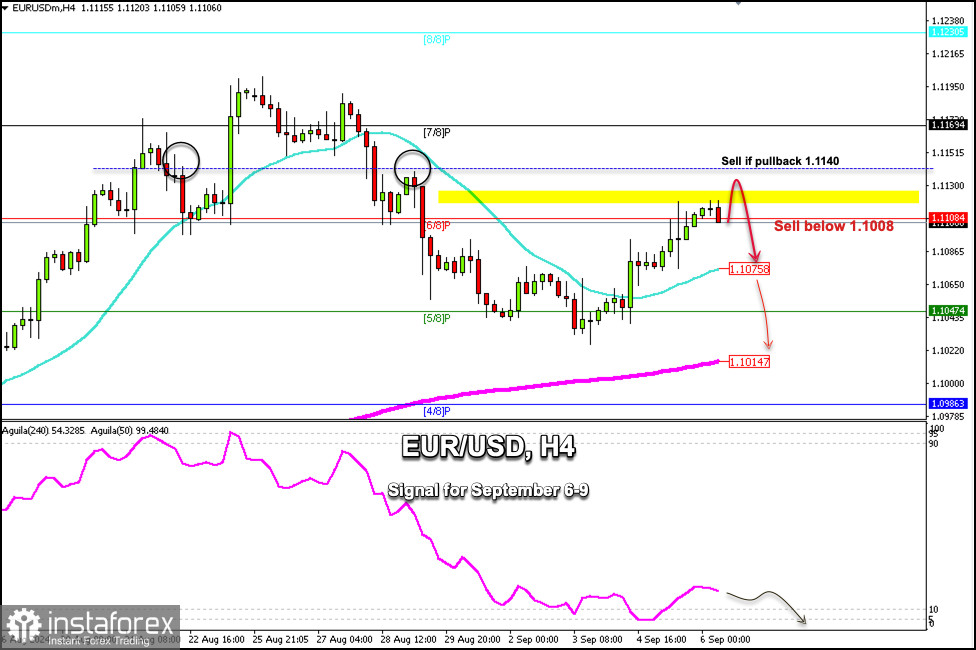

Early in the American session, the EUR/USD pair is trading around 1.1101 below 6/8 Murray, above the 21 SMA, and above the 200 EMA.

According to the H4 chart, we can see that the euro is trading with a bullish signal but it could find it difficult to continue rising as we see an exhaustion of the bullish force.

In the next few hours, US employment data will be released. Weak nonfarm payrolls will be bearish for the US dollar. If so, EUR/USD is likely to respond with a strong bullish move and could reach 7/8 Murray located at 1.1169.

If the euro falls below 6/8 Murray or if the price pulls back at 1.1140 (strong resistance), EUR/USD could start a bearish cycle and we expect it to reach the 21 SMA located at 1.1063. Eventually, the instrument could reach the 200 EMA around 1.1014.

In the medium term, the euro could reach 1.1200 and the July 2023 high of 1.1275 will be the target for euro bulls. For the outlook to remain positive, the euro should continue trading above the psychological level of 1.10.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română