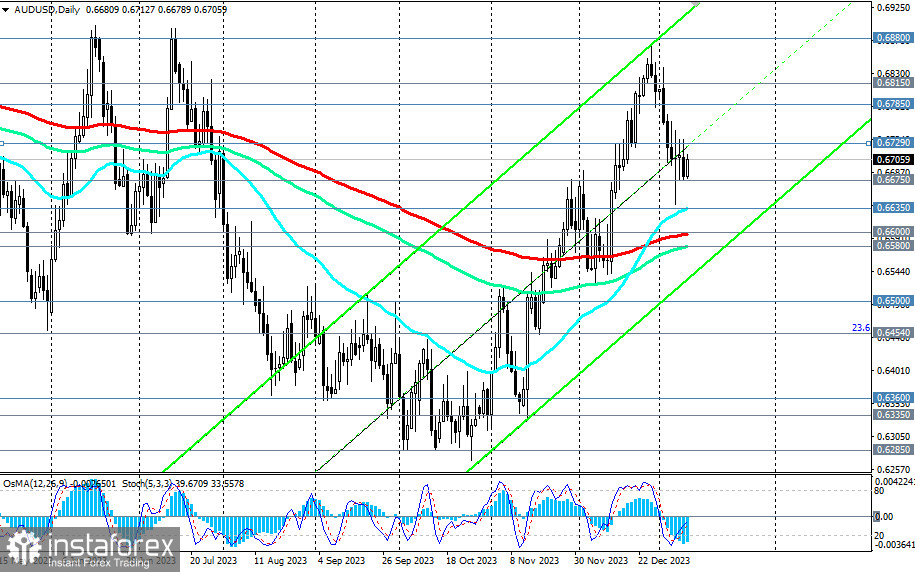

After breaking through an important short-term support level of 0.6729 last week (200 EMA on the 1-hour chart), AUD/USD continued to decline towards another important short-term support level of 0.6675 (200 EMA on the 4-hour chart).

Breaking through this level would open the path towards the key medium-term support level of 0.6600 (200 EMA on the daily chart). Further decline and breaking through the important support level of 0.6580 (144 EMA on the daily chart) would bring AUD/USD into the territory of a medium-term bear market with the potential to decline to multi-month lows near the 0.6300 mark.

In an alternative scenario, AUD/USD will break through the key long-term resistance level of 0.6880 (200 EMA on the weekly chart) and head towards the important resistance level of 0.7000 (200 EMA on the monthly chart) and the resistance level of 0.7040 (38.2% Fibonacci retracement level in the wave of decline from the level of 0.9500 to 0.5510). Breaking through these levels would lead AUD/USD into the global bull market zone.

The first signal for the realization of this scenario is breaking through today's high of 0.6712 and the resistance level of 0.6729.

Thus, in the short-term and medium-term perspectives, the direction of movement of AUD/USD will be determined by breaking through the upper or lower boundary of the range formed between the levels of 0.6675 and 0.6729.

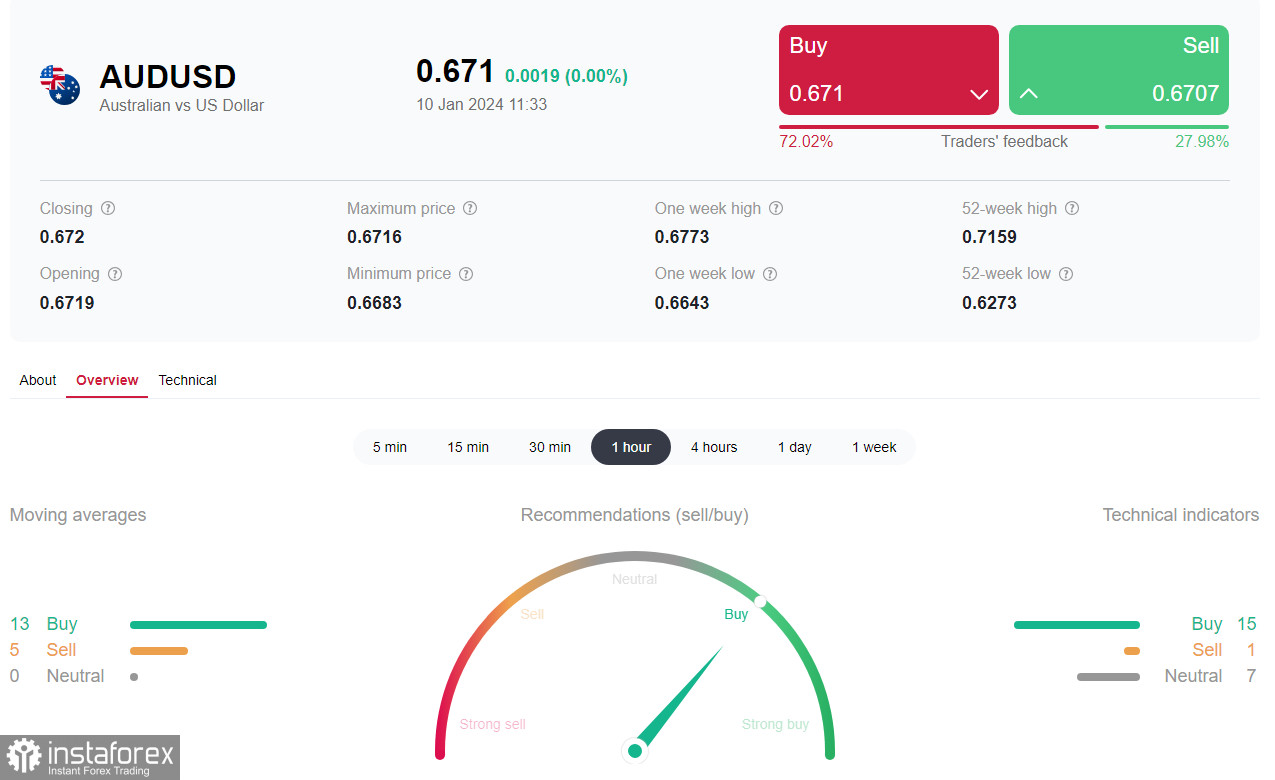

Support levels: 0.6675, 0.6635, 0.6600, 0.6580, 0.6500, 0.6454, 0.6400, 0.6360, 0.6335, 0.6300, 0.6285, 0.6200, 0.6170

Resistance levels: 0.6712, 0.6729, 0.6785, 0.6800, 0.6815, 0.6880, 0.6900, 0.6940, 0.7000, 0.7040

Trading Scenarios

Main Scenario: Sell Stop 0.6670. Stop-Loss 0.6740. Targets 0.6635, 0.6600, 0.6580, 0.6500, 0.6454, 0.6400, 0.6360, 0.6335, 0.6300, 0.6285, 0.6200, 0.6170

Alternative Scenario: Buy Stop 0.6740. Stop-Loss 0.6670. Targets 0.6785, 0.6800, 0.6815, 0.6880, 0.6900, 0.6940, 0.7000, 0.7040

"Targets" correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but can serve as a guide in planning and placing your trading positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română