Gold rode a roller coaster after U.S. non-farm employment rose by 216,000, exceeding Bloomberg experts' forecasts, followed by the ISM's service sector employment indicator showing the most significant contraction in three years. The labor market is cooling, indicating an economic slowdown and supporting demand for precious metals.

According to Matterhorn Asset Management, the United States is already in a recession. The yield curve is beginning to emerge from inversion, which typically corresponds to a downturn. The rise in bankruptcies and a 4% decrease in the M2 money supply also indicate serious problems. The money supply has only decreased four times in the entire history of America, and in all cases, it was a sign of deflation. It usually goes hand in hand with a recession.

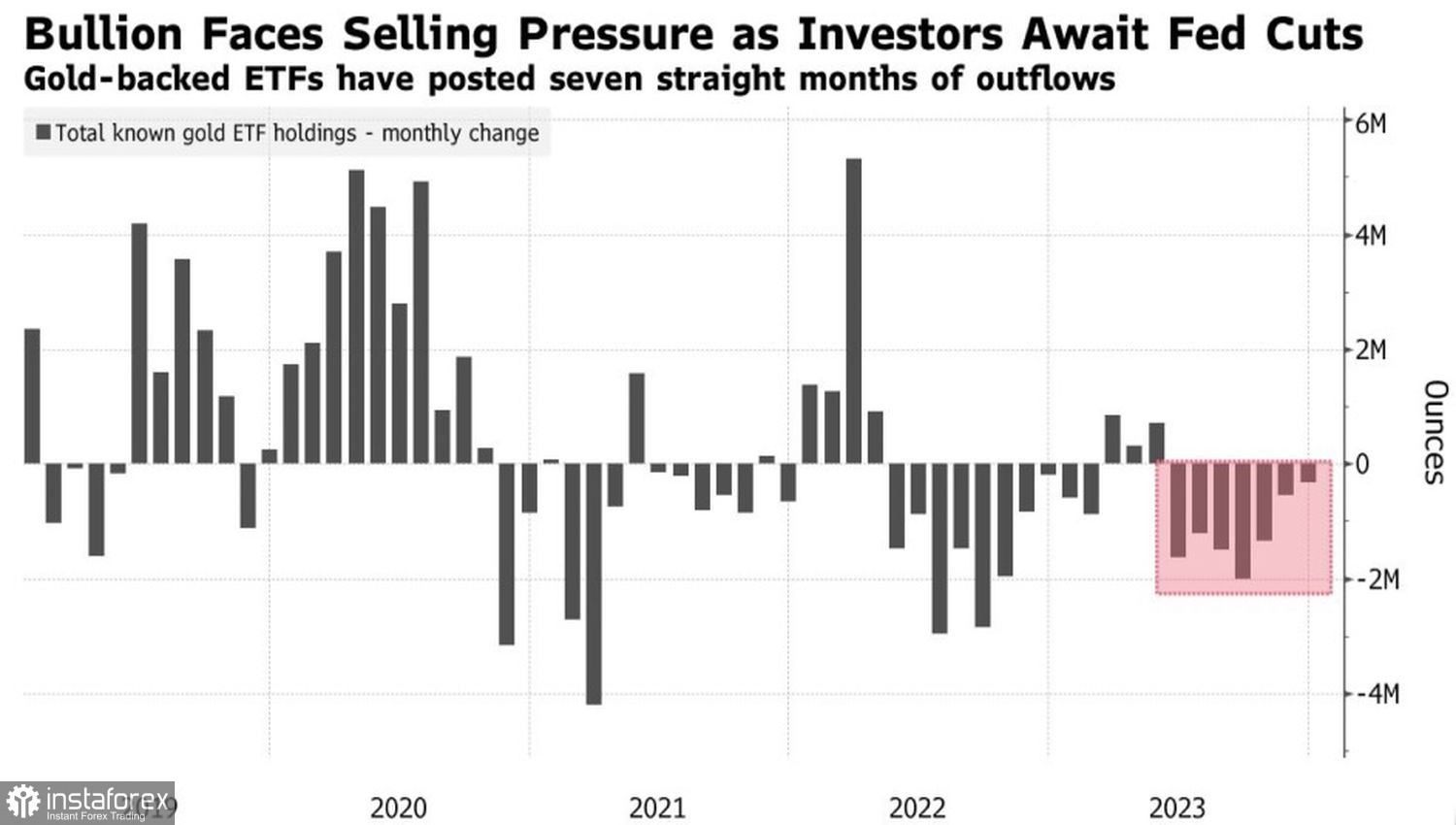

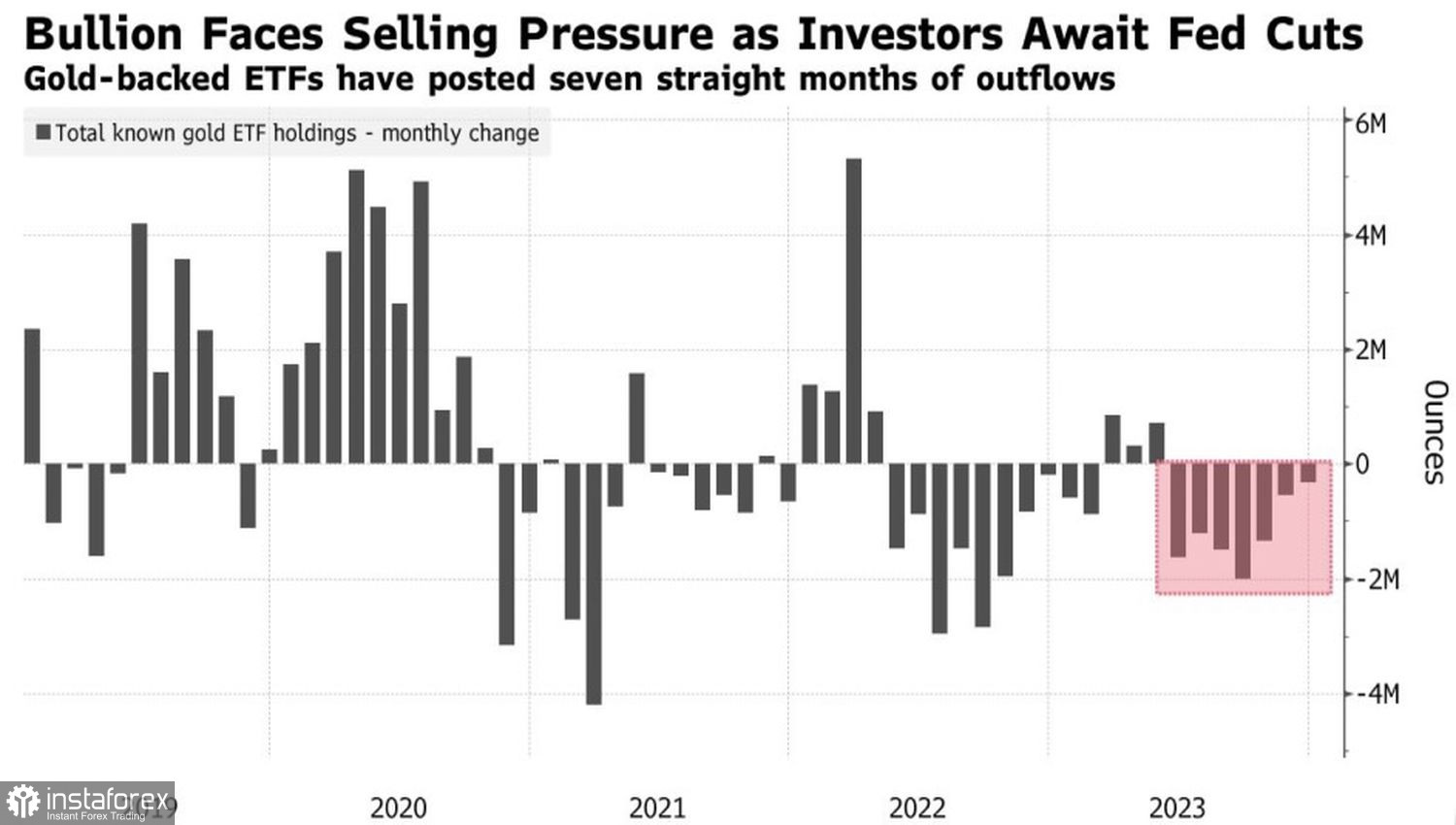

Against this backdrop, the ongoing outflow of capital from gold-oriented ETFs seems illogical. However, there is good news here too. December marked the seventh consecutive month of investor flight from specialized exchange-traded funds. Their reserves decreased by approximately $1 billion. However, the outflow is mainly from European ETFs, which lost about $2 billion. In contrast, their American counterparts attracted $717 million. The Federal Reserve's rate cuts will create a favorable background for the growth of XAU/USD quotes. On the other hand, the ECB's intention to keep borrowing costs high undermines demand for precious metals in the Old World.

Dynamics of capital flows in gold-oriented ETFs

According to MarketVector Indexes, the Securities and Exchange Commission's approval of applications to create ETFs with Bitcoin as the underlying asset will create serious competition for gold. This was the case in 2021 when BTC/USD quotes soared to record highs due to the start of specialized exchange-traded funds with Bitcoin futures as the underlying asset. At that time, there was a belief that this event took money away from the gold market. If not for it, the precious metal would have closed at least 3% higher.

On the other hand, according to MKS PAMP, XAU/USD could be supported by the Federal Reserve's political bias. The company believes that the Central Bank is focused on economic growth, not inflation. It will lower rates sooner than the futures market expects to ensure good GDP figures ahead of the U.S. presidential elections, thus supporting the current government.

In the short term, the fate of gold will depend on U.S. inflation statistics for December. If deflationary processes continue to accelerate in the States, the Federal Reserve will lower rates more aggressively than its latest forecasts suggest, creating a tailwind for XAU/USD.

Technically, on the gold daily chart, there is a struggle for fair value at $2,033 per ounce. The bears' attempt to play an inside bar ended in failure, increasing the likelihood of a rise in quotes on breaking its upper boundary at $2,043.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română