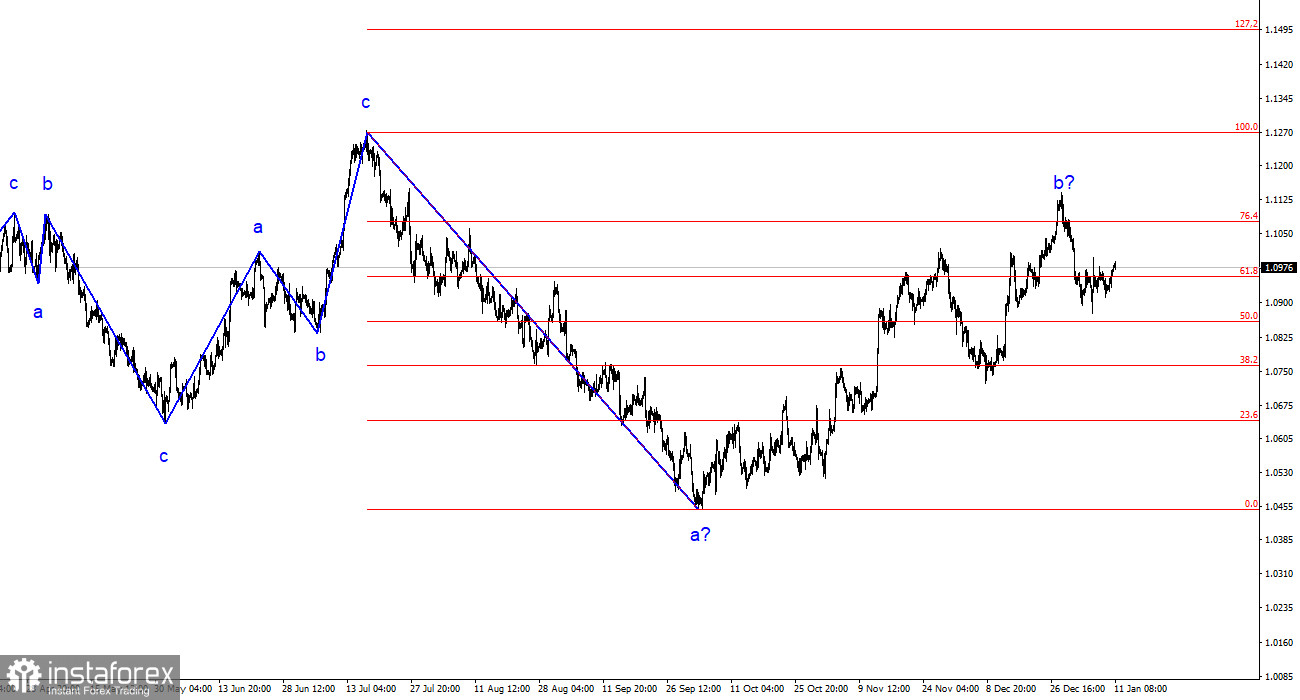

The wave analysis of the 4-hour chart for the euro/dollar pair has become more complex. In the past year, we have seen only three wave structures that constantly alternate with each other. The construction of another three-wave structure, a downward one, is continuing. The presumed wave 1 is complete, but wave 2 or b has become more complex three or four times, and there are no guarantees that it won't become even more complex.

Despite the fact that the news background cannot be considered "supportive of the European currency," the market keeps finding new reasons to increase demand for the pair. Such a situation is not normal. Even if the upward segment of the trend resumes, its internal structure will become unreadable.

The internal wave structure of the presumed wave 2 or b has changed. Since the last downward wave was disproportionately large, I now interpret it as wave b. If this is indeed the case, then wave c is currently being built, and the entire wave 2 or b could still end at any moment (or may already have ended). The current retreat from the achieved highs looks convincing, so we can expect a transition to wave 3 or c construction.

The dollar reacted with restrained growth.

The euro/dollar pair's exchange rate dropped by ten basis points on Thursday. I want to remind you that the movement has been predominantly horizontal for more than a week, and the wave analysis currently cannot answer the question of which direction the pair will move next. The wave pattern currently allows for the completion of the presumed second wave, but at the same time, this wave could become more prolonged. The report on US inflation, which is the most important event this week, was supposed to help the market make a decision. Half an hour after the report was released, the market still needs to respond clearly to this question.

I would like to remind my readers that in recent weeks, the market has begun to anticipate the first rate cut by the FOMC in March. Perhaps this began even earlier, but this sentiment has become more pronounced recently. During this week, several FOMC members cautioned the market against having overly high expectations for a rate cut in 2024. And the inflation report for December was supposed to show whether a rate cut is expected so early.

The Consumer Price Index has risen to 3.4% from 3.1%. The market expected an acceleration of no more than 3.2%. Therefore, inflation has accelerated more than expected, and the Federal Reserve now has much less reason to cut rates in March. This information should support demand for the US dollar, but so far, I don't see it happening.

General conclusions.

Based on the analysis conducted, the construction of a bearish set of waves continues. The targets around the 1.0463 level have been ideally fulfilled, and the unsuccessful attempt to break through this level indicates a transition to the construction of a corrective wave. Wave 2 or b has taken on a completed form, so I expect the construction of an impulsive downward wave 3 or c with a significant decrease in the pair soon. The unsuccessful attempt to break the 1.1125 level, which corresponds to 23.6% on the Fibonacci, indicates the market's readiness for sales.

On the larger wave scale, it can be seen that the construction of corrective wave 2 or b continues, which is already more than 61.8% in length on the Fibonacci from the first wave. As I have already mentioned, this is not critical, and the scenario of constructing wave 3 or c with a decrease in the pair below the 1.10 level remains valid.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română