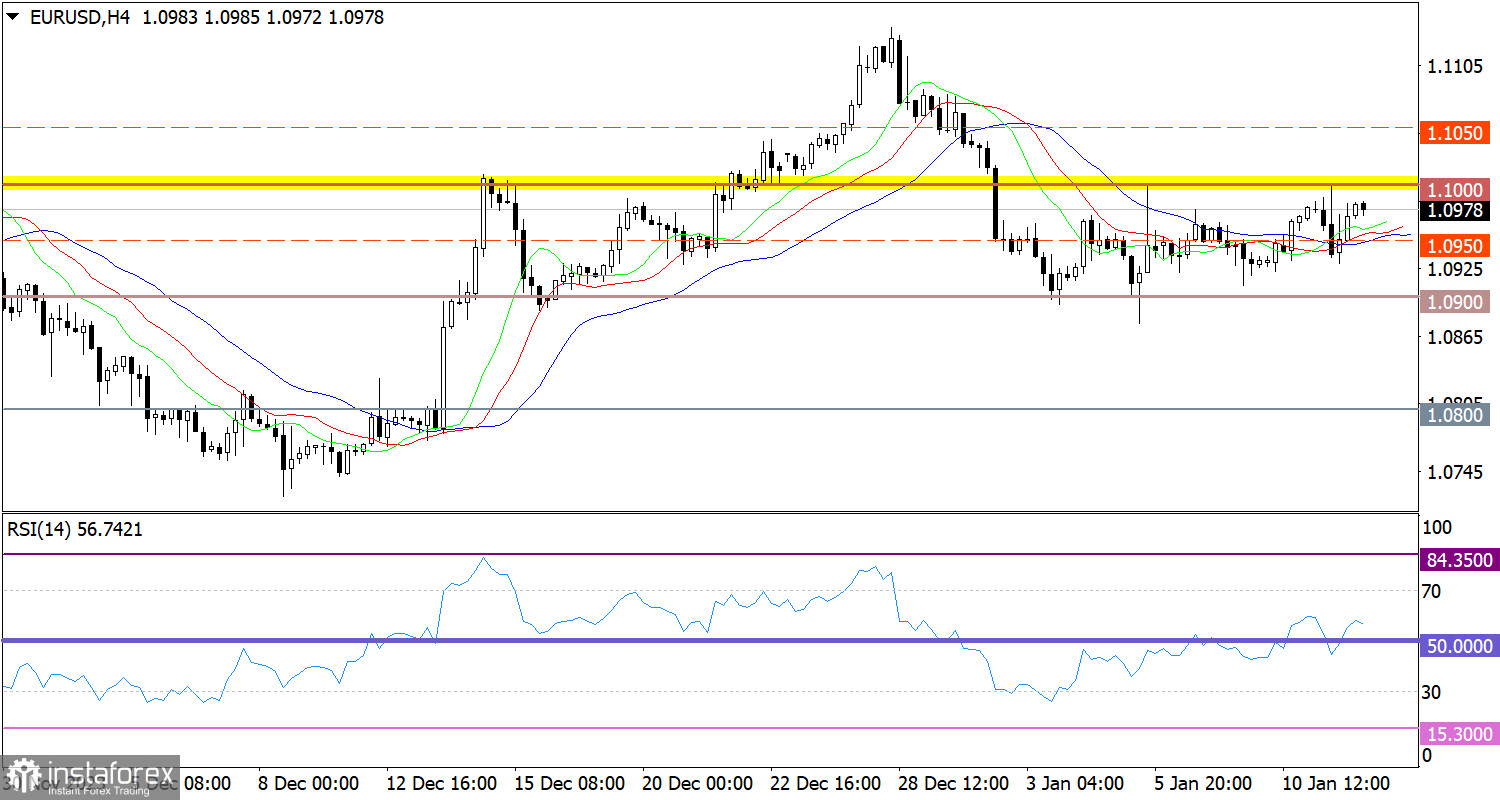

Despite a local surge in activity in the EUR/USD pair, we have not seen any crucial changes. The exchange rate continues to move within the consolidation range between 1.0900 and 1.1000.

On the four-hour chart, the RSI technical indicator is hovering in the area of 50/70, which corresponds to the price moving in the upper part of the range.

On the same time frame, the Alligator's MAs are intersecting each other, corresponding to a flat phase.

Outlook

According to the channel trading strategy, traders focus on two main methods: bounce and breakout relative to either boundaries of the range. This is considered an optimal strategy as long as a price channel pattern is being formed.

The complex indicator analysis revealed that in the intraday and short-term periods, technical indicators suggest a bullish bias as the price moves in the upper area of the channel.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română