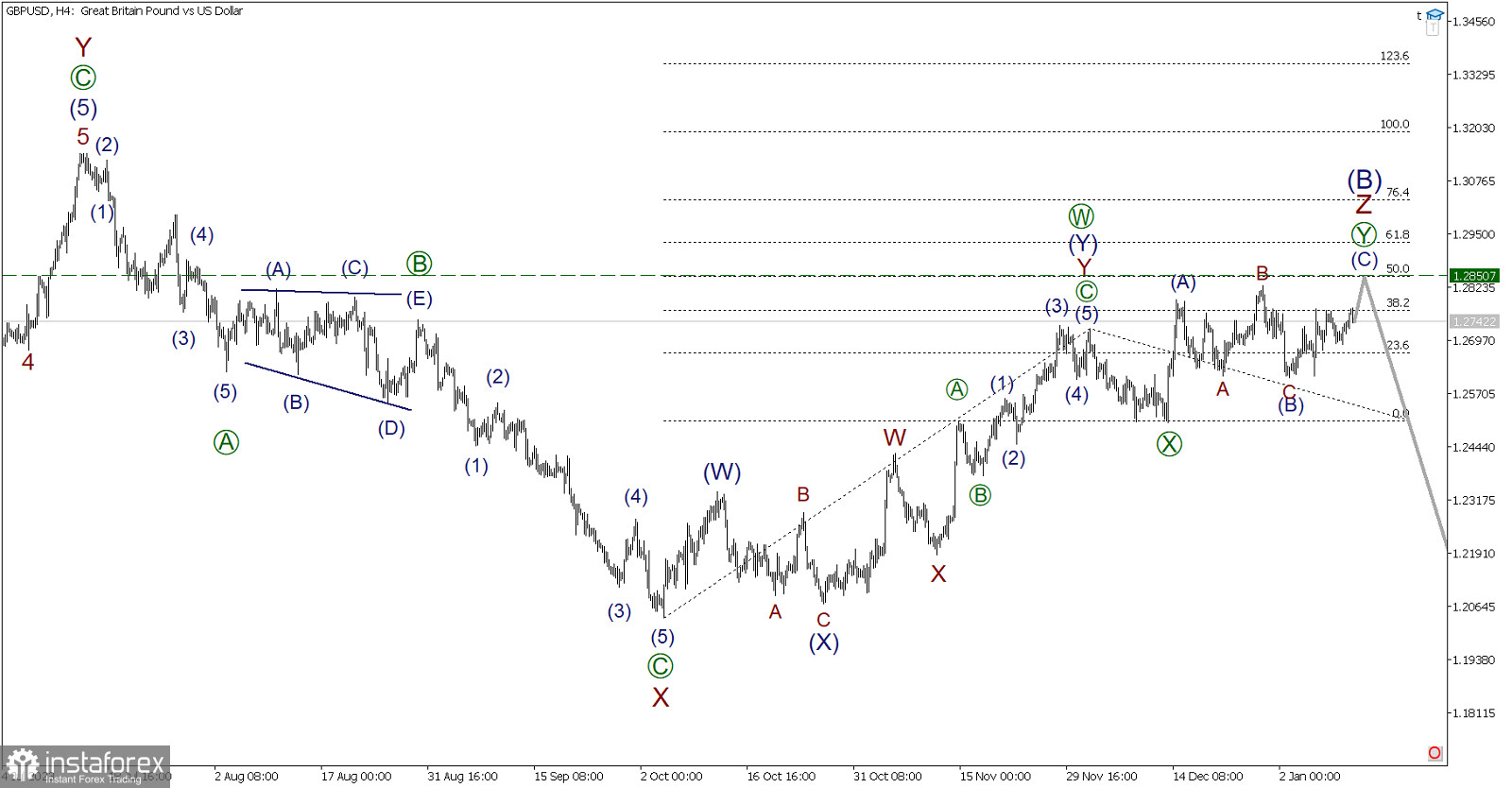

For the British pound, it is likely that a major correction (B) is being formed, taking the shape of a triple zigzag. Currently, we are observing the development of an upward wave Z, the internal structure of which resembles a double zigzag [W]-[X]-[Y].

It is assumed that the wave [W] takes the form of a double zigzag of a smaller wave level, after which the connector wave [X] was fully formed. After the completion of [X], bulls drove the price upwards in an impulse (A), then the price corrected in wave (B). In the upcoming trading days, we may observe a rise in price in the final wave (C).

The bullish (C) price is likely to rise to the 1.2850 mark. At this level, the size of wave [Y] will be 50% of [W]. Wave (C) may take the form of a final diagonal.

Today, the publication of the consumer price index and a report on the number of claims for unemployment benefits are expected. These news can influence bullish sentiment.

Therefore, now is a favorable moment to open long positions from the current level with the target of profiting from the end of the bullish trend.

Trading recommendations: buy at 1.2742, take profit at 1.2850.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română