US inflation may not just remain at the current level but accelerate from 3.1% to 3.2%. This means that the Fed will start lowering interest rates later than previously anticipated, most likely around summer. In addition, the ECB may be the first among key central banks to start easing monetary policy.

Ideally, all this should contribute to the strengthening of dollar, but it lost its position instead. This may be because of anticipation over significant events like the release of US inflation data. By and large, even if inflation remains unchanged, the Fed may delay lowering interest rates, which could lead to a rise in dollar.

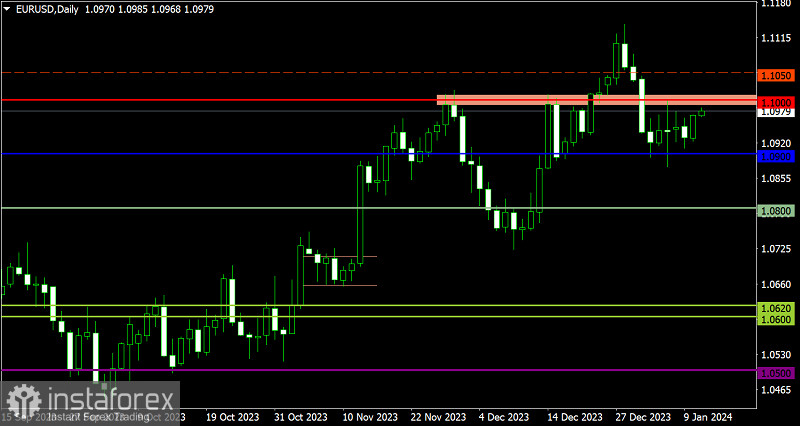

Euro rose and managed to reach the level of 1.1000 despite relatively low activity. In this situation, stagnation may lead to the accumulation of trading forces, which will become a catalyst for speculative interest.

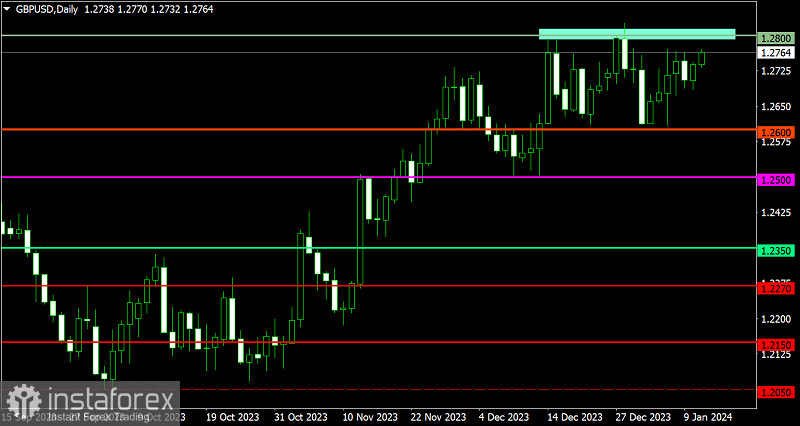

GBP/USD also shows an upward trend, almost recovering from the recent decline. The level of 1.2800 still stands as resistance, around which a reduction in the volume of long positions may occur.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română