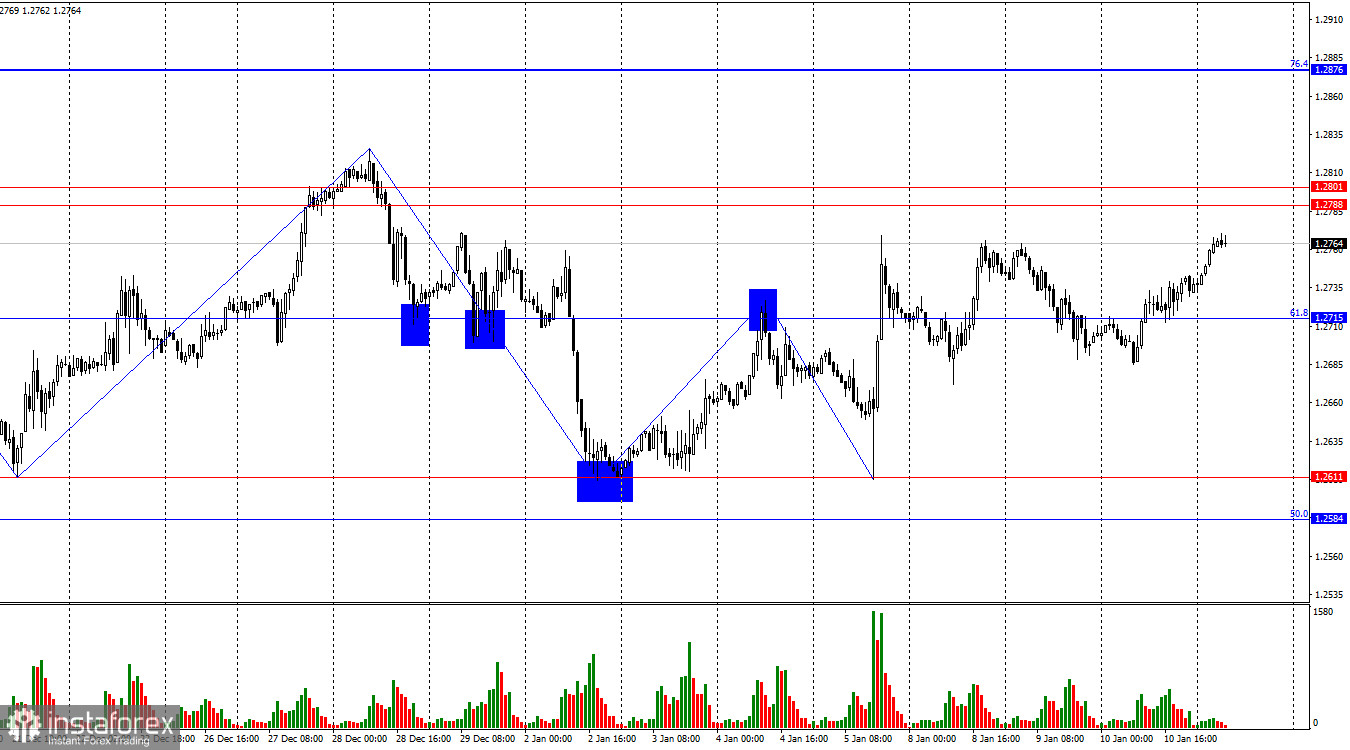

On the hourly chart, the GBP/USD pair reversed in favor of the British pound on Wednesday and established new support above the corrective level of 61.8% (1.2715). Consequently, the upward momentum in quotes may continue towards the resistance zone of 1.2788–1.2801. A rebound from this zone will favor the US dollar and lead to a drop back to the 1.2715 level. If the quotes hold above this zone, it will increase the chances of further growth toward the next corrective level at 76.4% (1.2876).

The wave situation remains ambiguous. The trends are relatively short-term, and we often see single waves representing complete trends. The bullish sentiment persists due to the absence of a decline in the British pound, but the waves do not clarify what is happening in the market. The latest downward wave failed to breach the 1.2611 level, the lowest of all previous waves. The new upward wave has broken the peak of the previous one, but several waves are now visible within it, making it challenging to interpret the current picture. The British pound may anticipate a return to the 1.2788–1.2811 zone. Still, I believe the current movement exhibits all the characteristics of horizontal consolidation, and I do not see the pound's rate rising above 1.2801.

The background information on Wednesday needed to be stronger, even though Bank of England Governor Andrew Bailey was scheduled to speak in Parliament. At this moment, there is no information regarding this speech, but the market seems to have assumed that the nature of the speech will be "hawkish," as it was in December, and is buying the pound once again.

Today in America, the Consumer Price Index for December will be released, which could strongly influence trader sentiment. However, since we are in a horizontal range, a very strong and unexpected report value will be needed for the British pound to break out of it. The report must exert pressure on the dollar, which can only happen if inflation for December decreases rather than increases, as is currently forecasted.

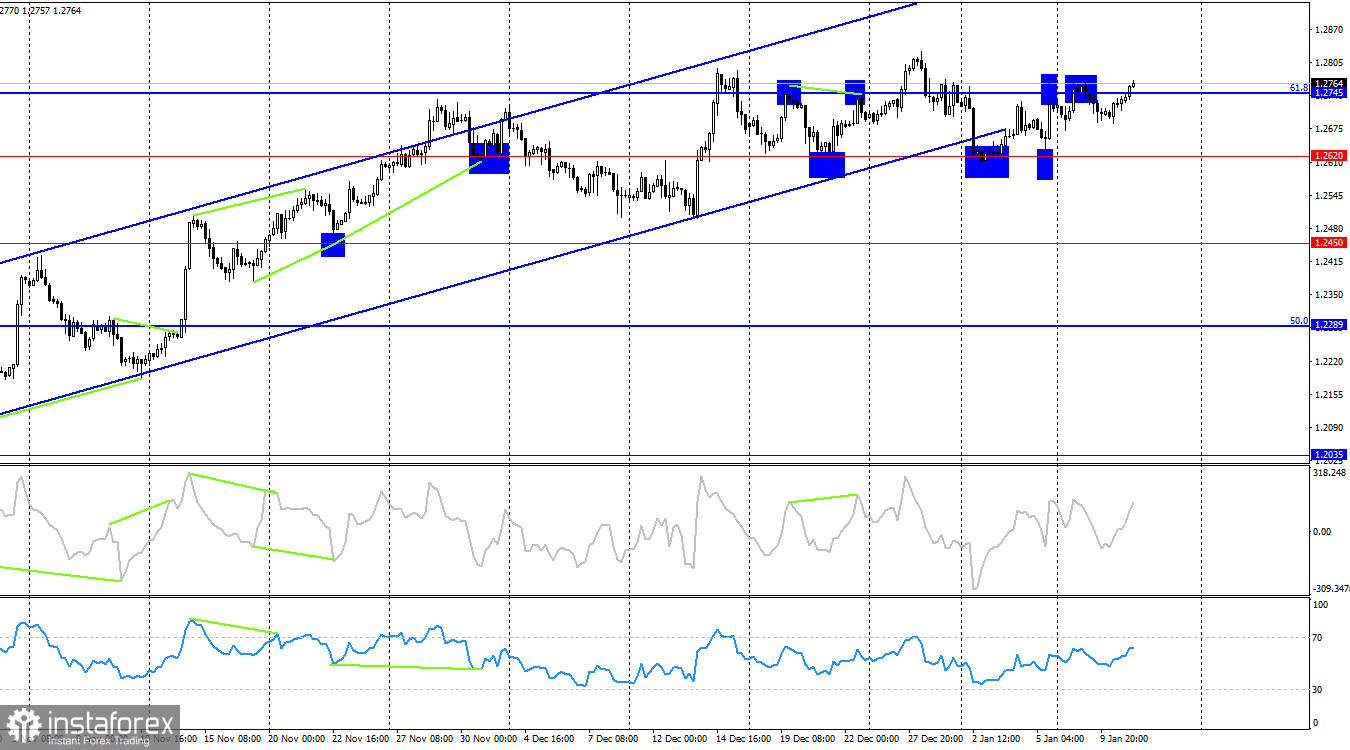

On the 4-hour chart, the pair has executed another return to the Fibonacci level of 61.8% (1.2745). A new bounce from this level will again favor the US currency and lead to a drop towards the 1.2620 level. On the 4-hour chart, the horizontal movement between the levels of 1.2620 and 1.2745 is visible. No imminent divergences are observed with any of the indicators today, and the ascending trend corridor has been abandoned. The trend may continue to shift towards a "bearish" one, but it will take time and effort from the bears.

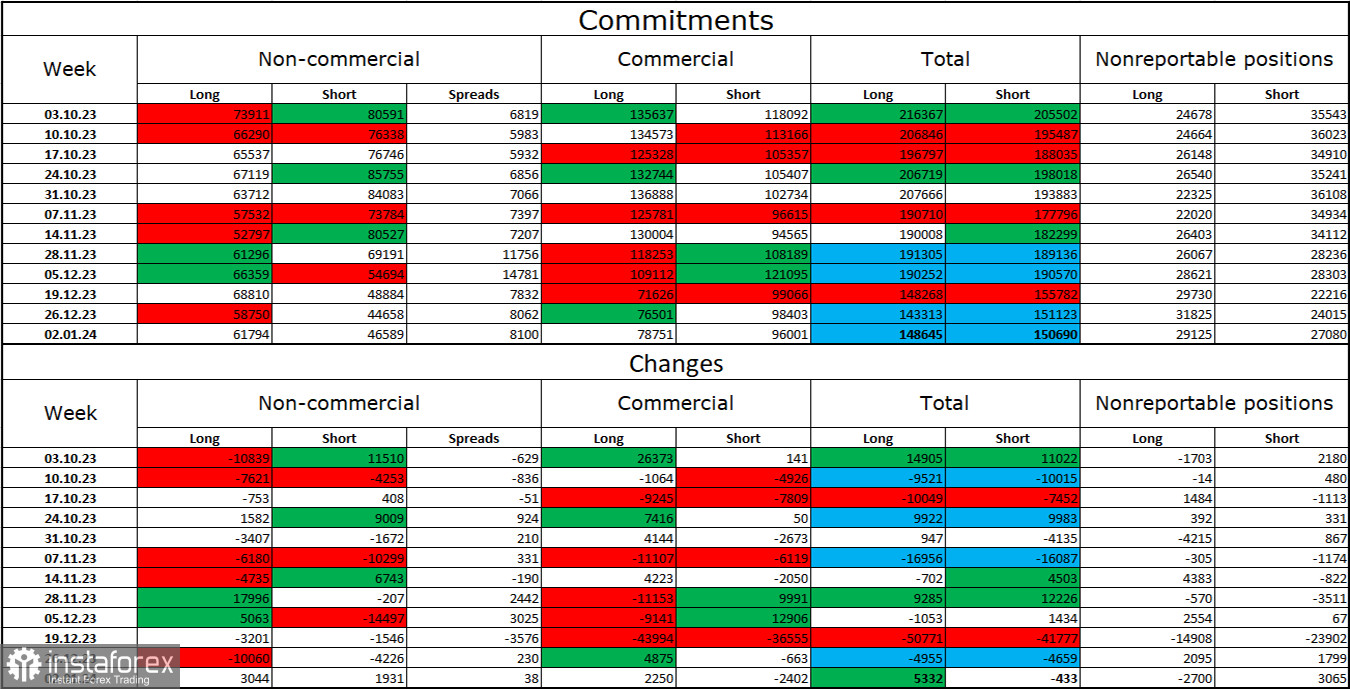

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category has shifted in favor of the bulls in the last reporting week. The number of long contracts held by speculators increased by 3044 units, while the number of short contracts increased by 1931. The overall sentiment of large players shifted to "bearish" a few months ago, but the bulls now have a slight advantage. There is a gap between the number of long and short contracts: 62 thousand versus 46 thousand, but the gap is small and hardly increasing.

The British pound continues to have excellent downward prospects. I do not expect a significant rise in the British pound. I believe that the bulls will continue to unwind their buy positions over time, as all possible factors for buying the British pound have already been exhausted. The recent growth we have seen in the last three months is corrective.

Economic Calendar for the US and the UK:

US - Consumer Price Index (13:30 UTC).

US - Initial and Continuing Jobless Claims (13:30 UTC).

On Thursday, the economic events calendar includes the US inflation report, which is very important. The impact of the information background on market sentiment today can be of moderate strength.

GBP/USD Forecast and Trader Tips:

Selling the British pound may be considered today in case of a rebound from the 1.2788-1.2801 zone on the hourly chart, targeting 1.2715. Buying opportunities today can be considered if the pair closes above the 1.2788-1.2801 zone, targeting 1.2876.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română